Bubble Alert! Is it Getting Too Easy to Get a Mortgage?

There is little doubt that it is easier to get a home mortgage today than it was last year. The Mortgage Credit Availability Index (MCAI), published by the Mortgage Bankers Association, shows that mortgage credit has become more available in each of the last several years. In fact, in June the last year:

-

More buyers are putting less than 20% down to purchase a home

-

The average credit score on closed mortgages is lower

-

More low-down-payment programs have been introduced

This has some people worrying that we are returning to the lax lending standards which led to the boom and bust that real estate experienced ten years ago. Let’s alleviate some of that concern.

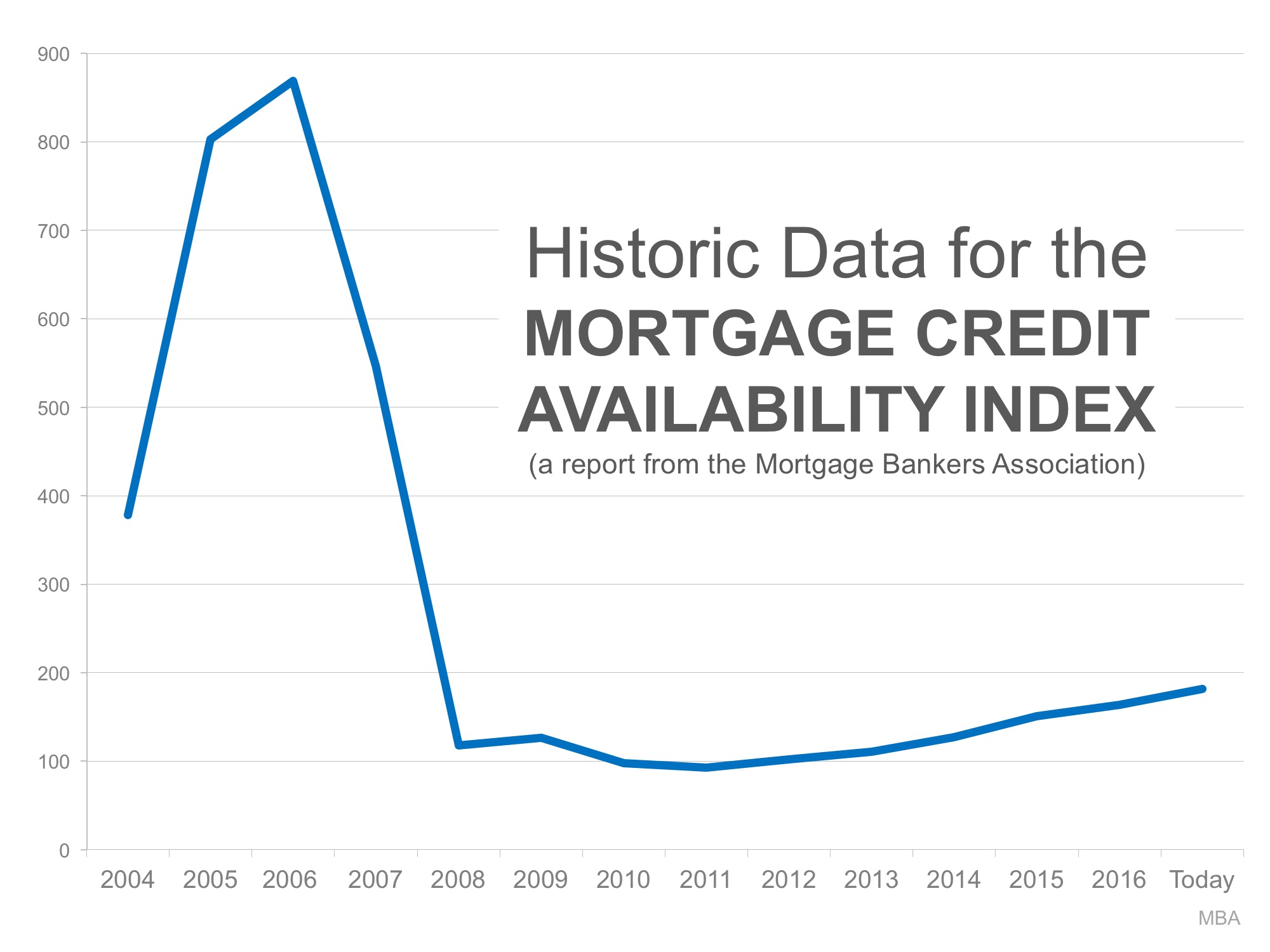

The graph below shows the MCAI going back to the boom years of 2004-2005. The higher the graph line, the easier it was to get a mortgage.

As you can see, lending standards were much more lenient from 2004 to 2007. Though it has gradually become easier to get a mortgage since 2011, we are nowhere near the lenient standards during the boom.

