Builder Offering to Pay Off Student Loans for Buyers

Millennials are on track to become the most educated generation in history. This means they are also the generation with the most student debt. Depending on the type of degree earned, as well as the prestige of the institution attended, there are some millennials who graduate college with what equates to a mortgage payment.

For those first-time buyers, and even some move-up buyers, who took advantage of the First-Time Homebuyer Tax Credit in 2008, there is an interesting program being introduced by Lennar Home Builders and Eagle Home Mortgage.

“Borrowers with Eagle Home Mortgage’s Student Loan Debt Mortgage Program can direct up to 3% of the purchase price (up to $13,000) to pay their student loans when they buy a new home from Lennar, one of the nation’s largest homebuilders. The contribution doesn’t directly increase the purchase price of the home or add to the balance of the loan.”

The program allows borrowers, whose credit and income requirements qualify, to put down as low as 3% and have a maximum loan amount of $424,100. At the time of closing, Lennar contributes up to 3% to pay down student loans incurred while attending universities, colleges, community colleges, trade schools and other certificate-granting programs.

Jimmy Timmons, President of Eagle Home Mortgage, gave more context about the reasons behind the creation of the program.

“Americans are more burdened than ever by student loans, with $1.3 trillion in outstanding student loans spread out among 42 million borrowers.

Particularly with millennial buyers, people who want to buy a home of their own are not feeling as though they can move forward. Our program is designed to relieve some of that burden and remove that barrier to owning a home.”

According to the Wall Street Journal, “housing observers said other builders are likely to look to mimic the program, which could help lure more of the critical first-time-buyer segment into home purchases.”

Bottom Line

If you are one of the many millennials who may have delayed purchasing your first home, or feel stuck in a house that no longer fits your needs, there are programs and options available to help you achieve your dream!

To see original article please visit Keeping Current Matters.

Expert Advice: 3 Benefits to Owning a Home

Homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you’re contributing to your net worth.

2 Myths Holding Back Home Buyers

Don’t let these common myths get in the way of owning the home of your dreams. More often than not, your dream home is within your reach.

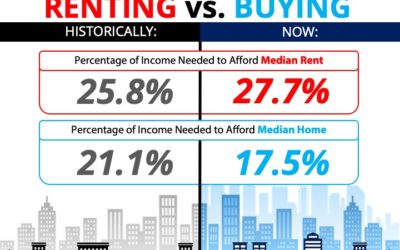

The Cost of Renting vs. Buying a Home

Before you renew your lease, find out if you can put your housing costs to work by buying a home this year. Call BrookHampton Realty today!

This is Not 2008 All Over Again: The Mortgage Lending Factor

Some are afraid the real estate market may be looking a lot like it did prior to the housing crash in 2008.

Buyer Demand Growing in Every Region

Let’s get together to discuss listing your house now while buyer traffic is actively surging throughout the country. Why wait until spring? Call us today!

Homeownership Rate Remains on the Rise

If you’re thinking of buying a home, let’s get together to make your dream a reality. Call BrookHampton Realty today!

75 Years of VA Home Loan Benefits

This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill.

VA Home Loans by the Numbers

Veterans Administration Home Loan is a benefit that is available to more than 22 million veterans and 2 million active duty service members.

Forget the Price of the Home. The Cost is What Matters.

The reacceleration of home values may raise concerns about affordability. Discover how market factors impact purchasing power.

Millennials: Here’s Why the Process is Well Worth It

Millennials…a generation of those who favor fast-paced, real-time answers – and results.