What is the Cost of Waiting Until Next Year to Buy?

We recently shared that over the course of the last 12 months, home prices have appreciated by 7.0%. Over the same amount of time, interest rates have remained historically low which has allowed many buyers to enter the market.

As a seller, you will likely be most concerned about ‘short-term price’ – where home values are headed over the next six months. As a buyer, however, you must not be concerned about price, but instead about the ‘long-term cost’ of the home.

The Mortgage Bankers Association (MBA), Freddie Mac, and Fannie Mae all project that mortgage interest rates will increase by this time next year. According to CoreLogic’s most recent Home Price Index Report, home prices will appreciate by 4.7% over the next 12 months.

What Does This mean as a Buyer?

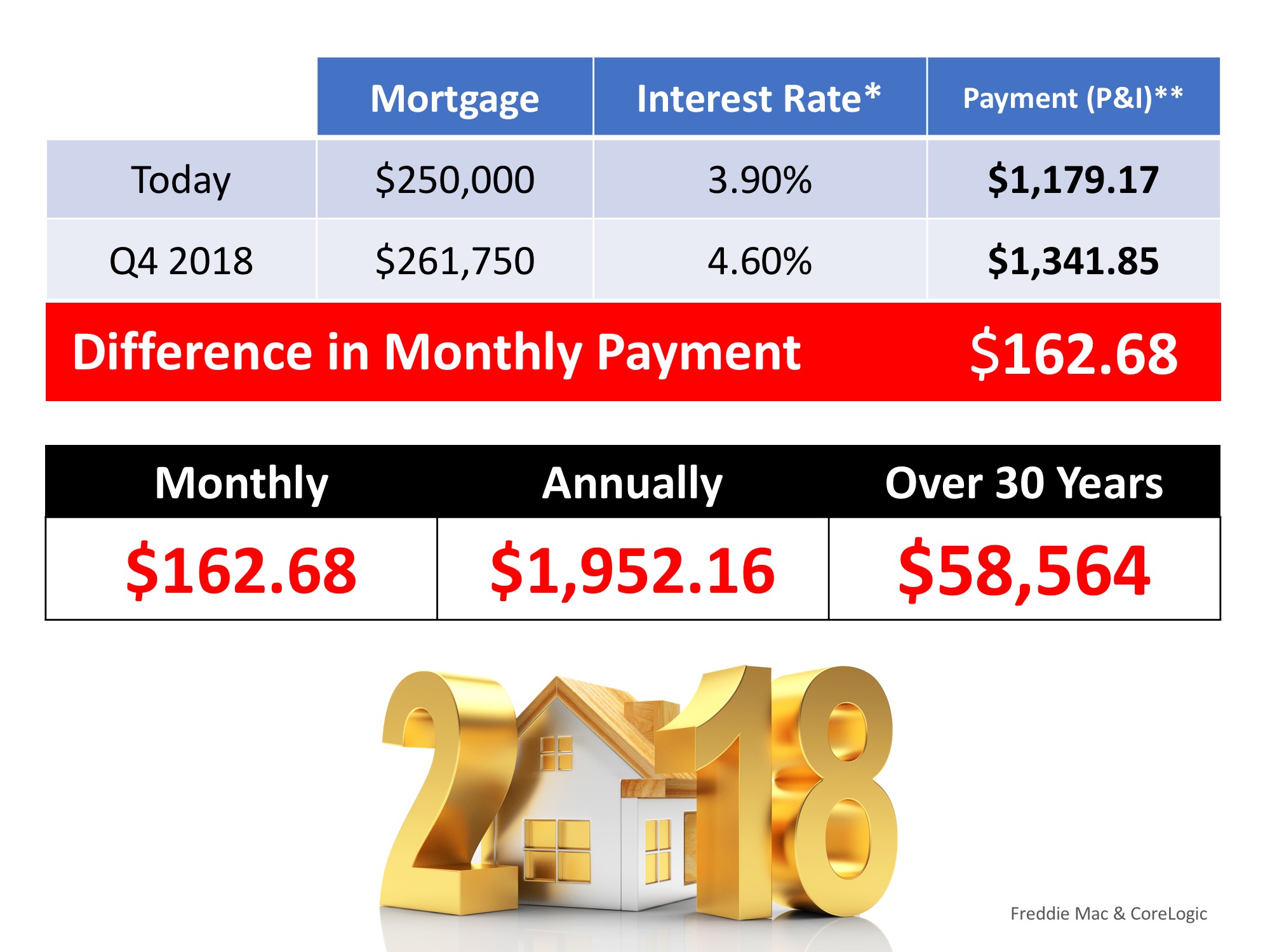

If home prices appreciate by 4.7% over the next twelve months as predicted by CoreLogic, here is a simple demonstration of the impact that an increase in interest rate would have on the mortgage payment of a home selling for approximately $250,000 today:

Bottom Line

If buying a home is in your plan for 2018, doing it sooner rather than later could save you thousands of dollars over the terms of your loan.

To view original article, please visit Keeping Current Matters.

Why Pre-Approval Is Key for Homebuyers in 2022

Every step you can take to gain an advantage as a buyer is crucial when today’s market is constantly changing.

Buyers Want To Know: Why Is Housing Supply Still So Low?

While low inventory in the housing market isn’t new, it’s a challenge that continues to grow over time.

With Mortgage Rates Climbing, Now’s the Time to Act

Historical data shows that today’s rate, even at 3.45%, is still well below the average for each of the last five decades.

Why Inflation Shouldn’t Stop You from Buying a Home in 2022

Housing is commonly looked at as a good inflation hedge, especially with interest rates so low.

Real Estate Professionals Are Experts at Keeping You Safe When You Sell

Real estate professionals have learned new technologies plus safety and sanitation measures.

There Won’t Be a Wave of Foreclosures in the Housing Market

Most homeowners exited their forbearance plan either fully caught up or with a plan from the bank to start making payments again.

Avoid the Rental Trap in 2022

Before you decide whether to look for a new house or another apartment, it’s important to understand the true costs of renting in 2022.

How Much Do You Need for Your Down Payment?

Be sure to also work with a real estate advisor from the start to learn what you may qualify for in the homebuying process.

Expert Insights on the 2022 Housing Market

This sellers’ market will remain in 2022 as home prices are projected to continue climbing, just at a more moderate pace.

5 Tips for Making Your Best Offer on a Home

When putting together an offer, your trusted real estate advisor will help you consider which levers you can pull.