Bubble Alert! Is it Getting Too Easy to Get a Mortgage?

There is little doubt that it is easier to get a home mortgage today than it was last year. The Mortgage Credit Availability Index (MCAI), published by the Mortgage Bankers Association, shows that mortgage credit has become more available in each of the last several years. In fact, in June the last year:

-

More buyers are putting less than 20% down to purchase a home

-

The average credit score on closed mortgages is lower

-

More low-down-payment programs have been introduced

This has some people worrying that we are returning to the lax lending standards which led to the boom and bust that real estate experienced ten years ago. Let’s alleviate some of that concern.

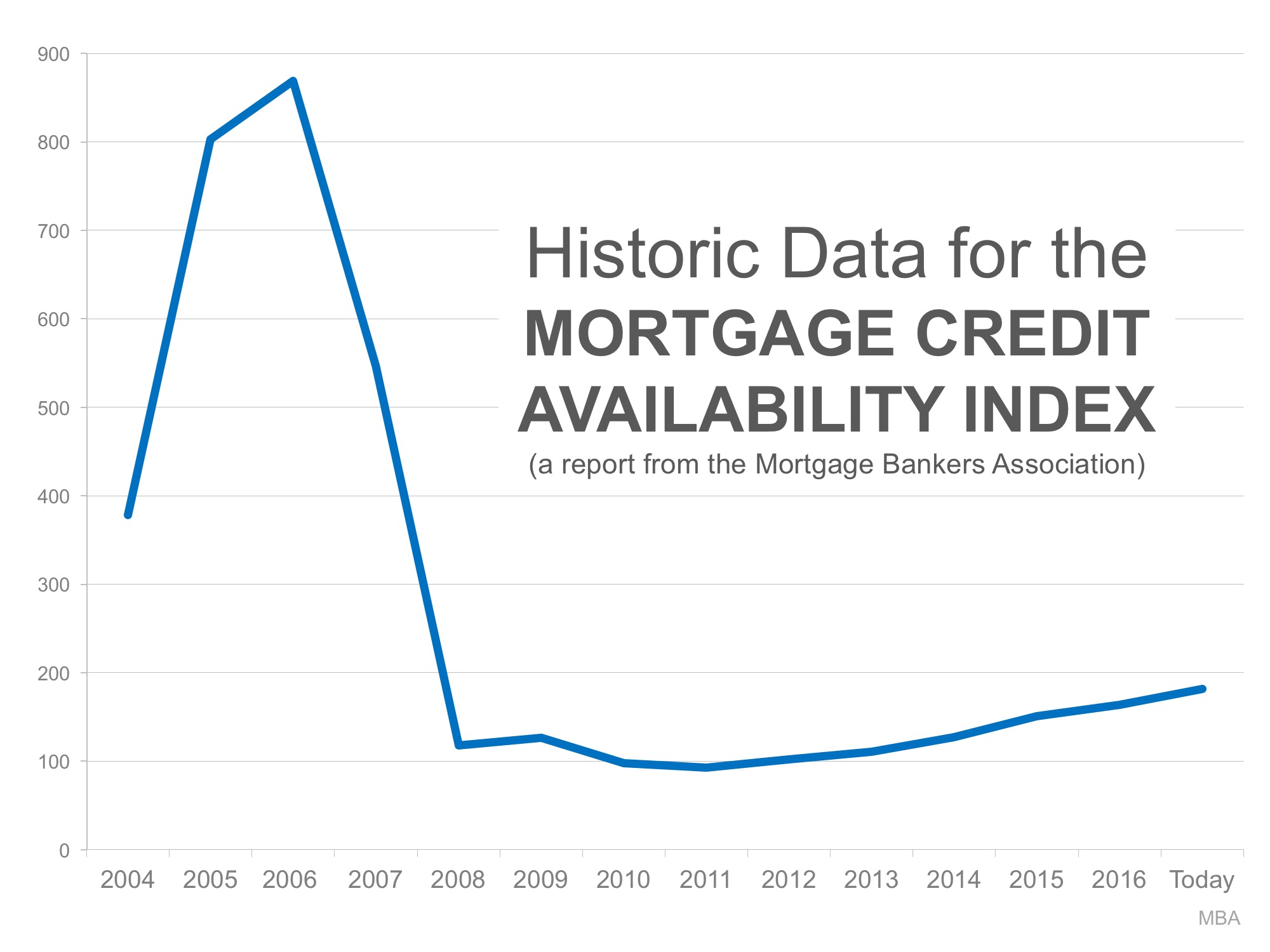

The graph below shows the MCAI going back to the boom years of 2004-2005. The higher the graph line, the easier it was to get a mortgage.

As you can see, lending standards were much more lenient from 2004 to 2007. Though it has gradually become easier to get a mortgage since 2011, we are nowhere near the lenient standards during the boom.

