Again… You Do Not Need 20% Down to Buy NOW!

![20170403-Share-STM[1] https://goo.gl/zjDMFW](https://brookhampton.com/wp-content/uploads/blog-post-images/20170403-Share-STM1.jpg)

A survey by Ipsos found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. There are two major misconceptions that we want to address today.

1. Down Payment

The survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 40% of consumers think a 20% down payment is always required. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

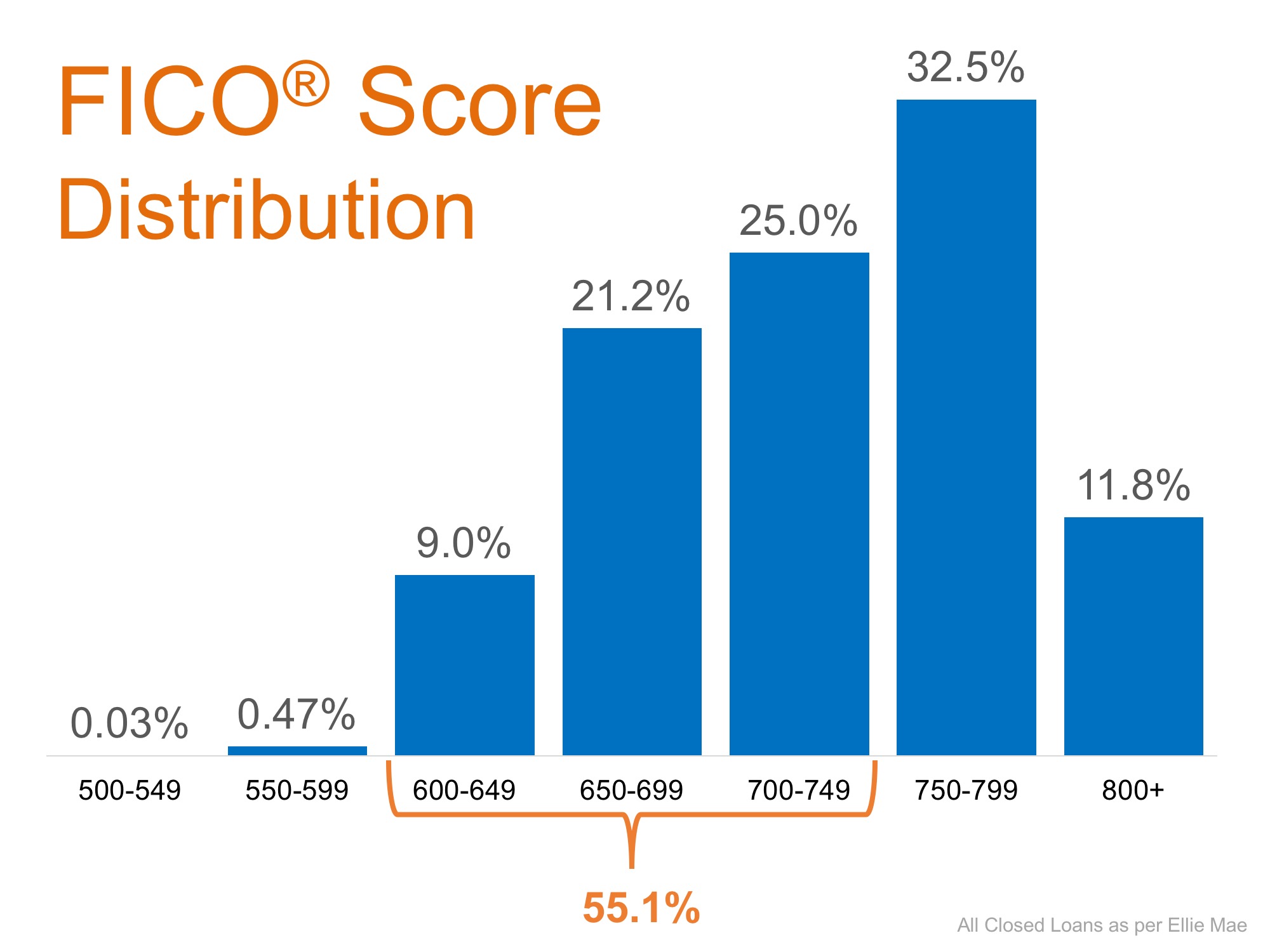

The survey also revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in February had a credit score of 752, while FHA mortgages closed with a score of 686. The average across all loans closed in February was 720. The chart below shows the distribution of FICO® Scores for all loans approved in February.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

Keys to Success for First-Time Homebuyers

The best way to make sure you’re set up for success, especially if you’re just starting out, is to work with a trusted real estate agent.

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off

The pandemic profoundly changed real estate over the last few years. The demand for a home of our own skyrocketed, and needs changed.

The Benefits of Selling Now, According to Experts

Sellers who price and market their home competitively shouldn’t have a problem finding a buyer especially in today’s market.

Why Buyers Need an Expert Agent by Their Side

Advice and guidance from a professional real estate agent can be invaluable, particularly amid a hot or unpredictable housing market.

What You Need To Know About Home Price News

More ‘less-expensive’ houses are selling right now, and that’s causing the median price to decline.

The Worst Home Price Declines Are Behind Us

If we take a yearly view, home prices stayed positive – they just appreciated more slowly than they did at the peak of the pandemic.

Homeowners Have Incredible Equity To Leverage Right Now

A real estate professional can help you understand the value of your home, so you’ll get a clearer picture of how much equity you have.

It May Be Time To Consider a Newly Built Home

When housing inventory is as low as it is right now, it can feel like a bit of an uphill battle to find the perfect home.

Why Buying a Home Makes More Sense Than Renting Today

With rents much higher now than they were in more normal, pre-pandemic years, owning your home may be a better option.

Why Today’s Foreclosure Numbers Are Nothing Like 2008

While foreclosures are climbing, it’s clear foreclosure activity now is nothing like it was during the housing crisis.