Bubble Alert! Is it Getting Too Easy to Get a Mortgage?

There is little doubt that it is easier to get a home mortgage today than it was last year. The Mortgage Credit Availability Index (MCAI), published by the Mortgage Bankers Association, shows that mortgage credit has become more available in each of the last several years. In fact, in June the last year:

-

More buyers are putting less than 20% down to purchase a home

-

The average credit score on closed mortgages is lower

-

More low-down-payment programs have been introduced

This has some people worrying that we are returning to the lax lending standards which led to the boom and bust that real estate experienced ten years ago. Let’s alleviate some of that concern.

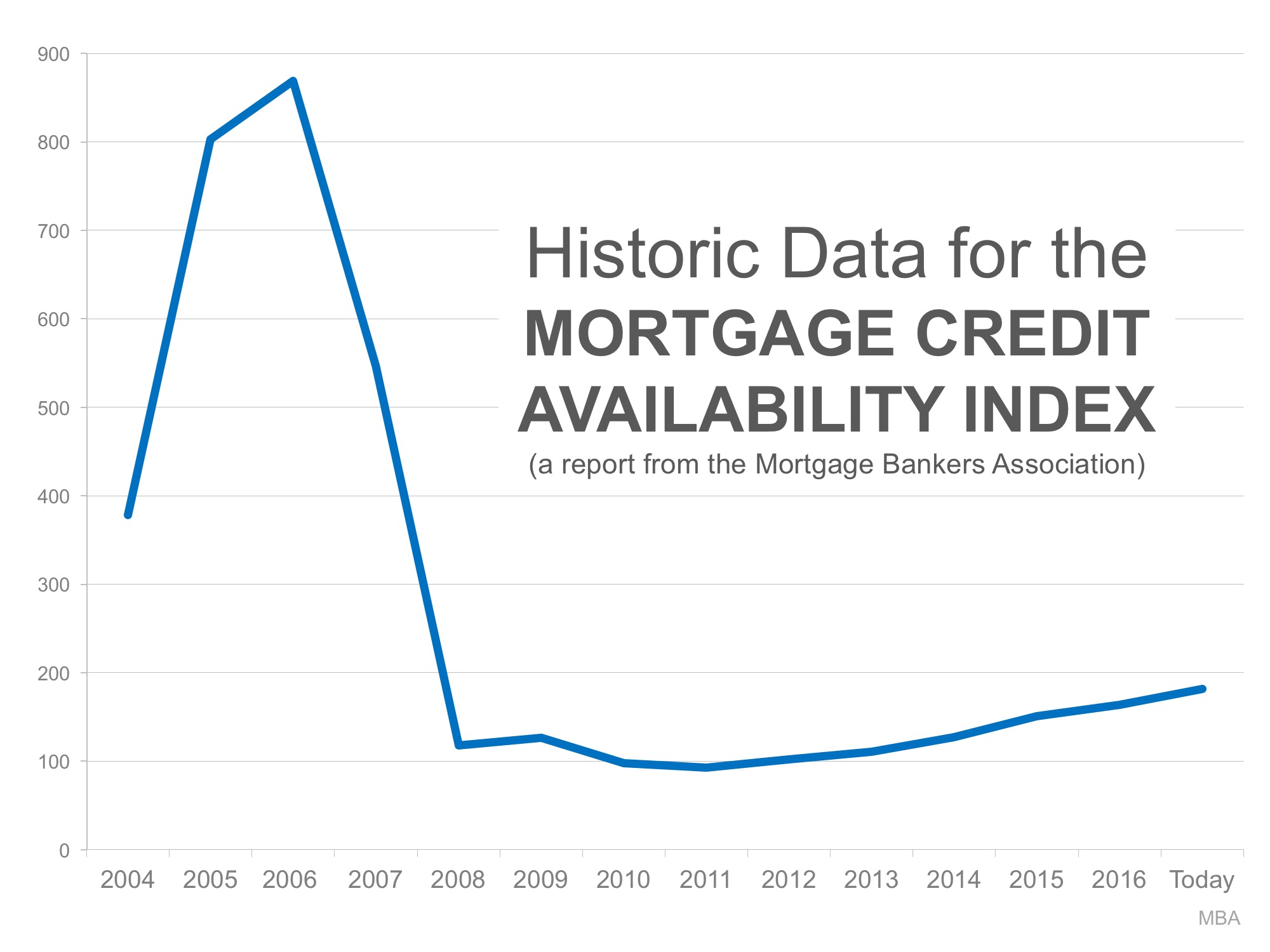

The graph below shows the MCAI going back to the boom years of 2004-2005. The higher the graph line, the easier it was to get a mortgage.

As you can see, lending standards were much more lenient from 2004 to 2007. Though it has gradually become easier to get a mortgage since 2011, we are nowhere near the lenient standards during the boom.

