What is the Cost of Waiting Until Next Year to Buy?

We recently shared that over the course of the last 12 months, home prices have appreciated by 7.0%. Over the same amount of time, interest rates have remained historically low which has allowed many buyers to enter the market.

As a seller, you will likely be most concerned about ‘short-term price’ – where home values are headed over the next six months. As a buyer, however, you must not be concerned about price, but instead about the ‘long-term cost’ of the home.

The Mortgage Bankers Association (MBA), Freddie Mac, and Fannie Mae all project that mortgage interest rates will increase by this time next year. According to CoreLogic’s most recent Home Price Index Report, home prices will appreciate by 4.7% over the next 12 months.

What Does This mean as a Buyer?

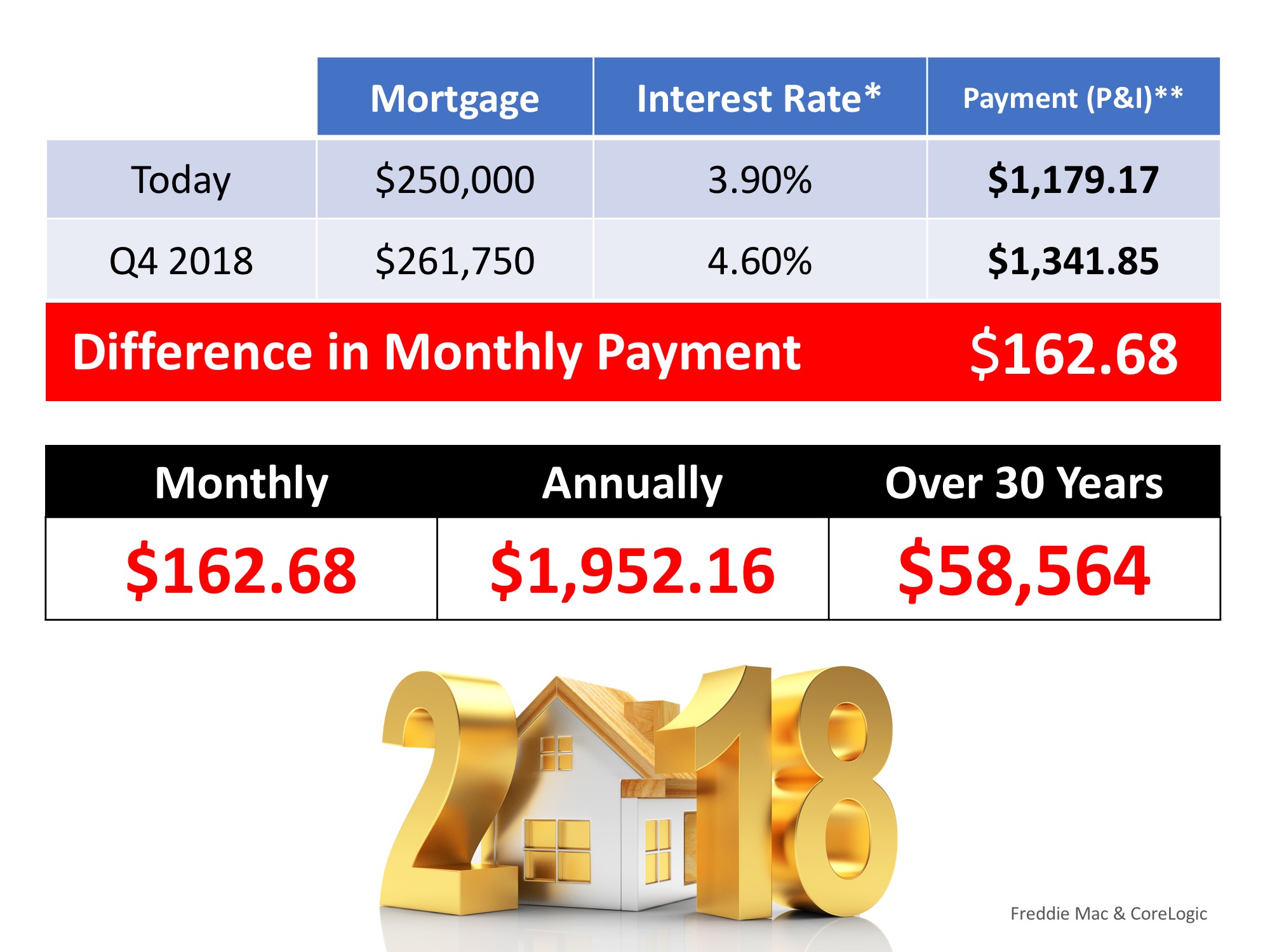

If home prices appreciate by 4.7% over the next twelve months as predicted by CoreLogic, here is a simple demonstration of the impact that an increase in interest rate would have on the mortgage payment of a home selling for approximately $250,000 today:

Bottom Line

If buying a home is in your plan for 2018, doing it sooner rather than later could save you thousands of dollars over the terms of your loan.

To view original article, please visit Keeping Current Matters.

Key Things To Avoid After Applying for a Mortgage

Any blip in income, assets, or credit should be reviewed and executed in a way that ensures your home loan can still be approved.

Happy Holidays!

Happy Holidays for all of us at BrookHampton Realty!

When a House Becomes a Home

Whether it’s a familiar scent or a favorite chair, the feel-good connections to our own homes can be more important to us than the financial ones.

The Average Homeowner Gained $56,700 in Equity over the Past Year

Understanding the importance of equity can help you realize why homeownership is a worthwhile goal.

Homebuyers: Be Ready To Act This Winter

Competition among buyers will remain fierce as there still won’t be enough homes for sale to meet the demand. so be ready to act!

What Everyone Wants To Know: Will Home Prices Decline in 2022?

it’s important to note that price increases won’t be as monumental as they were in 2021 – but they certainly won’t decline anytime soon.

Advice for First-Generation Homebuyers

Your dream of homeownership has far-reaching impacts and if you’re about to be the first person in your family to buy a home, let that motivate you throughout the process.

If You Think the Housing Market Will Slow This Winter, Think Again.

All signs point to the winter housing market picking up steam, making it much busier than in a more typical year.

Struggling to Find a Home to Buy? New Construction May be an Option

Working with the guidance of your trusted real estate advisor will help you make the most informed and educated decision.

Why It Just Became Much Easier to Buy a Home

More homes now qualify for a conforming loan with lower down payment requirements and easier lending standards.