Builder Offering to Pay Off Student Loans for Buyers

Millennials are on track to become the most educated generation in history. This means they are also the generation with the most student debt. Depending on the type of degree earned, as well as the prestige of the institution attended, there are some millennials who graduate college with what equates to a mortgage payment.

For those first-time buyers, and even some move-up buyers, who took advantage of the First-Time Homebuyer Tax Credit in 2008, there is an interesting program being introduced by Lennar Home Builders and Eagle Home Mortgage.

“Borrowers with Eagle Home Mortgage’s Student Loan Debt Mortgage Program can direct up to 3% of the purchase price (up to $13,000) to pay their student loans when they buy a new home from Lennar, one of the nation’s largest homebuilders. The contribution doesn’t directly increase the purchase price of the home or add to the balance of the loan.”

The program allows borrowers, whose credit and income requirements qualify, to put down as low as 3% and have a maximum loan amount of $424,100. At the time of closing, Lennar contributes up to 3% to pay down student loans incurred while attending universities, colleges, community colleges, trade schools and other certificate-granting programs.

Jimmy Timmons, President of Eagle Home Mortgage, gave more context about the reasons behind the creation of the program.

“Americans are more burdened than ever by student loans, with $1.3 trillion in outstanding student loans spread out among 42 million borrowers.

Particularly with millennial buyers, people who want to buy a home of their own are not feeling as though they can move forward. Our program is designed to relieve some of that burden and remove that barrier to owning a home.”

According to the Wall Street Journal, “housing observers said other builders are likely to look to mimic the program, which could help lure more of the critical first-time-buyer segment into home purchases.”

Bottom Line

If you are one of the many millennials who may have delayed purchasing your first home, or feel stuck in a house that no longer fits your needs, there are programs and options available to help you achieve your dream!

To see original article please visit Keeping Current Matters.

Is Your House “Priced to Sell Immediately”?

In today’s real estate market, more houses are coming to market every day. Pricing your home right from the start can make a big difference!

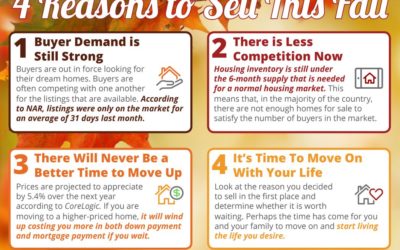

4 Reasons to Sell This Fall

Fall is a great time to sell your house! Take a look at 4 great reasons why you should consider selling this Fall and then let us help you with the rest!

What Buyers Need to Know About HOAs

It’s important to understand what fees, structures, and regulations will come into play if there is an HOA where you’d like to live. We can help you! Give us a call today!

One of the Top Reasons to Own a Home

One of the benefits of homeownership is that it is a “forced savings plan.” Tired of renting and paying into your landlord’s equity? Give #brookhamptonrealty a call today!

Home Prices Increase in Every Price Range

If you’re a homeowner thinking of selling, let’s get together to find out how much your home is increasing in value.

Things to Avoid After Applying for a Mortgage

The best advice is to fully disclose and discuss your plans with your loan officer before you do anything financial in nature.

Watch The Video: 43 Marc Drive, Ridge

Well maintained 3 bedroom Ranch located on a quiet block. Features energy saving solar panels and a private backyard with Koi pond.

Watch The Video: 65 North Woods Road, Baiting Hollow

Beautifully kept home located on cul-de-sac on Long Island’s desirable North Fork. Plenty of space for your family – inside and out!

Watch The Video: 15 Carlile Court, Center Moriches

Spacious 5 bedroom Victorian, located on a quiet street in Center Moriches!

6 Graphs Showing the Strength of the Current Housing Market

Is it time for you to get back in the market? Make sure to determine what’s happening in your local market so you are fully informed.