Builder Offering to Pay Off Student Loans for Buyers

Millennials are on track to become the most educated generation in history. This means they are also the generation with the most student debt. Depending on the type of degree earned, as well as the prestige of the institution attended, there are some millennials who graduate college with what equates to a mortgage payment.

For those first-time buyers, and even some move-up buyers, who took advantage of the First-Time Homebuyer Tax Credit in 2008, there is an interesting program being introduced by Lennar Home Builders and Eagle Home Mortgage.

“Borrowers with Eagle Home Mortgage’s Student Loan Debt Mortgage Program can direct up to 3% of the purchase price (up to $13,000) to pay their student loans when they buy a new home from Lennar, one of the nation’s largest homebuilders. The contribution doesn’t directly increase the purchase price of the home or add to the balance of the loan.”

The program allows borrowers, whose credit and income requirements qualify, to put down as low as 3% and have a maximum loan amount of $424,100. At the time of closing, Lennar contributes up to 3% to pay down student loans incurred while attending universities, colleges, community colleges, trade schools and other certificate-granting programs.

Jimmy Timmons, President of Eagle Home Mortgage, gave more context about the reasons behind the creation of the program.

“Americans are more burdened than ever by student loans, with $1.3 trillion in outstanding student loans spread out among 42 million borrowers.

Particularly with millennial buyers, people who want to buy a home of their own are not feeling as though they can move forward. Our program is designed to relieve some of that burden and remove that barrier to owning a home.”

According to the Wall Street Journal, “housing observers said other builders are likely to look to mimic the program, which could help lure more of the critical first-time-buyer segment into home purchases.”

Bottom Line

If you are one of the many millennials who may have delayed purchasing your first home, or feel stuck in a house that no longer fits your needs, there are programs and options available to help you achieve your dream!

To see original article please visit Keeping Current Matters.

Just How Strong Is the Housing Recovery?

The residential real estate market has definitely been the shining light in this country’s current economic situation.

Sellers Are Returning to the Housing Market

With sellers starting to get back into the market, if you want to sell your house for the best possible price, now is a great time to do so.

The Beginning of an Economic Recovery

Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, some indicating over 20% growth along with improved consumer spending.

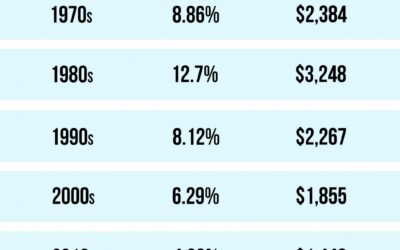

Mortgage Rates & Payments by Decade

Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your loan is significant.

#brookhamptonrealty

Homes Are More Affordable Right Now Than They Have Been in Years

If you’re thinking of making a move, now is the time to take advantage of the affordability that comes with low mortgage rates.

Why Foreclosures Won’t Crush the Housing Market Next Year

Homeowners today have many options to avoid foreclosure, and equity is surely helping to keep many afloat.

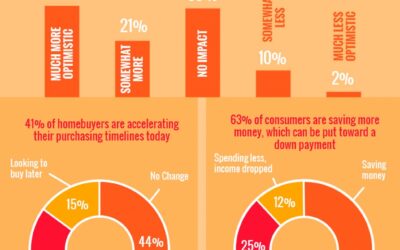

Current Buyer & Seller Perks in the Housing Market

Today’s housing market is making an impressive turnaround. It’s also setting up some outstanding opportunities for buyers and sellers.

The Latest Unemployment Report: Slow and Steady Improvement

There is, however, still a long way to go before the job market fully recovers.

2020 Homebuyer Preferences

If your needs have changed recently and you’re thinking of making a move, taking advantage of today’s low mortgage rates is an opportunity you won’t want to miss!

How Is Remote Work Changing Homebuyer Needs?

Mortgage rates hovering at historical lows may enable you to purchase more home for your money, just when your family needs it most.