Bubble Alert! Is it Getting Too Easy to Get a Mortgage?

There is little doubt that it is easier to get a home mortgage today than it was last year. The Mortgage Credit Availability Index (MCAI), published by the Mortgage Bankers Association, shows that mortgage credit has become more available in each of the last several years. In fact, in June the last year:

-

More buyers are putting less than 20% down to purchase a home

-

The average credit score on closed mortgages is lower

-

More low-down-payment programs have been introduced

This has some people worrying that we are returning to the lax lending standards which led to the boom and bust that real estate experienced ten years ago. Let’s alleviate some of that concern.

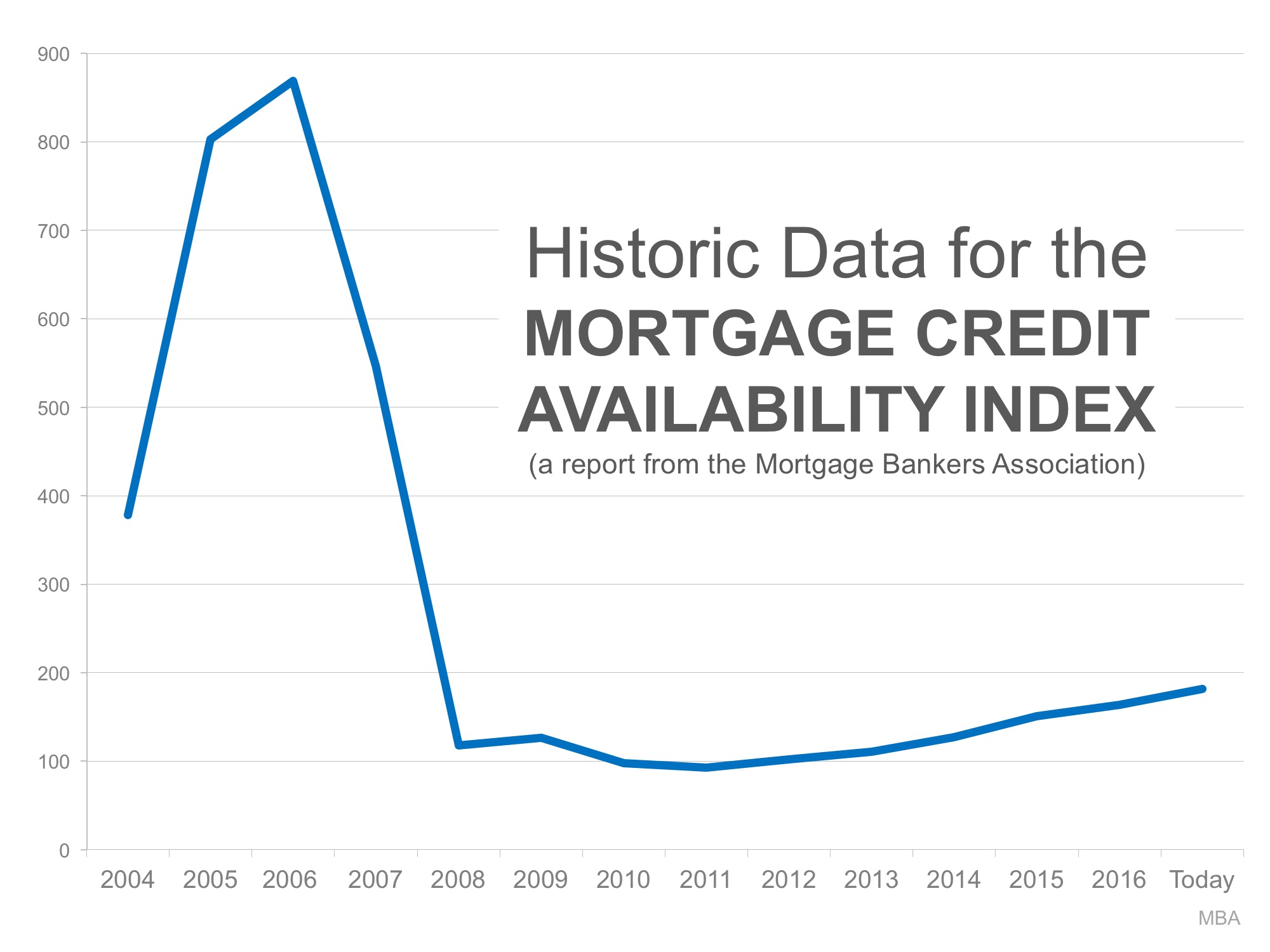

The graph below shows the MCAI going back to the boom years of 2004-2005. The higher the graph line, the easier it was to get a mortgage.

As you can see, lending standards were much more lenient from 2004 to 2007. Though it has gradually become easier to get a mortgage since 2011, we are nowhere near the lenient standards during the boom.

