“Before you decide whether to look for a new house or another apartment, it’s important to understand the true costs of renting in 2022.”

Are you one of the many renters thinking about where you’ll live the next time your lease is up? Before you decide whether to look for a new house or another apartment, it’s important to understand the true costs of renting in 2022.

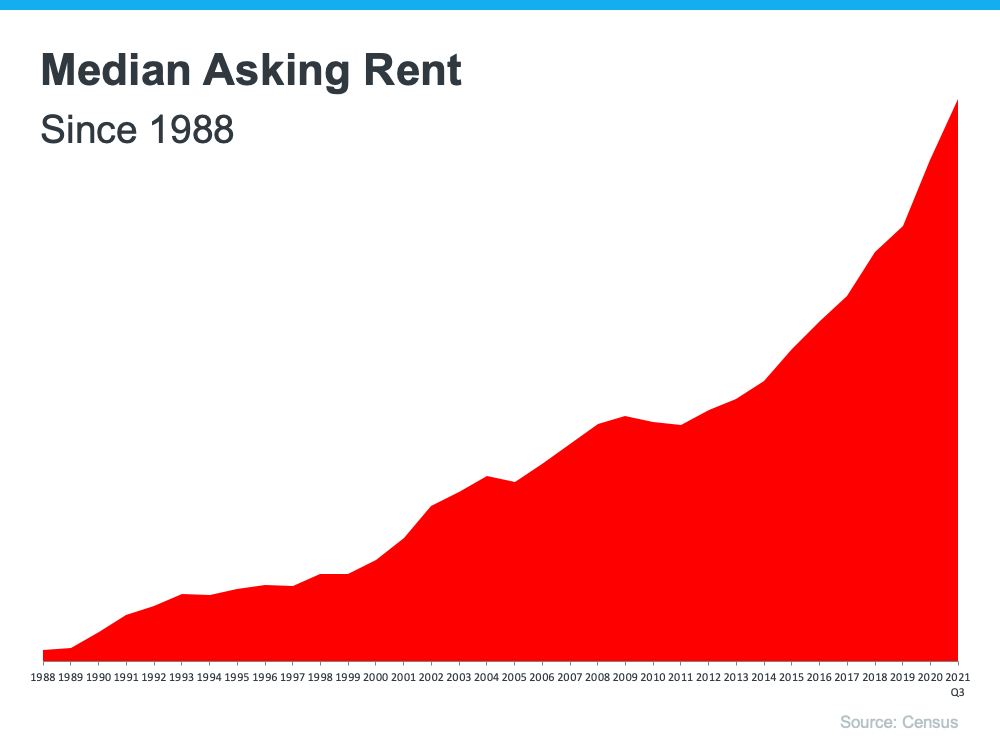

As a renter, you should know rents have been rising since 1988 (see graph below):

In 2021, rents grew dramatically. According to ApartmentList.com, since January 2021:

“. . . the national median rent has increased by a staggering 17.8 percent. To put that in context, rent growth from January to November averaged just 2.6 percent in the pre-pandemic years from 2017-2019.”

That increase in 2021 was far greater than the typical rent increases we’ve seen in recent years. In other words – rents are rising fast. And the 2022 National Housing Forecast from realtor.com projects prices for vacant units will continue to increase this year:

“In 2022, we expect this trend will continue and fuel rent growth. At a national level, we forecast rent growth of 7.1% in the next 12 months, somewhat ahead of home price growth . . .”

That means, if you’re planning to move into a different rental this year, you’ll likely pay far more than you have in years past.

Homeownership Provides an Alternative to Rising Rents

If you’re a renter facing rising rental costs, you might wonder what alternatives you have. If so, consider homeownership. One of the many benefits of homeownership is it provides a stable monthly cost you can lock in for the duration of your loan.

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“. . . fast-rising rents and increasing consumer prices, may have some prospective buyers seeking the protection of a fixed, consistent mortgage payment.”

If you’re planning to make a move this year, locking in your monthly housing costs for 15-30 years can be a major benefit. You’ll avoid wondering if you’ll need to adjust your budget to account for annual increases.

Homeowners also enjoy the added benefit of home equity, which has grown substantially right now. In fact, the latest Homeowner Equity Insight report from CoreLogic shows the average homeowner gained $56,700 in equity over the last 12 months. As a renter, your rent payment only covers the cost of your dwelling. When you pay your mortgage, you grow your wealth through the forced savings that is your home equity.

Bottom Line

If you’re thinking of renting this year, it’s important to keep in mind the true costs you’ll face. Let’s connect so you can see how you can begin your journey to homeownership today.

To view original article, visit Keeping Current Matters.

The Big Advantage If You Sell This Spring

Thinking about selling your house? If you’ve been waiting for the right time, it could be now while the supply of homes for sale is so low.

Homebuyer Activity Shows Signs of Warming Up for Spring

The recent uptick in mortgage applications, and the decline in mortgage rates, is good news for sellers!

Trying To Buy a Home? Hang in There.

As we move into the spring buying season, even though we are still in a sellers’ market, mortgage rates have ticked lower, a welcomed sign of progress towards affordability.

Two Reasons You Should Sell Your House

Wondering if you should sell your house this year? As you make your decision, think about what’s motivating you to consider moving and let’s connect today!

How Changing Mortgage Rates Can Affect You

It’s critical to lean on your expert real estate advisors to explore your mortgage options and understand what impacts mortgage rates.

We’re in a Sellers’ Market. What Does That Mean?

Right now, there are still buyers who are ready, willing, and able to purchase a home. List your home at the right price 🙂