Buying Remains Cheaper Than Renting in 39 States!

In the latest Rent vs. Buy Report from Trulia, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.

The updated numbers show that the range is an average of 3.5% less expensive in San Jose (CA), all the was up to 50.1% less expensive in Baton Rouge (LA), and 33.1% nationwide!

A study by GoBankingRates looked at the cost of renting vs. owning a home at the state level and concluded that in 39 states, it is actually ‘a little’ or ‘a lot’ cheaper to own (represented by the two shade of blue in the map below).

One of the main reasons owning a home has remained significantly cheaper than renting is the fact that interest rates have remained at or near historic lows. Freddie Mac reports that the current interest rate on a 30-year fixed rate mortgage is 3.91%.

Nationally, rates would have to reach 9.1%, a 128% increase over today’s average of 4.0%, for renting to be cheaper than buying. Rates haven’t been that high since January of 1995, according to Freddie Mac.

Bottom Line

Buying a home makes sense socially and financially. If you are one of the many renters who would like to evaluate your ability to buy this year, let’s get together and find you your dream home.

To see original article, please visit Keeping Current Matters.

Should You Buy a Retirement Home Sooner Rather than Later?

If you’re a retiree with a single-family home and want to move closer to your family, now is the time to put your house on the market.

A Homeowner’s Net Worth Is 40x Greater Than a Renter’s

The housing market has made a full recovery, and all-time low interest rates are giving home buyers a big boost in purchasing power.

Is it Time to Move into a Single-Story Home?

Single-story homes have a lot of benefits and are often in higher demand. This bodes well for future resale opportunities.

Why Pricing Your House Right Is Essential

When it comes to pricing your home, the goal is to increase visibility and drive more buyers your way.

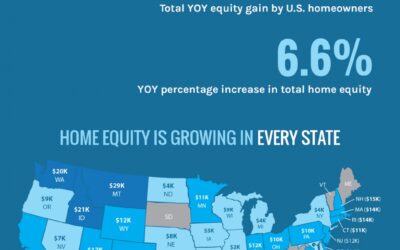

Rising Home Equity Can Power Your Next Move

Over the past year, the average homeowner gained $9,800 in equity, growing their overall net worth.

Buyers Are Finding More Space in the Luxury Home Market

Home offices, multi-purpose rooms, gyms, and theaters are becoming more popular.

Why Selling this Fall May Be Your Best Move

If you’re thinking about moving, selling your house this fall might be the way to go.

Where Are Home Values Headed Over the Next 12 Months?

The only major industry to display immunity to the economic impacts of the coronavirus is the housing market.

Housing Market on Track to Beat Last Year’s Success

Housing has experienced a strong V-shaped recovery and is now exceeding pre-pandemic levels.

Why Pricing Your Home Right Matters This Fall

To sell your home quickly and for the best possible price, you should price your home competitively right from the start.