Builder Offering to Pay Off Student Loans for Buyers

Millennials are on track to become the most educated generation in history. This means they are also the generation with the most student debt. Depending on the type of degree earned, as well as the prestige of the institution attended, there are some millennials who graduate college with what equates to a mortgage payment.

For those first-time buyers, and even some move-up buyers, who took advantage of the First-Time Homebuyer Tax Credit in 2008, there is an interesting program being introduced by Lennar Home Builders and Eagle Home Mortgage.

“Borrowers with Eagle Home Mortgage’s Student Loan Debt Mortgage Program can direct up to 3% of the purchase price (up to $13,000) to pay their student loans when they buy a new home from Lennar, one of the nation’s largest homebuilders. The contribution doesn’t directly increase the purchase price of the home or add to the balance of the loan.”

The program allows borrowers, whose credit and income requirements qualify, to put down as low as 3% and have a maximum loan amount of $424,100. At the time of closing, Lennar contributes up to 3% to pay down student loans incurred while attending universities, colleges, community colleges, trade schools and other certificate-granting programs.

Jimmy Timmons, President of Eagle Home Mortgage, gave more context about the reasons behind the creation of the program.

“Americans are more burdened than ever by student loans, with $1.3 trillion in outstanding student loans spread out among 42 million borrowers.

Particularly with millennial buyers, people who want to buy a home of their own are not feeling as though they can move forward. Our program is designed to relieve some of that burden and remove that barrier to owning a home.”

According to the Wall Street Journal, “housing observers said other builders are likely to look to mimic the program, which could help lure more of the critical first-time-buyer segment into home purchases.”

Bottom Line

If you are one of the many millennials who may have delayed purchasing your first home, or feel stuck in a house that no longer fits your needs, there are programs and options available to help you achieve your dream!

To see original article please visit Keeping Current Matters.

Why Homeowners Have Great Selling Power Today

With average home sale profits growing, it’s a great time to leverage your equity and make a move!

In Center Moriches, 19th century farmhouse asks $699,900

88 Lake Avenue, Center Moriches featured in the Real Estate section of Newsday! Interested in this home? Give Steve and Marc a call today.

Today’s Buyers Are Serious about Purchasing a Home

As demand for homes to buy grows and millennials enter the market with buying power, the opportunity to sell your house grows too.

Experts Weigh-In on the Remarkable Strength of the Housing Market

Here’s a look at what the experts have said about the housing market over the past few weeks.

Where Is the Housing Market Headed for the Rest of 2020?

Historically low mortgage rates are creating great potential for homebuyers, and home sales are on the rise.

Will We See a Surge of Homebuyers Moving to the Suburbs?

With the ongoing health crisis, it’s no surprise that many people are starting to consider moving out of bigger cities.

Homeownership Rate Continues to Rise in 2020

There are many reasons why the homeownership rate in this country is rising, and one of the key factors is historically-low mortgage rates.

Guidance and Support Are Key When Buying Your First Home

If you’re not sure where to begin or you simply want help in figuring out how to save for a home, we are here to help you! Call us today 🙂

Three of the Latest Reports Show Housing Market Is Strong

The residential real estate market is remaining resilient as the country still struggles to beat the COVID-19 pandemic.

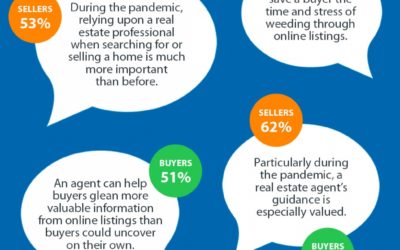

A Real Estate Pro Is More Helpful NOW than Ever

A recent study shared by NAR notes that both buyers and sellers think an agent is more helpful than ever during the current health crisis.