Builder Offering to Pay Off Student Loans for Buyers

Millennials are on track to become the most educated generation in history. This means they are also the generation with the most student debt. Depending on the type of degree earned, as well as the prestige of the institution attended, there are some millennials who graduate college with what equates to a mortgage payment.

For those first-time buyers, and even some move-up buyers, who took advantage of the First-Time Homebuyer Tax Credit in 2008, there is an interesting program being introduced by Lennar Home Builders and Eagle Home Mortgage.

“Borrowers with Eagle Home Mortgage’s Student Loan Debt Mortgage Program can direct up to 3% of the purchase price (up to $13,000) to pay their student loans when they buy a new home from Lennar, one of the nation’s largest homebuilders. The contribution doesn’t directly increase the purchase price of the home or add to the balance of the loan.”

The program allows borrowers, whose credit and income requirements qualify, to put down as low as 3% and have a maximum loan amount of $424,100. At the time of closing, Lennar contributes up to 3% to pay down student loans incurred while attending universities, colleges, community colleges, trade schools and other certificate-granting programs.

Jimmy Timmons, President of Eagle Home Mortgage, gave more context about the reasons behind the creation of the program.

“Americans are more burdened than ever by student loans, with $1.3 trillion in outstanding student loans spread out among 42 million borrowers.

Particularly with millennial buyers, people who want to buy a home of their own are not feeling as though they can move forward. Our program is designed to relieve some of that burden and remove that barrier to owning a home.”

According to the Wall Street Journal, “housing observers said other builders are likely to look to mimic the program, which could help lure more of the critical first-time-buyer segment into home purchases.”

Bottom Line

If you are one of the many millennials who may have delayed purchasing your first home, or feel stuck in a house that no longer fits your needs, there are programs and options available to help you achieve your dream!

To see original article please visit Keeping Current Matters.

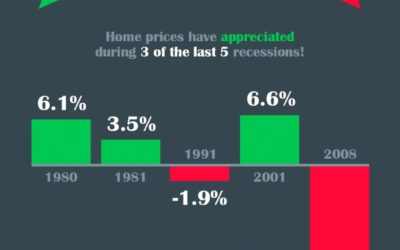

What Is the Probability That Home Values Sink?

Those waiting for prices to fall before purchasing a home should realize that the probability of that happening anytime soon is very low.

Millennial Buying Power Poised to Boost Home Ownership

More millennials are getting ready to jump into the market and join the ranks of homeownership.

The Role Access Plays in Getting Your House Sold

Here are five levels of access you and your agent can provide to buyers looking to see your home.

Home Sales Expected to Continue Increasing In 2020

Freddie Mac, Fannie Mae, and the Mortgage Bankers Association are all projecting home sales will increase nicely in 2020.

Everybody Calm Down! This Is NOT 2008

It is important to realize that the impact of a recession on the housing market will in no way resemble 2008.

How Property Taxes Can Impact Your Mortgage Payment

When buying a home, taxes are one of the expenses that can make a significant difference in your monthly payment.

5 Reasons to Sell This Fall

Perhaps the time has come for you and your family to move on and start living the life you desire. NOW may be exactly that time! Let’s get together and talk about it!

A Recession Does Not Equal a Housing Crisis

Experts predict a potential recession on the horizon. But, housing will not be the trigger; home values will still continue to appreciate.

Top Priorities When Moving With Kids

If you’re a seller with children and looking to relocate, let’s get together to navigate the process in the most reasonable time frame for you and your family.

What’s the Latest on Interest Rates?

As a potential buyer, the best thing you can do is work with a trusted advisor who can help you keep a close eye on how the market is changing.