“While we look for signs that we’ve reached a plateau in cases of COVID-19, the concern and fear of what will happen as businesses open up again is on all of our minds.”

- Business Science – How has the economy rebounded from similar slowdowns in the past?

- Health Science – When will COVID-19 be under control? Will there be another flareup of the virus this fall?

- People Science – After businesses are fully operational, how long will it take American consumers to return to normal consumption patterns? (Ex: going to the movies, attending a sporting event, or flying).

Sam Khater, Chief Economist at Freddie Mac, says:

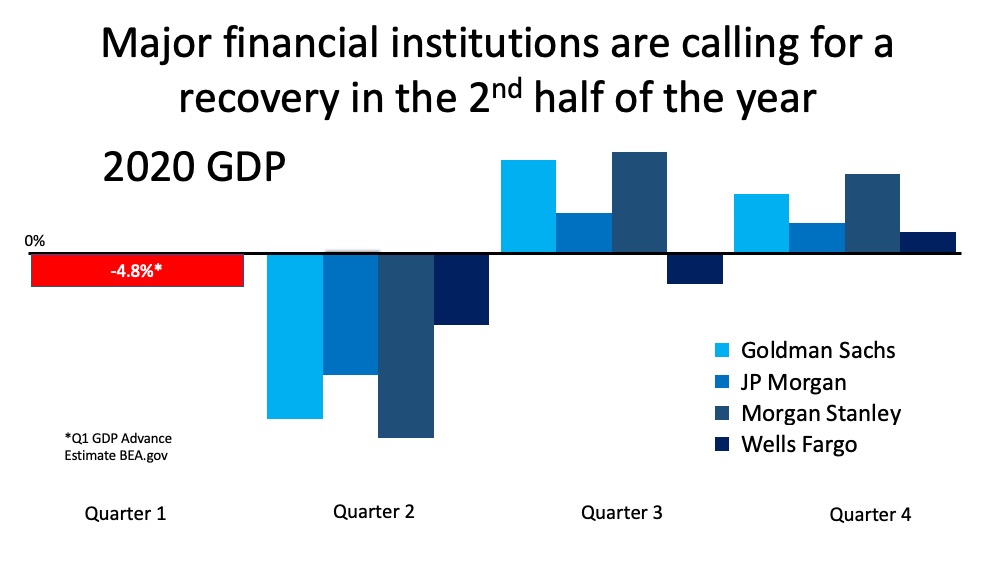

“Although the uncertainty of the crisis means forecasts of economic activity are more unclear than usual, we expect that most of the economic damage from the virus will be contained to the first half of the year. Going forward, we should see a recovery starting in the second half of 2020.”

This past week, the Bureau of Economic Analysis released the advanced estimate for Gross Domestic Product (GDP) for the first quarter of 2020. That estimate came in at -4.8%. It was a clear indicator showing how the U.S. economy slowed as businesses shut down and consumers retreated to their homes in fear of the health crisis and of contracting COVID-19. Experts agree that the second quarter of 2020 will be an even greater slowdown, a sign more businesses are feeling the effects of this health crisis. The same experts, however, project businesses will rebound, and a recovery will start to happen in the second half of this year.

Experts agree that the second quarter of 2020 will be an even greater slowdown, a sign more businesses are feeling the effects of this health crisis. The same experts, however, project businesses will rebound, and a recovery will start to happen in the second half of this year.

Bottom Line

As time goes on, we’ll have more clarity around what the true economic recovery will look like, and we’ll have more information on the sciences that will affect it. As the nation’s economy comes back to life and businesses embrace new waves of innovation to serve their customers, the American spirit of grit, growth, and prosperity will be alive and well.

To view original article, visit Keeping Current Matters.

What To Know About Credit Scores Before Buying a Home

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan.

Why You Want an Agent’s Advice for Your Move

A real estate advisor can anticipate what could happen next and work with you to put together a solid plan.

Why Today’s Housing Supply Is a Sweet Spot for Sellers

The number of homes for sale and new listing activity continues to improve compared to last year.

The Truth About Down Payments

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

Expert Home Price Forecasts for 2024 Revised Up

Now that rates have come down from their peak, and with further declines expected this year, buyer demand has picked up.

Strategic Tips for Buying Your First Home

If you’re ready, willing, and able to buy your first home, here are some tips to help you turn your dream into a reality.