Bubble Alert! Is it Getting Too Easy to Get a Mortgage?

There is little doubt that it is easier to get a home mortgage today than it was last year. The Mortgage Credit Availability Index (MCAI), published by the Mortgage Bankers Association, shows that mortgage credit has become more available in each of the last several years. In fact, in June the last year:

-

More buyers are putting less than 20% down to purchase a home

-

The average credit score on closed mortgages is lower

-

More low-down-payment programs have been introduced

This has some people worrying that we are returning to the lax lending standards which led to the boom and bust that real estate experienced ten years ago. Let’s alleviate some of that concern.

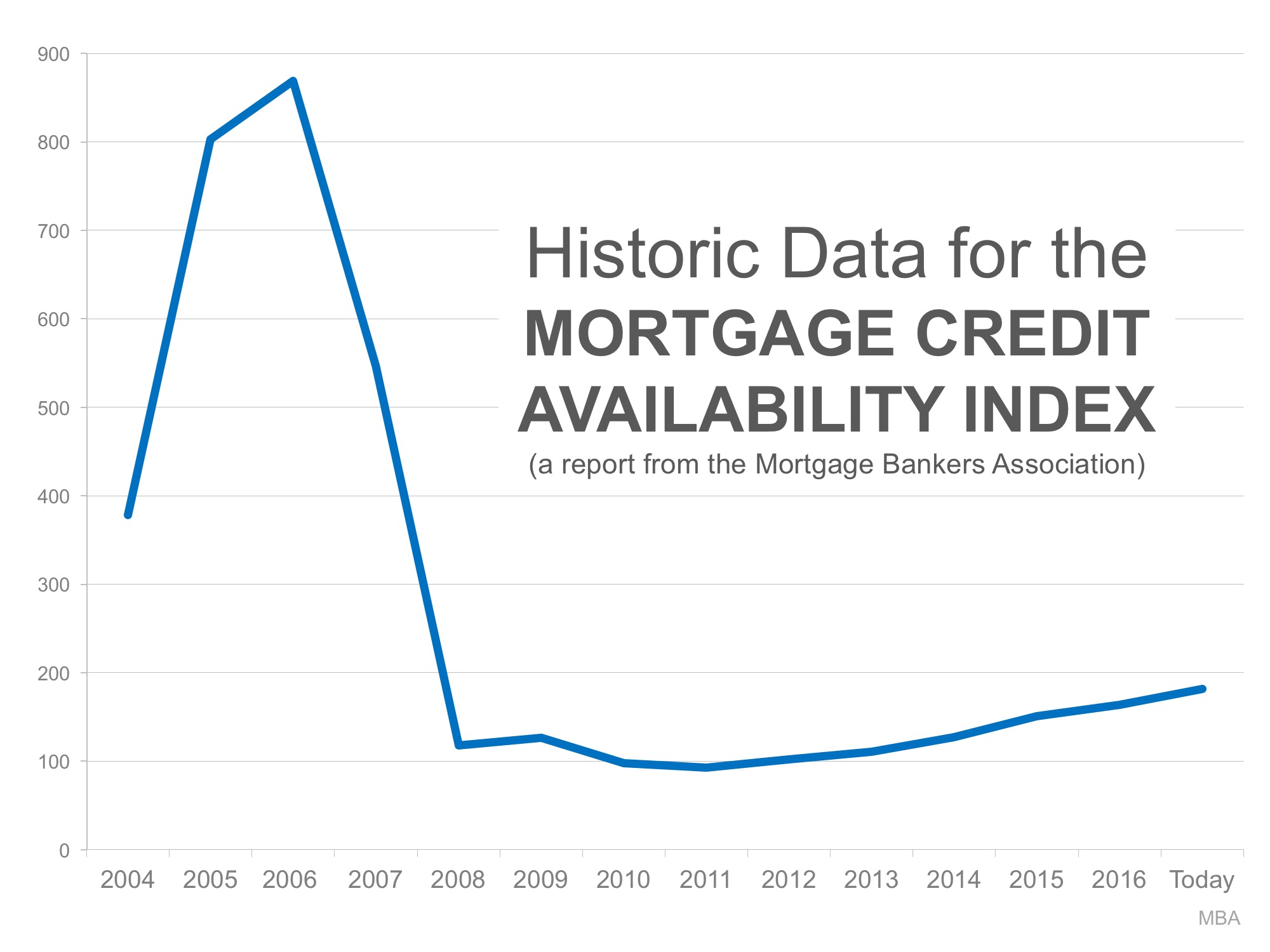

The graph below shows the MCAI going back to the boom years of 2004-2005. The higher the graph line, the easier it was to get a mortgage.

As you can see, lending standards were much more lenient from 2004 to 2007. Though it has gradually become easier to get a mortgage since 2011, we are nowhere near the lenient standards during the boom.

