What is the Cost of Waiting Until Next Year to Buy?

We recently shared that over the course of the last 12 months, home prices have appreciated by 7.0%. Over the same amount of time, interest rates have remained historically low which has allowed many buyers to enter the market.

As a seller, you will likely be most concerned about ‘short-term price’ – where home values are headed over the next six months. As a buyer, however, you must not be concerned about price, but instead about the ‘long-term cost’ of the home.

The Mortgage Bankers Association (MBA), Freddie Mac, and Fannie Mae all project that mortgage interest rates will increase by this time next year. According to CoreLogic’s most recent Home Price Index Report, home prices will appreciate by 4.7% over the next 12 months.

What Does This mean as a Buyer?

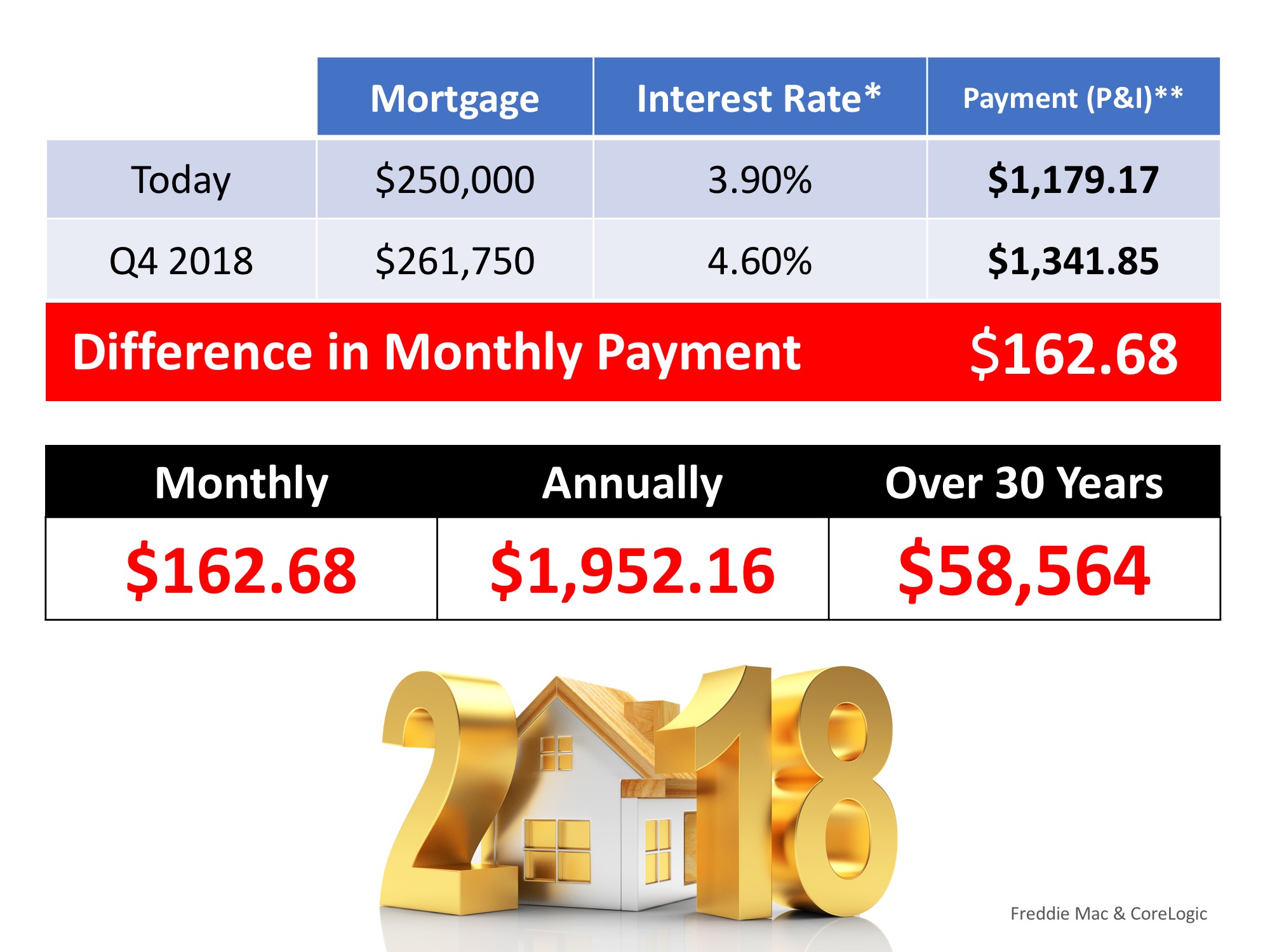

If home prices appreciate by 4.7% over the next twelve months as predicted by CoreLogic, here is a simple demonstration of the impact that an increase in interest rate would have on the mortgage payment of a home selling for approximately $250,000 today:

Bottom Line

If buying a home is in your plan for 2018, doing it sooner rather than later could save you thousands of dollars over the terms of your loan.

To view original article, please visit Keeping Current Matters.

5 Reasons Millennials Are Buying Homes

The top reasons include building equity, a change in life stage, wanting stability, rising home values, and wanting to make somewhere truly their own.

Think Twice Before Waiting for Lower Home Prices

The best way to understand what home values are doing is to work with a local real estate agent who can give you the latest insights.

The Big Advantage If You Sell This Spring

Thinking about selling your house? If you’ve been waiting for the right time, it could be now while the supply of homes for sale is so low.

Homebuyer Activity Shows Signs of Warming Up for Spring

The recent uptick in mortgage applications, and the decline in mortgage rates, is good news for sellers!

Trying To Buy a Home? Hang in There.

As we move into the spring buying season, even though we are still in a sellers’ market, mortgage rates have ticked lower, a welcomed sign of progress towards affordability.

Two Reasons You Should Sell Your House

Wondering if you should sell your house this year? As you make your decision, think about what’s motivating you to consider moving and let’s connect today!

How Changing Mortgage Rates Can Affect You

It’s critical to lean on your expert real estate advisors to explore your mortgage options and understand what impacts mortgage rates.

We’re in a Sellers’ Market. What Does That Mean?

Right now, there are still buyers who are ready, willing, and able to purchase a home. List your home at the right price 🙂

How Homeownership is Life Changing for Many Women

The financial security and independence homeownership provides can be life changing.

Get Ready: The Best Time To List Your House Is Almost Here

If you’re thinking about selling this spring, it’s time to get moving – the best week to list your house is fast approaching.