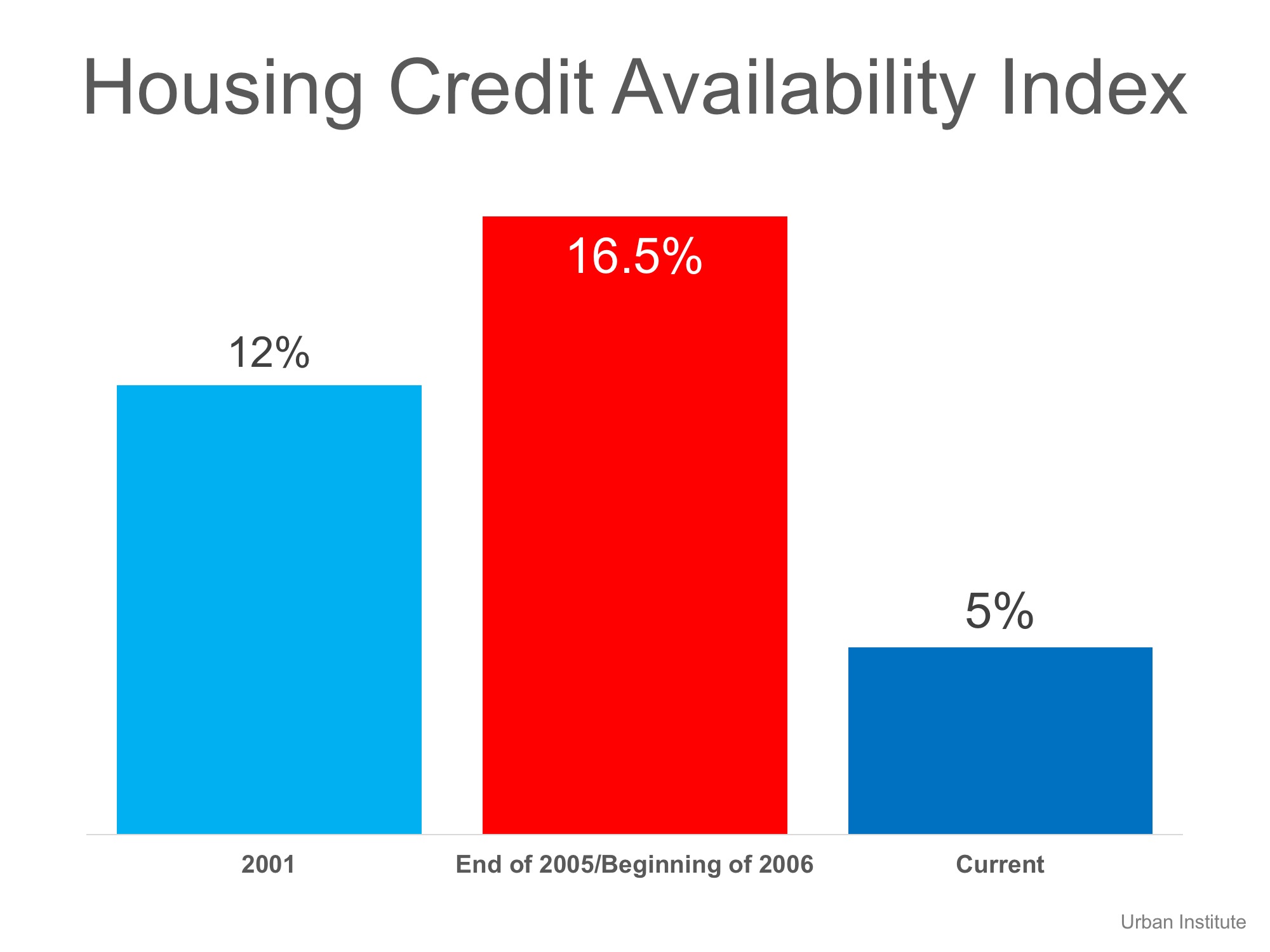

The Urban Institute also publishes a Home Credit Availability Index (HCAI). According to the institute, the HCAI:

“Measures the percentage of home purchase loans that are likely to default – that is, go unpaid for more than 90 days past their due date. A lower HCAI Indicated that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates…it is easier to get a loan.”

Here is a graph showing their findings:

Again, today’s lending standards are nowhere near the levels of the boom years. As a matter of fact, they are more stringent than they were even before the boom.

Bottom Line

It is getting easier to gain financing for a home purchase. However, we are not seeing the irresponsible lending that caused the housing crisis.

To view original article, please visit Keeping Current Matters.

Are We Heading into a Balanced Market?

Whether you’re buying or selling, understanding how the market is changing gives you a big advantage. Your agent has the latest data and local insights.

What’s the Impact of Presidential Elections on the Housing Market?

Historically, the housing market doesn’t tend to look very different in presidential election years compared to other years.

What Mortgage Rate Are You Waiting For?

If you’ve been holding out and waiting for rates to come down, know that it’s already happening.

Today’s Biggest Housing Market Myths

If you have questions about what you’re hearing or reading, let’s connect. You deserve to have someone you can trust to get the facts and sort out the misconceptions.

How To Choose a Great Local Real Estate Agent

The right agent should be someone you trust to guide you through one of the most significant transactions of your life.

How Mortgage Rate Changes Impact Your Homebuying Power

Real estate agents have the expertise to help you understand what’s happening and what it means for you.

What Credit Score Do You Really Need to Buy a House?

While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy.

Is Affordability Starting to Improve?

While affordability is still tight, there are signs it’s getting a little better and might keep improving throughout the rest of the year. Here’s a look at the latest data.

Are There More Homes for Sale Where You Live?

Increased housing supply spells good news for consumers who want to see more properties before making purchasing decisions.

Where Will You Go After You Sell?

Want to see what’s available? Your real estate agent can show you what homes are for sale in your area, so you can see if there’s one that works for you and your needs.