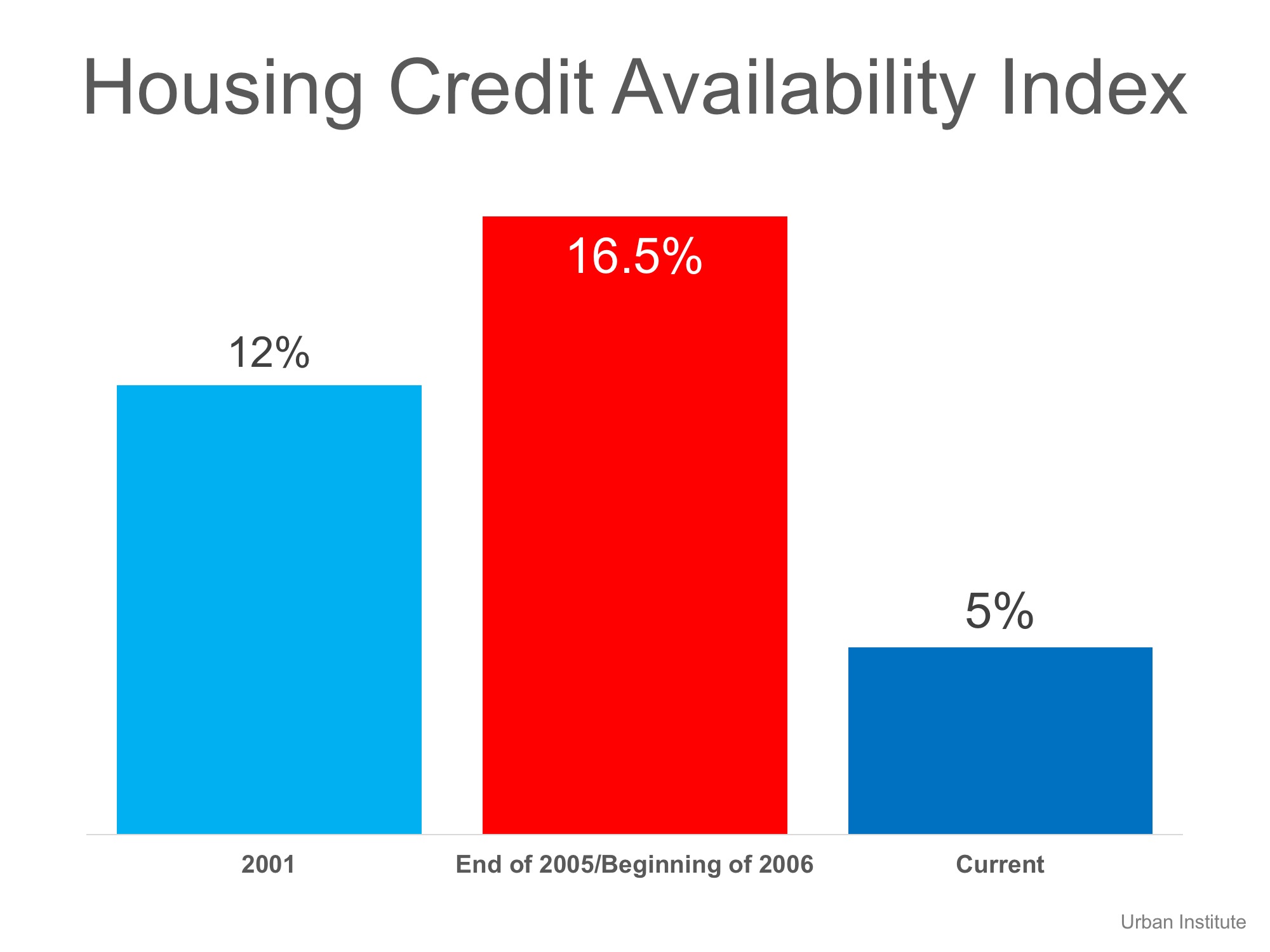

The Urban Institute also publishes a Home Credit Availability Index (HCAI). According to the institute, the HCAI:

“Measures the percentage of home purchase loans that are likely to default – that is, go unpaid for more than 90 days past their due date. A lower HCAI Indicated that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates…it is easier to get a loan.”

Here is a graph showing their findings:

Again, today’s lending standards are nowhere near the levels of the boom years. As a matter of fact, they are more stringent than they were even before the boom.

Bottom Line

It is getting easier to gain financing for a home purchase. However, we are not seeing the irresponsible lending that caused the housing crisis.

To view original article, please visit Keeping Current Matters.

What You Need To Know About Today’s Down Payment Programs

If you want more information on down payment programs, the best place to start is by contacting a trusted real estate professional.

Worried About Mortgage Rates? Control the Controllables

Remember, you can’t control what happens in the broader economy. But you can control the controllables.

Home Prices Aren’t Declining, But Headlines Might Make You Think They Are

Here’s what’s really happening with home prices.

Your Equity Could Make a Move Possible

Today’s mortgage rates are higher than the one they currently have on their home, and that’s making it harder to want to sell and make a move. Equity can help you make your move.

More Than a House: The Emotional Benefits of Homeownership

Here’s a look at just a few of those more emotional or lifestyle perks, to help anchor you to why homeownership is one of your goals.

The Biggest Mistakes Buyers Are Making Today

There’s one way to avoid getting tripped up – and that’s leaning on a real estate agent for the best possible advice.

How Do Climate Risks Affect Your Next Home?

How can you be sure your investment is safe from the elements? Work with a local real estate agent!

Questions You May Have About Selling Your House

If you’ve been considering selling your house, and have some questions, call us today for some clarity.

Worried about Home Maintenance Costs? Consider This

If you’re worried about home maintenance, here’s some information you may find interesting.

What’s Next for Home Prices and Mortgage Rates?

If you’re ready, willing, and able to afford a home right now, partner with a trusted real estate advisor to decide what’s right for you.