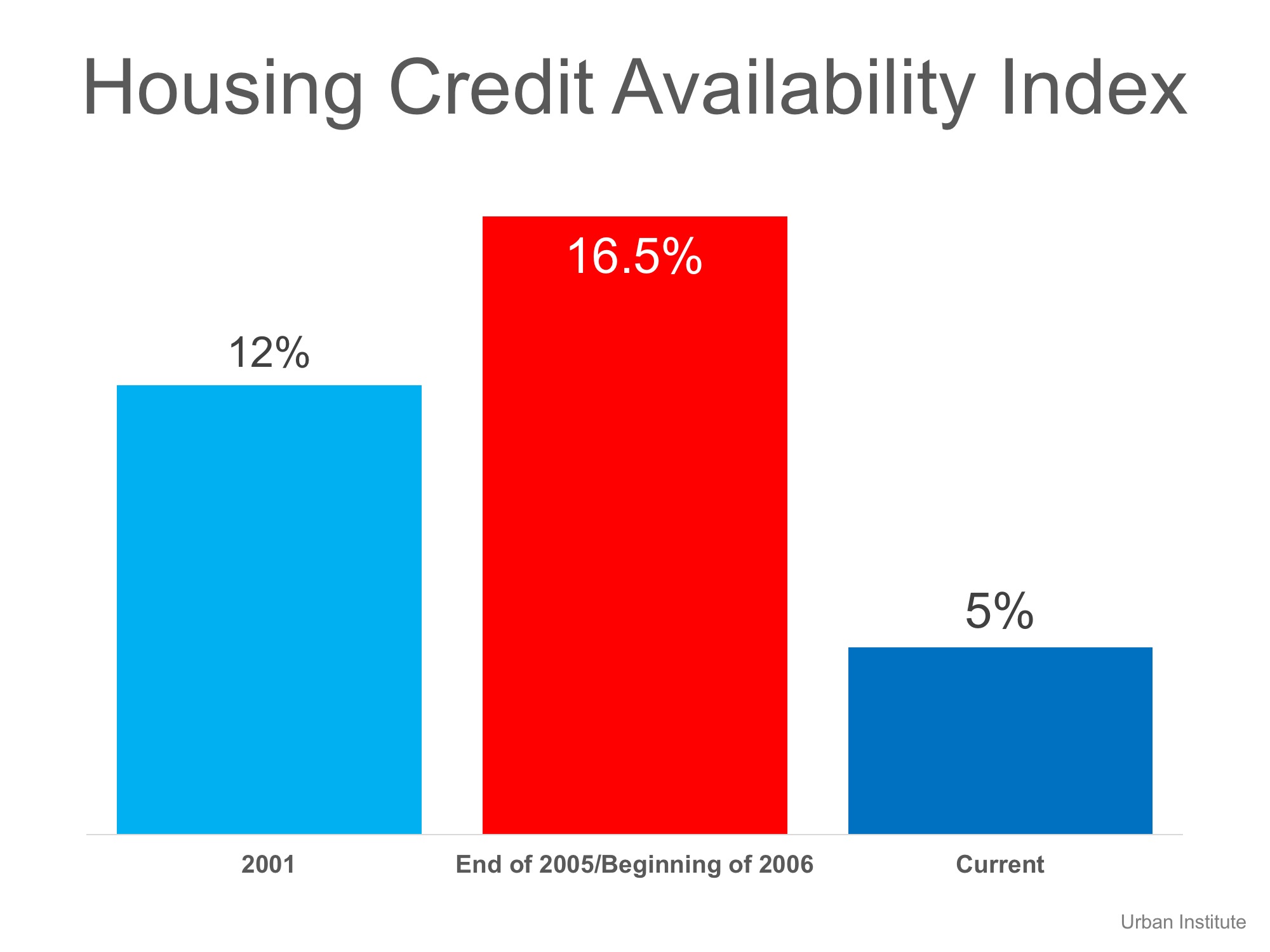

The Urban Institute also publishes a Home Credit Availability Index (HCAI). According to the institute, the HCAI:

“Measures the percentage of home purchase loans that are likely to default – that is, go unpaid for more than 90 days past their due date. A lower HCAI Indicated that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates…it is easier to get a loan.”

Here is a graph showing their findings:

Again, today’s lending standards are nowhere near the levels of the boom years. As a matter of fact, they are more stringent than they were even before the boom.

Bottom Line

It is getting easier to gain financing for a home purchase. However, we are not seeing the irresponsible lending that caused the housing crisis.

To view original article, please visit Keeping Current Matters.

Key Things To Avoid After Applying for a Mortgage

Any blip in income, assets, or credit should be reviewed and executed in a way that ensures your home loan can still be approved.

Happy Holidays!

Happy Holidays for all of us at BrookHampton Realty!

When a House Becomes a Home

Whether it’s a familiar scent or a favorite chair, the feel-good connections to our own homes can be more important to us than the financial ones.

The Average Homeowner Gained $56,700 in Equity over the Past Year

Understanding the importance of equity can help you realize why homeownership is a worthwhile goal.

Homebuyers: Be Ready To Act This Winter

Competition among buyers will remain fierce as there still won’t be enough homes for sale to meet the demand. so be ready to act!

What Everyone Wants To Know: Will Home Prices Decline in 2022?

it’s important to note that price increases won’t be as monumental as they were in 2021 – but they certainly won’t decline anytime soon.

Advice for First-Generation Homebuyers

Your dream of homeownership has far-reaching impacts and if you’re about to be the first person in your family to buy a home, let that motivate you throughout the process.

If You Think the Housing Market Will Slow This Winter, Think Again.

All signs point to the winter housing market picking up steam, making it much busier than in a more typical year.

Struggling to Find a Home to Buy? New Construction May be an Option

Working with the guidance of your trusted real estate advisor will help you make the most informed and educated decision.

Why It Just Became Much Easier to Buy a Home

More homes now qualify for a conforming loan with lower down payment requirements and easier lending standards.