What is the Cost of Waiting Until Next Year to Buy?

We recently shared that over the course of the last 12 months, home prices have appreciated by 7.0%. Over the same amount of time, interest rates have remained historically low which has allowed many buyers to enter the market.

As a seller, you will likely be most concerned about ‘short-term price’ – where home values are headed over the next six months. As a buyer, however, you must not be concerned about price, but instead about the ‘long-term cost’ of the home.

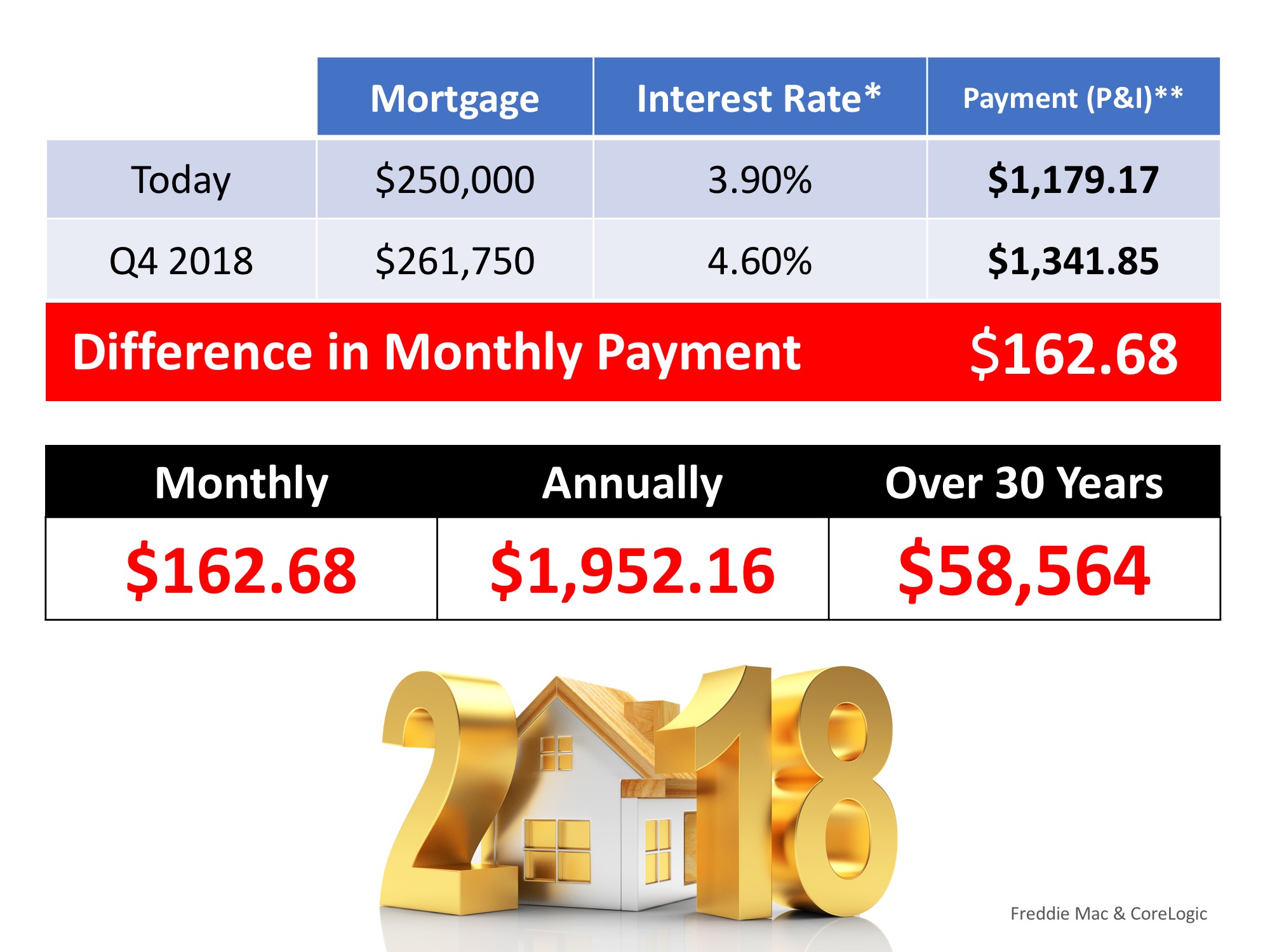

The Mortgage Bankers Association (MBA), