Buyer Demand Surging as Spring Market Begins

Last fall, some predicted that the 2019 residential real estate market would be a disaster. There was even belief we might experience a housing crash like the one that occurred during the last decade.

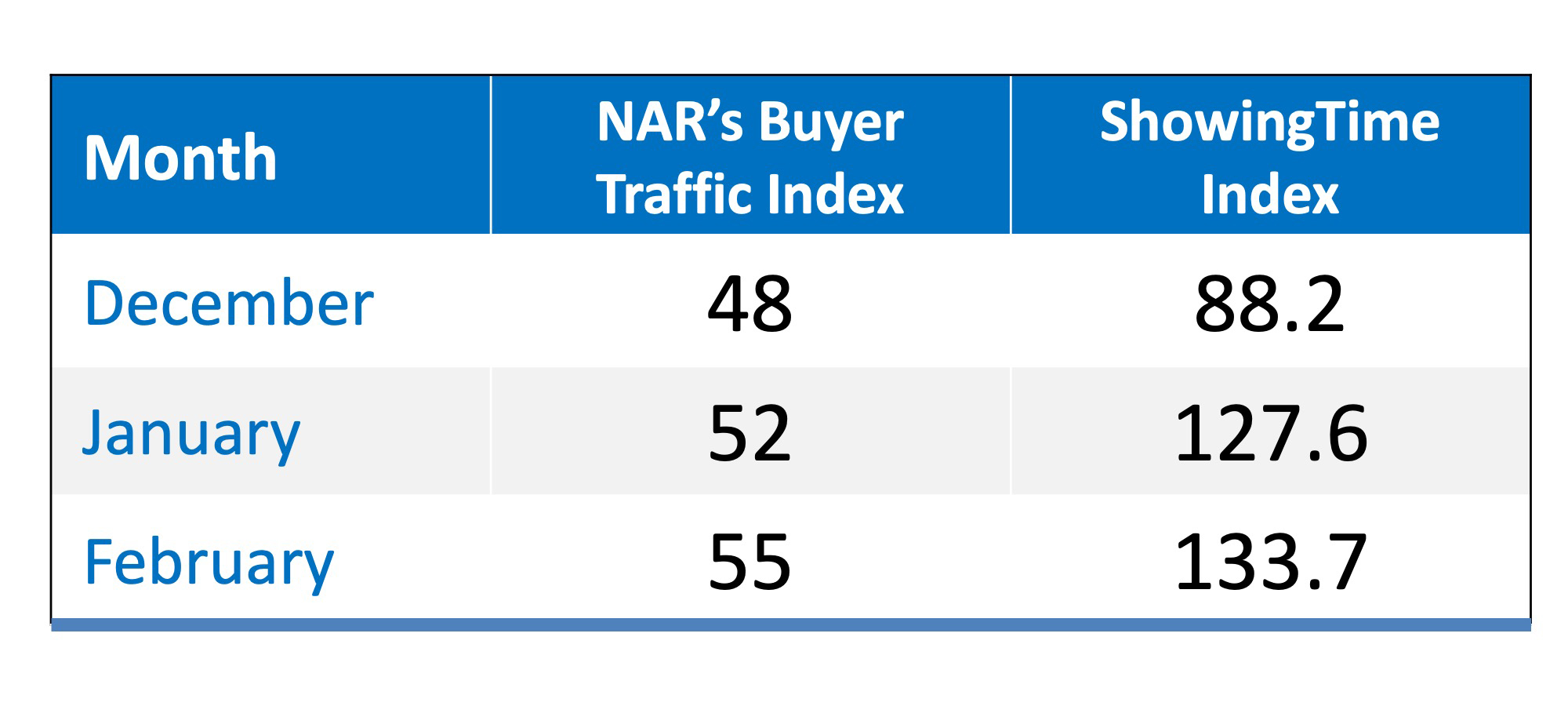

However, according to two separate reports*, buyer demand dramatically increased over the last three months, leading into this spring buyers’ market (the March data is not yet available).

Both the ShowingTime Showing Index and the National Association of REALTORS Buyer Traffic Index show that buyer demand has increased in each of the last three months.

Why the increase in demand? Increased buying power.

According to the National Association of Realtors’ Economists’ Outlook Blog, purchasing a home has become more affordable, which has led to increased demand.

“Due to the combination of falling home prices and mortgage rates, the income needed to make an affordable mortgage payment (mortgage no more than 25% of income) on a median-priced home with 10% down payment and 30-year fixed rate mortgage decreased from $60,425 in June 2018 to $53,783 as of February 2019, and the difference of $6,642 represents a gain in buying power because one can afford a home purchase at a lower level of income.”

Bottom Line

It appears the spring buyers’ market is going to be much stronger than many had projected. Whether you are selling or buying, this is important news.

To view original article, visit Keeping Current Matters.

How Much Do You Need for Your Down Payment?

Be sure to also work with a real estate advisor from the start to learn what you may qualify for in the homebuying process.

Happy New Year!

Wishing you a happy, healthy and prosperous New Year from all of us at BrookHampton Realty!

#happynewyear #2022 #brookhamptonrealty

Expert Insights on the 2022 Housing Market

This sellers’ market will remain in 2022 as home prices are projected to continue climbing, just at a more moderate pace.

5 Tips for Making Your Best Offer on a Home

When putting together an offer, your trusted real estate advisor will help you consider which levers you can pull.

Key Things To Avoid After Applying for a Mortgage

Any blip in income, assets, or credit should be reviewed and executed in a way that ensures your home loan can still be approved.

Happy Holidays!

Happy Holidays for all of us at BrookHampton Realty!