“Let’s look back at the cost of a home over the last five decades and adjust it for inflation by converting that cost to 2021 dollars”

There are many headlines about how housing affordability is declining. The headlines are correct: it’s less affordable to purchase a home today than it was a year ago. However, it’s important to give this trend context. Is it less expensive to buy a house today than it was in 2005? What about 1995? What happens if we go all the way back to 1985? Or even 1975?

Obviously, the price of a home has appreciated dramatically over the last 45 years. So have the prices of milk, bread, and just about every other consumable. Prices rise over time – we know it as inflation.

However, when we look at housing, price is just one component that makes up the monthly cost of the home. Another key factor is the mortgage rate at the time of purchase.

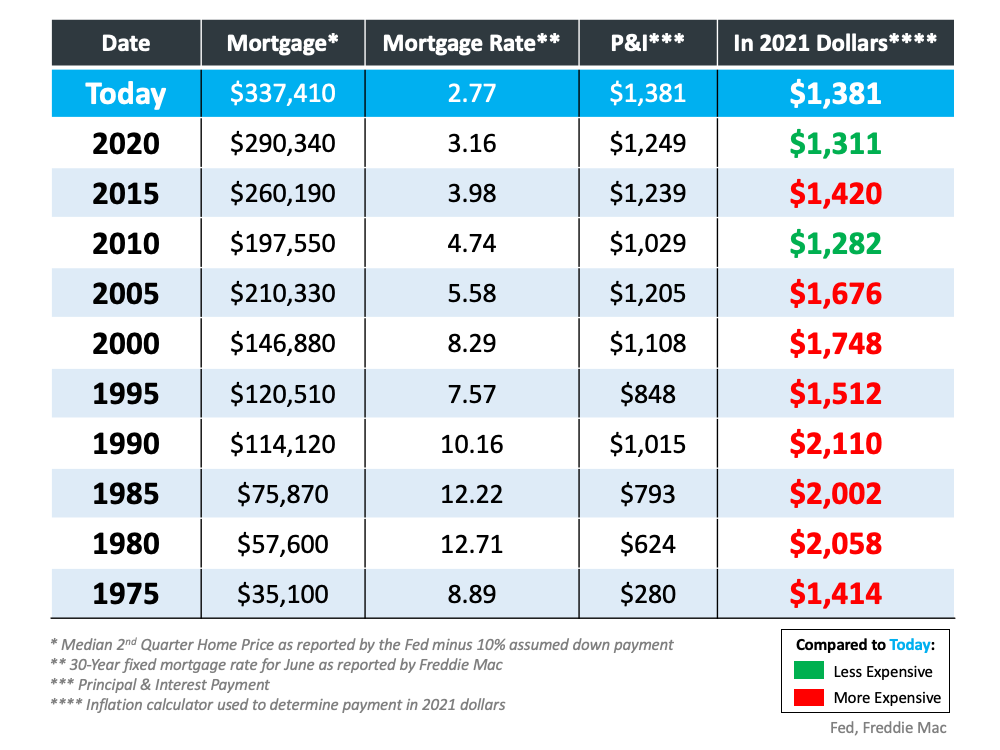

Let’s look back at the cost of a home over the last five decades and adjust it for inflation by converting that cost to 2021 dollars. Here’s the methodology for each data point of the table below:

- Mortgage Amount: Take the median sales price at the end of the second quarter of each year as reported by the Fed and assume that the buyer made a 10% down payment.

- Mortgage Rate: Look at the monthly 30-year fixed rate for June of that year as reported by Freddie Mac.

- P&I: Use a mortgage calculator to determine the monthly principal and interest on the loan.

- In 2021 Dollars: Use an inflation calculator to determine what each payment would be when adjusted for inflation. Green means the homes were less expensive than today. Red means they were more expensive.

As the chart shows, when adjusted for inflation, there were only two times in the last 45 years that it was less expensive to own a home than it is today.

As the chart shows, when adjusted for inflation, there were only two times in the last 45 years that it was less expensive to own a home than it is today.

- Last year: Prices saw strong appreciation over the last year and mortgage rates have remained relatively flat. Therefore, affordability weakened.

- 2010: Home values plummeted after the housing crash 15 years ago. One-third of all sales were distressed properties (foreclosures or short sales). They sold at major discounts and negatively impacted the value of surrounding homes – of course homes were more affordable then.

At every other point, even in 1975, it was more expensive to buy a home than it is today.

Bottom Line

If you want to buy a home, don’t let the headlines about affordability discourage you. You can’t get the deal your friend got last year, but you will get a better deal than your parents did 20 years ago and your grandparents did 40 years ago.

To view original article, visit Keeping Current Matters.

Are There More Homes for Sale Where You Live?

Increased housing supply spells good news for consumers who want to see more properties before making purchasing decisions.

Where Will You Go After You Sell?

Want to see what’s available? Your real estate agent can show you what homes are for sale in your area, so you can see if there’s one that works for you and your needs.

Helpful Negotiation Tactics for Today’s Housing Market

One thing is true whether you’re a buyer or a seller, and that’s how much your agent can help you throughout the process.

What Every Homeowner Should Know About Their Equity

Understanding how much equity you have is the first step to unlocking what you can afford when you move.

Why the Sandwich Generation Is Buying Multi-Generational Homes

If you’re thinking about buying a multi-generational home, working with a local real estate agent is essential.

The Biggest Mistakes Sellers Are Making Right Now

If you aren’t working with an agent, you may not realize the mistakes you are making. And they may be costing you!