“Before you decide whether to look for a new house or another apartment, it’s important to understand the true costs of renting in 2022.”

Are you one of the many renters thinking about where you’ll live the next time your lease is up? Before you decide whether to look for a new house or another apartment, it’s important to understand the true costs of renting in 2022.

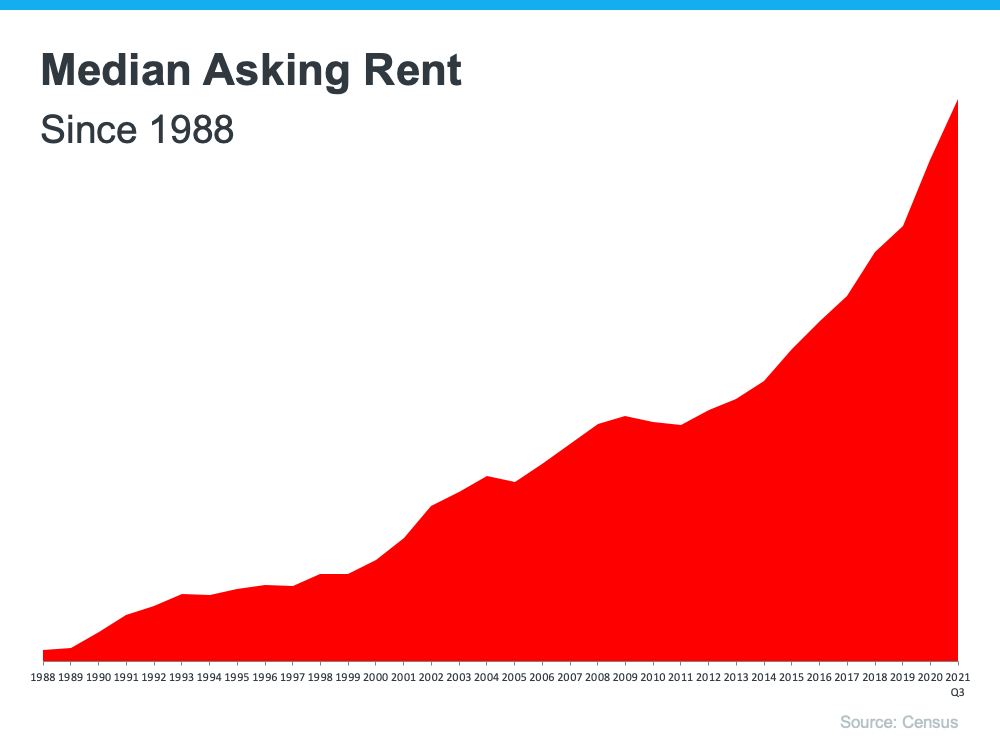

As a renter, you should know rents have been rising since 1988 (see graph below):

In 2021, rents grew dramatically. According to ApartmentList.com, since January 2021:

“. . . the national median rent has increased by a staggering 17.8 percent. To put that in context, rent growth from January to November averaged just 2.6 percent in the pre-pandemic years from 2017-2019.”

That increase in 2021 was far greater than the typical rent increases we’ve seen in recent years. In other words – rents are rising fast. And the 2022 National Housing Forecast from realtor.com projects prices for vacant units will continue to increase this year:

“In 2022, we expect this trend will continue and fuel rent growth. At a national level, we forecast rent growth of 7.1% in the next 12 months, somewhat ahead of home price growth . . .”

That means, if you’re planning to move into a different rental this year, you’ll likely pay far more than you have in years past.

Homeownership Provides an Alternative to Rising Rents

If you’re a renter facing rising rental costs, you might wonder what alternatives you have. If so, consider homeownership. One of the many benefits of homeownership is it provides a stable monthly cost you can lock in for the duration of your loan.

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“. . . fast-rising rents and increasing consumer prices, may have some prospective buyers seeking the protection of a fixed, consistent mortgage payment.”

If you’re planning to make a move this year, locking in your monthly housing costs for 15-30 years can be a major benefit. You’ll avoid wondering if you’ll need to adjust your budget to account for annual increases.

Homeowners also enjoy the added benefit of home equity, which has grown substantially right now. In fact, the latest Homeowner Equity Insight report from CoreLogic shows the average homeowner gained $56,700 in equity over the last 12 months. As a renter, your rent payment only covers the cost of your dwelling. When you pay your mortgage, you grow your wealth through the forced savings that is your home equity.

Bottom Line

If you’re thinking of renting this year, it’s important to keep in mind the true costs you’ll face. Let’s connect so you can see how you can begin your journey to homeownership today.

To view original article, visit Keeping Current Matters.

Where Are People Moving Today and Why?

If you’re thinking of moving, you may be considering the inventory and affordability challenges in the housing market and how to offset these.

There’s Only Half the Inventory of a Normal Housing Market Today

If you want to list your house, know that there’s only about half the inventory there’d usually be in a more normal year.

Four Ways You Can Use Your Home Equity

Understanding how home equity works, and how to leverage it, is important for any homeowner.

Sellers: Don’t Let These Two Things Hold You Back

If fear you won’t be able to find your next home is the primary thing holding you back, remember to consider all your options.

Pricing Your House Right Still Matters Today

Pricing your house fairly based on market conditions increases the chance you’ll have more buyers who are interested in purchasing it.

Homebuyers Are Still More Active Than Usual

Buyer demand hasn’t disappeared, and in many places remains strong largely due to the shortage of homes on the market.