What is the Cost of Waiting Until Next Year to Buy?

We recently shared that over the course of the last 12 months, home prices have appreciated by 7.0%. Over the same amount of time, interest rates have remained historically low which has allowed many buyers to enter the market.

As a seller, you will likely be most concerned about ‘short-term price’ – where home values are headed over the next six months. As a buyer, however, you must not be concerned about price, but instead about the ‘long-term cost’ of the home.

The Mortgage Bankers Association (MBA), Freddie Mac, and Fannie Mae all project that mortgage interest rates will increase by this time next year. According to CoreLogic’s most recent Home Price Index Report, home prices will appreciate by 4.7% over the next 12 months.

What Does This mean as a Buyer?

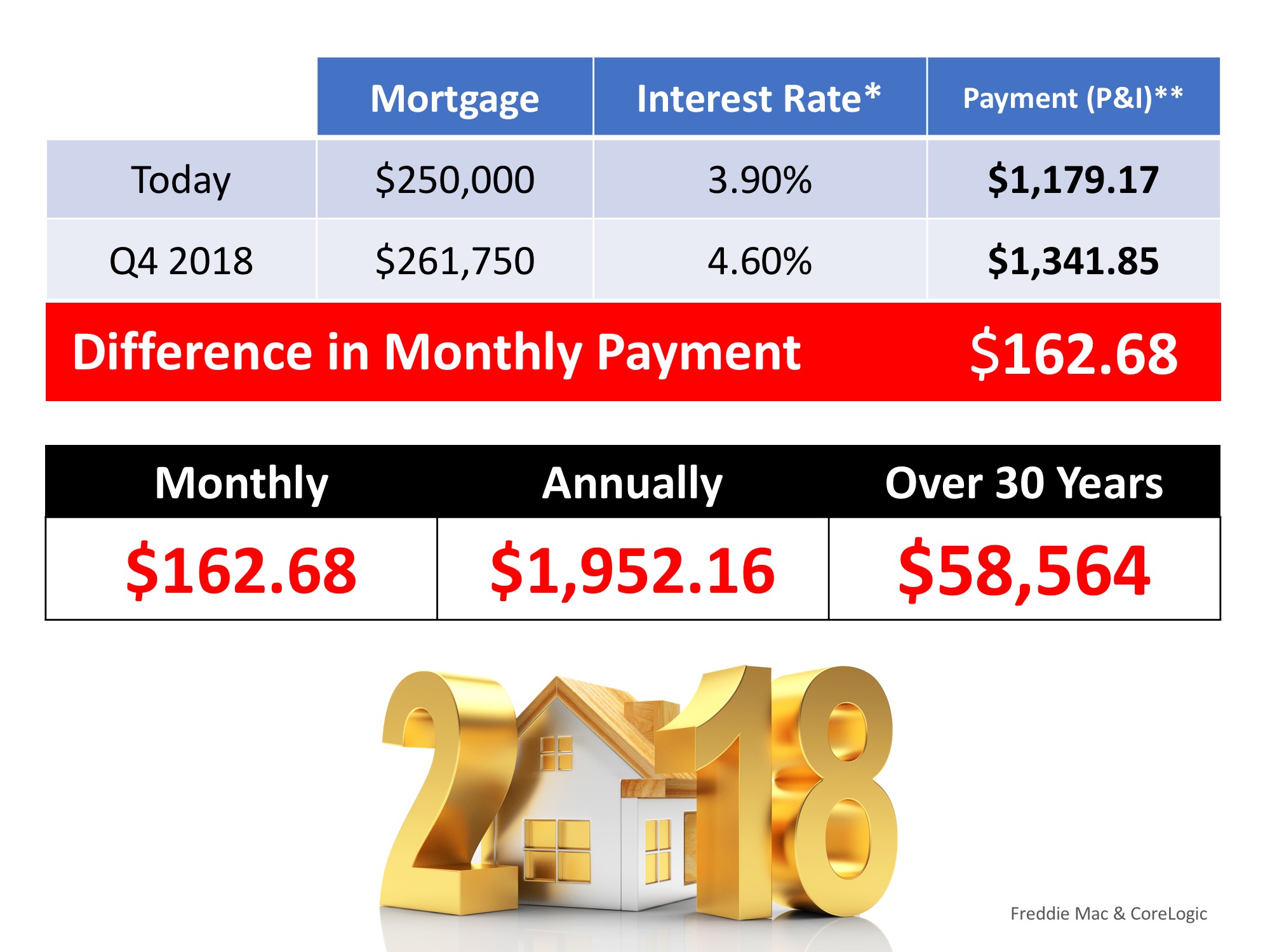

If home prices appreciate by 4.7% over the next twelve months as predicted by CoreLogic, here is a simple demonstration of the impact that an increase in interest rate would have on the mortgage payment of a home selling for approximately $250,000 today:

Bottom Line

If buying a home is in your plan for 2018, doing it sooner rather than later could save you thousands of dollars over the terms of your loan.

To view original article, please visit Keeping Current Matters.

To Renovate or Not To Renovate Before You Sell

Spending costly time and money on renovations before you sell might just mean you’ll miss your key window of opportunity.

What Is the Strongest Tailwind to Today’s Recovering Economy?

Real estate has been a beacon of light during a very challenging time in our nation’s history.

What Is the #1 Financial Benefit of Homeownership?

The wealth-building power of homeownership shows that home is not only where your heart is, but also where your wealth is.

How to Make a Winning Offer on a Home

A real estate professional should be the expert guide you lean on for advice when you’re ready to make an offer. Let’s connect today to make sure you’re headed in the right direction.

Will the Housing Market Bloom This Spring?

Here’s what a few industry experts have to say about the housing market and how it will bloom this season.

6 Simple Graphs Proving This Is Nothing Like Last Time

In 2020, real estate had one of its best years ever. Home sales were up over the year before. Find out why it’s different from 2008.

How Upset Should You Be about 3% Mortgage Rates?

Being upset that you missed the “best mortgage rate ever” is understandable. Buying now still makes more sense than waiting!

5 Reasons to Sell Your House This Spring

Sellers are driving the market right now so if you’ve considered making a move but have been waiting for the right market conditions, your wait may be over.

Home Prices: What Happened in 2020? What Will Happen This Year?

Home price appreciation will be strong this year, but it won’t reach the historic levels of 2020.

What Are the Benefits of a 20% Down Payment?

If you’re thinking of buying a home this year, you may be wondering how much money you need to come up with for your down payment.