“Let’s look back at the cost of a home over the last five decades and adjust it for inflation by converting that cost to 2021 dollars”

There are many headlines about how housing affordability is declining. The headlines are correct: it’s less affordable to purchase a home today than it was a year ago. However, it’s important to give this trend context. Is it less expensive to buy a house today than it was in 2005? What about 1995? What happens if we go all the way back to 1985? Or even 1975?

Obviously, the price of a home has appreciated dramatically over the last 45 years. So have the prices of milk, bread, and just about every other consumable. Prices rise over time – we know it as inflation.

However, when we look at housing, price is just one component that makes up the monthly cost of the home. Another key factor is the mortgage rate at the time of purchase.

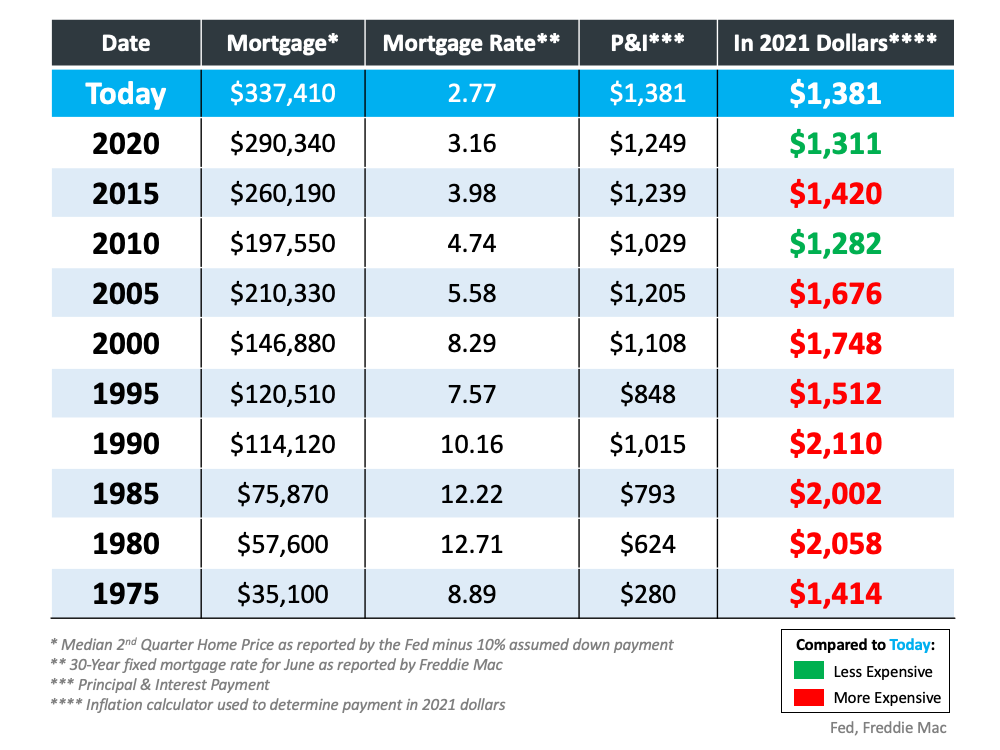

Let’s look back at the cost of a home over the last five decades and adjust it for inflation by converting that cost to 2021 dollars. Here’s the methodology for each data point of the table below:

- Mortgage Amount: Take the median sales price at the end of the second quarter of each year as reported by the Fed and assume that the buyer made a 10% down payment.

- Mortgage Rate: Look at the monthly 30-year fixed rate for June of that year as reported by Freddie Mac.

- P&I: Use a mortgage calculator to determine the monthly principal and interest on the loan.

- In 2021 Dollars: Use an inflation calculator to determine what each payment would be when adjusted for inflation. Green means the homes were less expensive than today. Red means they were more expensive.

As the chart shows, when adjusted for inflation, there were only two times in the last 45 years that it was less expensive to own a home than it is today.

As the chart shows, when adjusted for inflation, there were only two times in the last 45 years that it was less expensive to own a home than it is today.

- Last year: Prices saw strong appreciation over the last year and mortgage rates have remained relatively flat. Therefore, affordability weakened.

- 2010: Home values plummeted after the housing crash 15 years ago. One-third of all sales were distressed properties (foreclosures or short sales). They sold at major discounts and negatively impacted the value of surrounding homes – of course homes were more affordable then.

At every other point, even in 1975, it was more expensive to buy a home than it is today.

Bottom Line

If you want to buy a home, don’t let the headlines about affordability discourage you. You can’t get the deal your friend got last year, but you will get a better deal than your parents did 20 years ago and your grandparents did 40 years ago.

To view original article, visit Keeping Current Matters.

Don’t Let These Two Concerns Hold You Back from Selling Your House

Working with a local real estate agent is the best way to see what inventory trends look like in your area.

More Homes, Slower Price Growth – What It Means for You as a Buyer

Having a real estate agent who knows the local area can be a big advantage when you start the buying process.

What’s Motivating Homeowners To Move Right Now

Selling your home isn’t just about market conditions or mortgage rates—it’s also about making the best decision for your lifestyle and future.

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

VA home loans are designed to make homeownership a reality for those who have served our country.

Renting vs. Buying: The Net Worth Gap You Need To See

If you’re on the fence, it may be helpful to speak with a local real estate agent. They can help you weigh your options.

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

Understanding what’s happening will help you make the right decisions, whether that’s buying or selling.