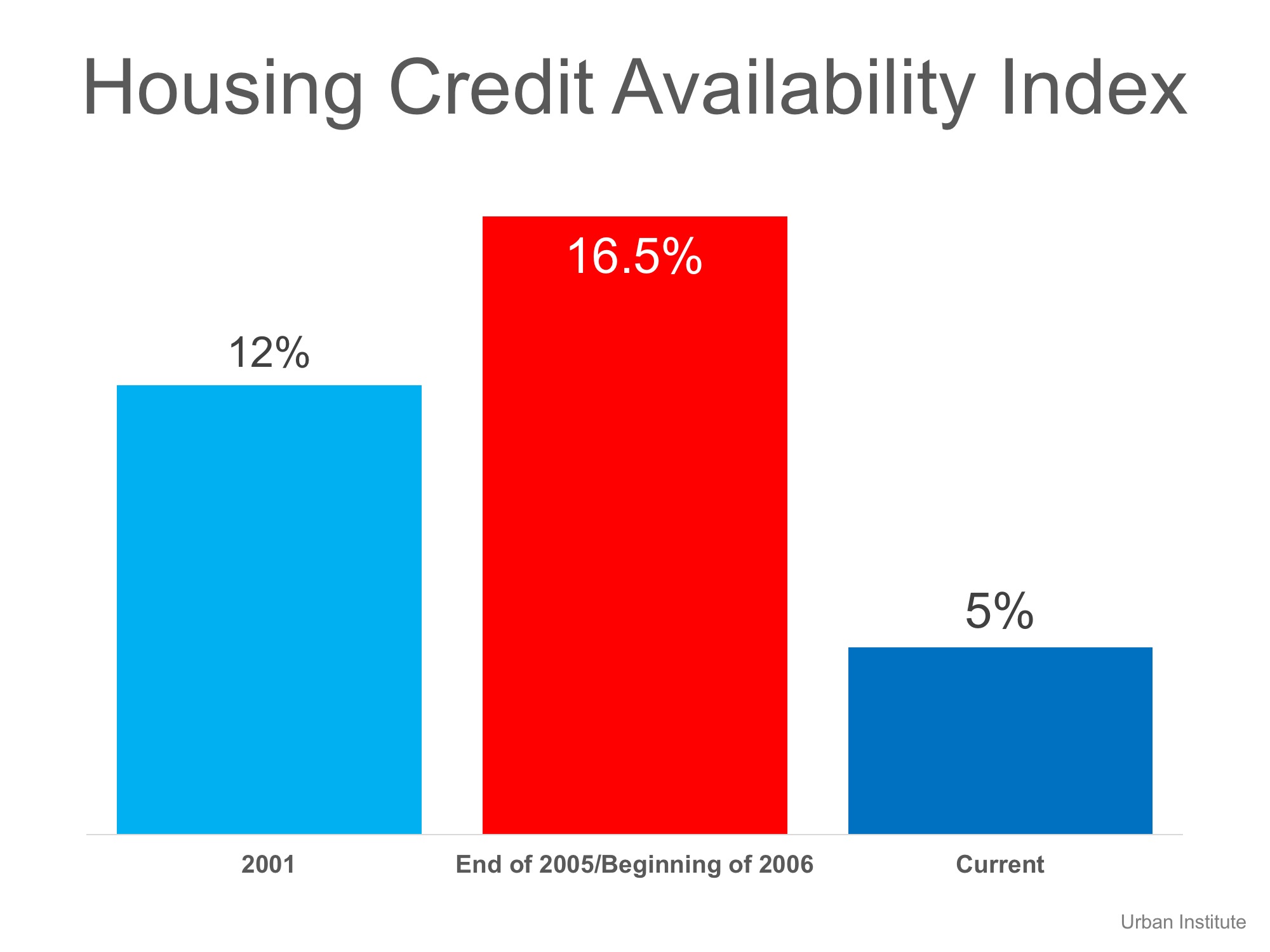

The Urban Institute also publishes a Home Credit Availability Index (HCAI). According to the institute, the HCAI:

“Measures the percentage of home purchase loans that are likely to default – that is, go unpaid for more than 90 days past their due date. A lower HCAI Indicated that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates…it is easier to get a loan.”

Here is a graph showing their findings:

Again, today’s lending standards are nowhere near the levels of the boom years. As a matter of fact, they are more stringent than they were even before the boom.

Bottom Line

It is getting easier to gain financing for a home purchase. However, we are not seeing the irresponsible lending that caused the housing crisis.

To view original article, please visit Keeping Current Matters.

The Difference a Year Makes for Homeownership

Today’s low mortgage rates are a huge perk for buyers, so it’s a great time to get more for your money and consider a new home.

The Do’s and Dont’s after Applying for a Mortgage

Once you’ve found the right home and applied for a mortgage, there are some key things to keep in mind before you close.

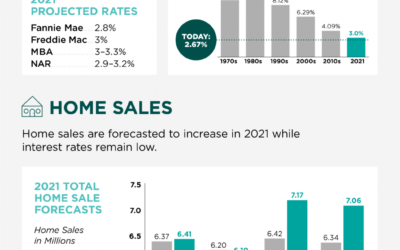

2021 Housing Forecast – Infographic

With mortgage rates forecasted to remain low, high buyer demand is expected to fuel more home sales and continue to increase home prices.

Homeowner Equity Increases an Astonishing $1 Trillion

Over the past year, strong home price growth has created a record level of home equity for homeowners.

The Holidays Aren’t Stopping Homebuyers This Year

There are first-time, move-up, and move-down buyers actively looking for the home of their dreams this winter.

5 Steps to Follow When Applying for Forbearance

Help is out there for homeowners in need, but it’s important to apply now while this benefit is still available.

Winning as a Buyer in a Sellers’ Market

Buying a home in today’s sellers’ market doesn’t have to feel like an uphill battle. Make your life easier by working with one of our trusted agents!

Why It Makes Sense to Sell Your House This Holiday Season

The supply of homes for sale is not keeping up with this high demand, making now the optimal time to sell your house.

Are Home Prices Headed Toward Bubble Territory?

High demand coupled with restricted supply has caused home prices to appreciate above historic levels.

An Honest Look at Unemployment Numbers

Though millions of Americans are still out of work, the situation was forecasted to be even direr than it is today.