Bubble Alert! Is it Getting Too Easy to Get a Mortgage?

There is little doubt that it is easier to get a home mortgage today than it was last year. The Mortgage Credit Availability Index (MCAI), published by the Mortgage Bankers Association, shows that mortgage credit has become more available in each of the last several years. In fact, in June the last year:

-

More buyers are putting less than 20% down to purchase a home

-

The average credit score on closed mortgages is lower

-

More low-down-payment programs have been introduced

This has some people worrying that we are returning to the lax lending standards which led to the boom and bust that real estate experienced ten years ago. Let’s alleviate some of that concern.

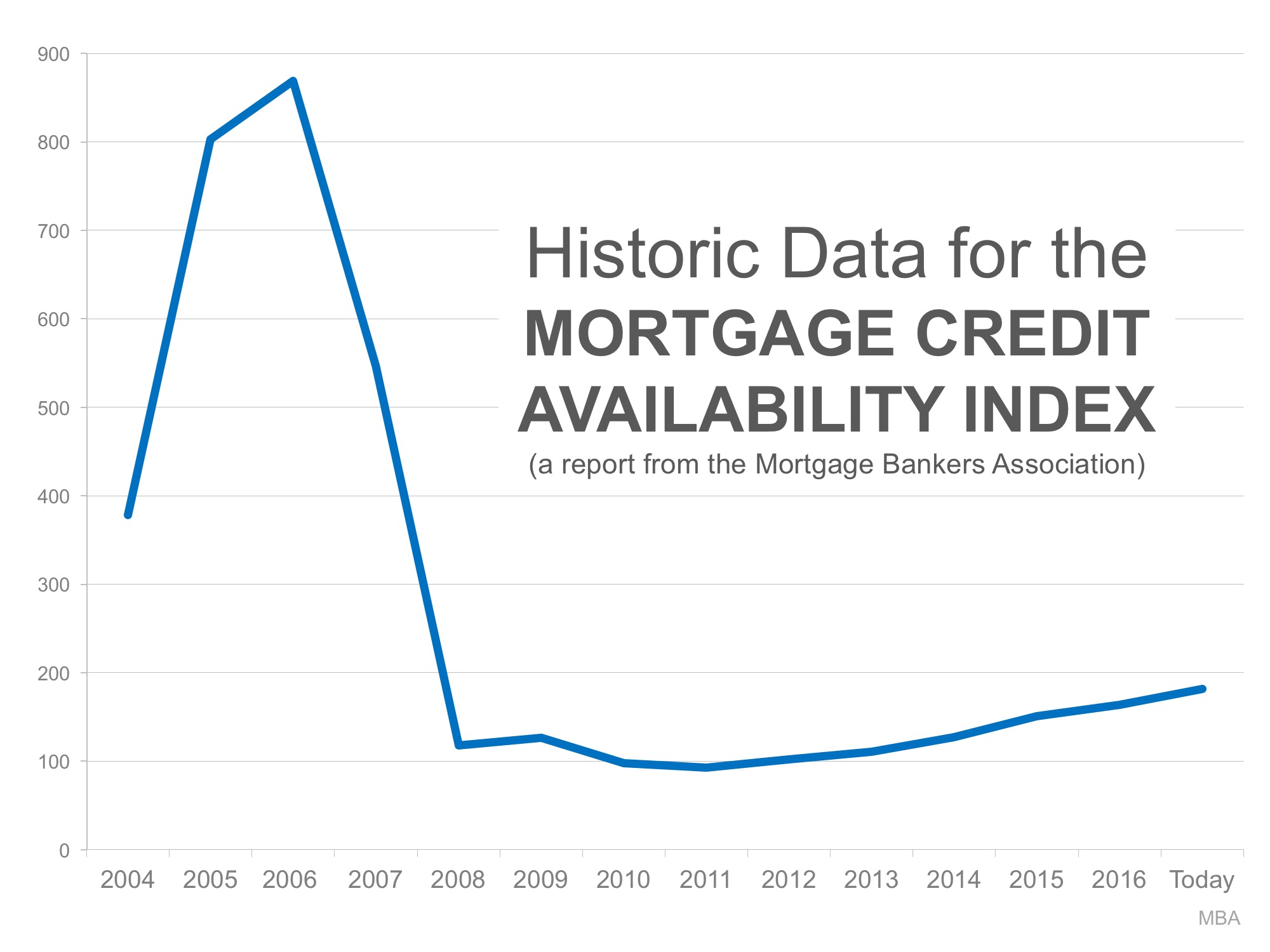

The graph below shows the MCAI going back to the boom years of 2004-2005. The higher the graph line, the easier it was to get a mortgage.

As you can see, lending standards were much more lenient from 2004 to 2007. Though it has gradually become easier to get a mortgage since 2011, we are nowhere near the lenient standards during the boom.

