Buying Remains Cheaper Than Renting in 39 States!

In the latest Rent vs. Buy Report from Trulia, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.

The updated numbers show that the range is an average of 3.5% less expensive in San Jose (CA), all the was up to 50.1% less expensive in Baton Rouge (LA), and 33.1% nationwide!

A study by GoBankingRates looked at the cost of renting vs. owning a home at the state level and concluded that in 39 states, it is actually ‘a little’ or ‘a lot’ cheaper to own (represented by the two shade of blue in the map below).

One of the main reasons owning a home has remained significantly cheaper than renting is the fact that interest rates have remained at or near historic lows. Freddie Mac reports that the current interest rate on a 30-year fixed rate mortgage is 3.91%.

Nationally, rates would have to reach 9.1%, a 128% increase over today’s average of 4.0%, for renting to be cheaper than buying. Rates haven’t been that high since January of 1995, according to Freddie Mac.

Bottom Line

Buying a home makes sense socially and financially. If you are one of the many renters who would like to evaluate your ability to buy this year, let’s get together and find you your dream home.

To see original article, please visit Keeping Current Matters.

Buyer Interest Is Growing among Younger Generations

he demand for homes this year is extraordinary as record-breaking numbers of hopeful buyers continue to shop for homes.

Two Important Impacts of Home Equity

According to the most recent data from CoreLogic, the average homeowner gained $9,800 in equity over the past year which can make moving up a real possibility.

Home Values Projected to Keep Rising

Looking at the big picture, the rules of supply and demand will give us the clearest idea of what is to come. Buyer demand is high, inventory is low driving home prices higher.

Why Today’s Options Will Save Homeowners from Foreclosure

Homeowners now have a large amount of equity in their homes and may decide to sell rather than wait for the bank to foreclose.

Real Estate Continues to Show Unprecedented Strength This Year

Home sales continue to amaze industry experts, and there are plenty of buyers in the pipeline ready to enter the market.

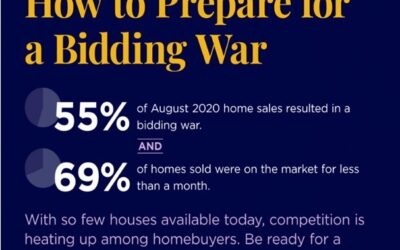

How to Prepare for a Bidding War

From pre-approval to making your best offer, here are three tips to make sure you can act quickly and confidently when you find the perfect home.

Do You Need to Know More about Forbearance and Mortgage Relief Options?

Know your options! Call your mortgage provider.

The #1 Reason Not to Wait to List Your House for Sale

Let’s connect today to get your house on the market at this optimal time to sell.

Do You Have Enough Money Saved for a Down Payment?

Be careful not to let big myths keep you and your family out of the housing market. Let’s connect to discuss your options today.

6 Reasons You’ll Win by Selling with a Real Estate Agent This Fall

There are many benefits to working with a real estate professional when selling your house. Find out why.