Builder Offering to Pay Off Student Loans for Buyers

Millennials are on track to become the most educated generation in history. This means they are also the generation with the most student debt. Depending on the type of degree earned, as well as the prestige of the institution attended, there are some millennials who graduate college with what equates to a mortgage payment.

For those first-time buyers, and even some move-up buyers, who took advantage of the First-Time Homebuyer Tax Credit in 2008, there is an interesting program being introduced by Lennar Home Builders and Eagle Home Mortgage.

“Borrowers with Eagle Home Mortgage’s Student Loan Debt Mortgage Program can direct up to 3% of the purchase price (up to $13,000) to pay their student loans when they buy a new home from Lennar, one of the nation’s largest homebuilders. The contribution doesn’t directly increase the purchase price of the home or add to the balance of the loan.”

The program allows borrowers, whose credit and income requirements qualify, to put down as low as 3% and have a maximum loan amount of $424,100. At the time of closing, Lennar contributes up to 3% to pay down student loans incurred while attending universities, colleges, community colleges, trade schools and other certificate-granting programs.

Jimmy Timmons, President of Eagle Home Mortgage, gave more context about the reasons behind the creation of the program.

“Americans are more burdened than ever by student loans, with $1.3 trillion in outstanding student loans spread out among 42 million borrowers.

Particularly with millennial buyers, people who want to buy a home of their own are not feeling as though they can move forward. Our program is designed to relieve some of that burden and remove that barrier to owning a home.”

According to the Wall Street Journal, “housing observers said other builders are likely to look to mimic the program, which could help lure more of the critical first-time-buyer segment into home purchases.”

Bottom Line

If you are one of the many millennials who may have delayed purchasing your first home, or feel stuck in a house that no longer fits your needs, there are programs and options available to help you achieve your dream!

To see original article please visit Keeping Current Matters.

4 Reasons People Are Buying Homes in 2021

As many of us spend extra time at home, we’re reevaluating what “home” means and what we may need in one going forward.

What Does 2021 Have in Store for Home Values?

Home price appreciation in 2021 will continue to be determined by the imbalance of supply and demand.

Is This the Year to Sell My House?

With so few homes available for buyers to choose from, we’re in a true sellers’ market. If you’re thinking of selling your home, now may be the time!

Why Not to Wait Until Spring to Make a Move

Selling your house before more listings come to the market in the traditionally busy spring market might be your best chance to shine.

3 Must-Do’s When Selling Your House This Year

A real estate professional can help you navigate the selling process while prioritizing these must-do’s. Give us a call today.

3 Reasons to Be Optimistic about Real Estate in 2021

While the economy improves and interest rates remain low, homes are expected to continue appreciating in the coming year.

Did You Outgrow Your Home in 2020?

It may seem hard to imagine that the home you’re in today might not be your forever home. Many needs have changed in 2020 and your home may no longer fit your lifestyle.

The Difference a Year Makes for Homeownership

Today’s low mortgage rates are a huge perk for buyers, so it’s a great time to get more for your money and consider a new home.

The Do’s and Dont’s after Applying for a Mortgage

Once you’ve found the right home and applied for a mortgage, there are some key things to keep in mind before you close.

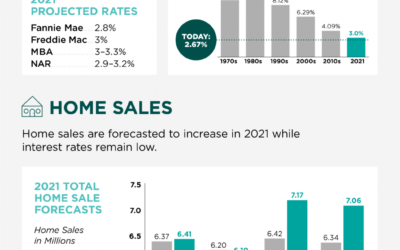

2021 Housing Forecast – Infographic

With mortgage rates forecasted to remain low, high buyer demand is expected to fuel more home sales and continue to increase home prices.