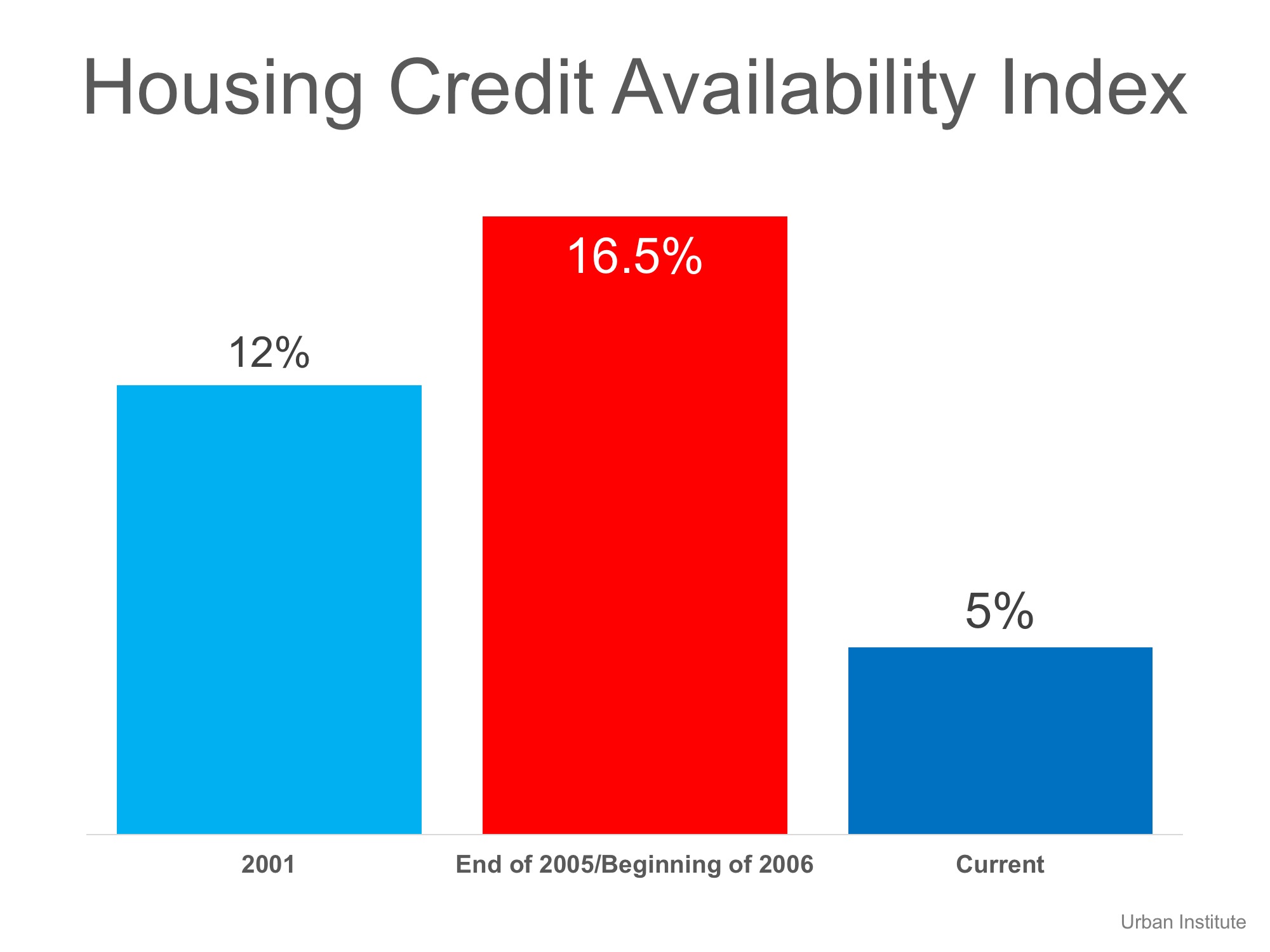

The Urban Institute also publishes a Home Credit Availability Index (HCAI). According to the institute, the HCAI:

“Measures the percentage of home purchase loans that are likely to default – that is, go unpaid for more than 90 days past their due date. A lower HCAI Indicated that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates…it is easier to get a loan.”

Here is a graph showing their findings:

Again, today’s lending standards are nowhere near the levels of the boom years. As a matter of fact, they are more stringent than they were even before the boom.

Bottom Line

It is getting easier to gain financing for a home purchase. However, we are not seeing the irresponsible lending that caused the housing crisis.

To view original article, please visit Keeping Current Matters.

Two New Surveys Indicate Urban to Suburban Lean

Americans are feeling less enamored with living in a large city and may be longing for the open spaces in suburban and rural areas.

Virtual School Is Changing Homebuyer Needs

With remote learning sweeping the nation this year, organized spaces with room for kids to learn effectively are high on buyer wish lists.

Homebuyer Traffic Is On the Rise

Lawrence Yun, Chief Economist of the National Association of Realtors (NAR), is now forecasting that more homes will sell this year than last year. Are you ready to make a move?

Have You Ever Seen a Housing Market Like This?

2020 will certainly be one to remember, with new realities and norms that changed the way we live and real estate is no exception.

The 2020 Homebuyer Wish List

The word “home” is taking on a whole new meaning this year, and buyers are starting to look for new features as they re-think their needs and what’s truly possible.

Homebuyer Demand Is Far Above Last Year’s Pace

If your current home doesn’t meet your family’s needs, let’s connect to help you sell your house and make the move you’ve been waiting for.

How Will the Presidential Election Impact Real Estate?

The year 2020 will be remembered as one of the most challenging times of our lives.

It’s Not Just About the Price of the Home

Today’s low rates are off-setting rising home prices because it’s less expensive to borrow money. Now may be the perfect time to purchase your dream home.

Three Ways to Win in a Bidding War

The housing market is very strong right now, and buyers are scooping up available homes faster than they’re coming to market.

#brookhamptonrealty

Why Is It so Important to Be Pre-Approved in the Homebuying Process?

Pre-approval shows homeowners you’re a serious buyer and helps you stand out from the crowd if you get into a multiple-offer scenario.