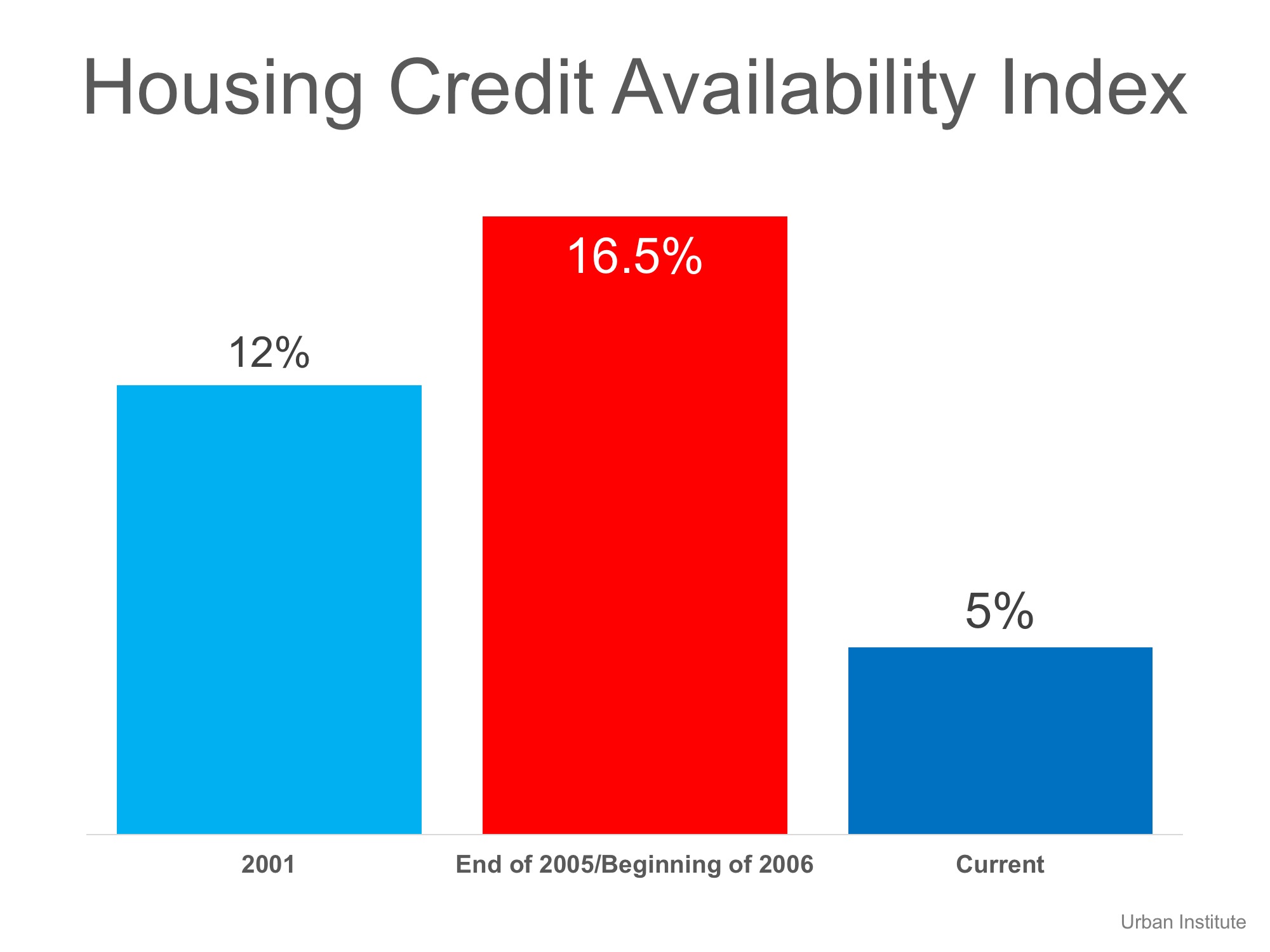

The Urban Institute also publishes a Home Credit Availability Index (HCAI). According to the institute, the HCAI:

“Measures the percentage of home purchase loans that are likely to default – that is, go unpaid for more than 90 days past their due date. A lower HCAI Indicated that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates…it is easier to get a loan.”

Here is a graph showing their findings:

Again, today’s lending standards are nowhere near the levels of the boom years. As a matter of fact, they are more stringent than they were even before the boom.

Bottom Line

It is getting easier to gain financing for a home purchase. However, we are not seeing the irresponsible lending that caused the housing crisis.

To view original article, please visit Keeping Current Matters.

To Renovate or Not To Renovate Before You Sell

Spending costly time and money on renovations before you sell might just mean you’ll miss your key window of opportunity.

What Is the Strongest Tailwind to Today’s Recovering Economy?

Real estate has been a beacon of light during a very challenging time in our nation’s history.

What Is the #1 Financial Benefit of Homeownership?

The wealth-building power of homeownership shows that home is not only where your heart is, but also where your wealth is.

How to Make a Winning Offer on a Home

A real estate professional should be the expert guide you lean on for advice when you’re ready to make an offer. Let’s connect today to make sure you’re headed in the right direction.

Will the Housing Market Bloom This Spring?

Here’s what a few industry experts have to say about the housing market and how it will bloom this season.

6 Simple Graphs Proving This Is Nothing Like Last Time

In 2020, real estate had one of its best years ever. Home sales were up over the year before. Find out why it’s different from 2008.

How Upset Should You Be about 3% Mortgage Rates?

Being upset that you missed the “best mortgage rate ever” is understandable. Buying now still makes more sense than waiting!

5 Reasons to Sell Your House This Spring

Sellers are driving the market right now so if you’ve considered making a move but have been waiting for the right market conditions, your wait may be over.

Home Prices: What Happened in 2020? What Will Happen This Year?

Home price appreciation will be strong this year, but it won’t reach the historic levels of 2020.

What Are the Benefits of a 20% Down Payment?

If you’re thinking of buying a home this year, you may be wondering how much money you need to come up with for your down payment.