Builder Offering to Pay Off Student Loans for Buyers

Millennials are on track to become the most educated generation in history. This means they are also the generation with the most student debt. Depending on the type of degree earned, as well as the prestige of the institution attended, there are some millennials who graduate college with what equates to a mortgage payment.

For those first-time buyers, and even some move-up buyers, who took advantage of the First-Time Homebuyer Tax Credit in 2008, there is an interesting program being introduced by Lennar Home Builders and Eagle Home Mortgage.

“Borrowers with Eagle Home Mortgage’s Student Loan Debt Mortgage Program can direct up to 3% of the purchase price (up to $13,000) to pay their student loans when they buy a new home from Lennar, one of the nation’s largest homebuilders. The contribution doesn’t directly increase the purchase price of the home or add to the balance of the loan.”

The program allows borrowers, whose credit and income requirements qualify, to put down as low as 3% and have a maximum loan amount of $424,100. At the time of closing, Lennar contributes up to 3% to pay down student loans incurred while attending universities, colleges, community colleges, trade schools and other certificate-granting programs.

Jimmy Timmons, President of Eagle Home Mortgage, gave more context about the reasons behind the creation of the program.

“Americans are more burdened than ever by student loans, with $1.3 trillion in outstanding student loans spread out among 42 million borrowers.

Particularly with millennial buyers, people who want to buy a home of their own are not feeling as though they can move forward. Our program is designed to relieve some of that burden and remove that barrier to owning a home.”

According to the Wall Street Journal, “housing observers said other builders are likely to look to mimic the program, which could help lure more of the critical first-time-buyer segment into home purchases.”

Bottom Line

If you are one of the many millennials who may have delayed purchasing your first home, or feel stuck in a house that no longer fits your needs, there are programs and options available to help you achieve your dream!

To see original article please visit Keeping Current Matters.

Should You Buy a Retirement Home Sooner Rather than Later?

If you’re a retiree with a single-family home and want to move closer to your family, now is the time to put your house on the market.

A Homeowner’s Net Worth Is 40x Greater Than a Renter’s

The housing market has made a full recovery, and all-time low interest rates are giving home buyers a big boost in purchasing power.

Is it Time to Move into a Single-Story Home?

Single-story homes have a lot of benefits and are often in higher demand. This bodes well for future resale opportunities.

Why Pricing Your House Right Is Essential

When it comes to pricing your home, the goal is to increase visibility and drive more buyers your way.

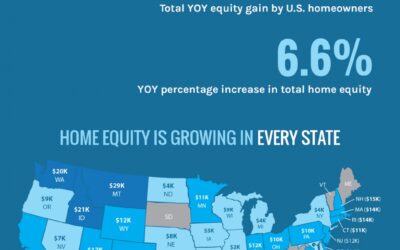

Rising Home Equity Can Power Your Next Move

Over the past year, the average homeowner gained $9,800 in equity, growing their overall net worth.

Buyers Are Finding More Space in the Luxury Home Market

Home offices, multi-purpose rooms, gyms, and theaters are becoming more popular.

Why Selling this Fall May Be Your Best Move

If you’re thinking about moving, selling your house this fall might be the way to go.

Where Are Home Values Headed Over the Next 12 Months?

The only major industry to display immunity to the economic impacts of the coronavirus is the housing market.

Housing Market on Track to Beat Last Year’s Success

Housing has experienced a strong V-shaped recovery and is now exceeding pre-pandemic levels.

Why Pricing Your Home Right Matters This Fall

To sell your home quickly and for the best possible price, you should price your home competitively right from the start.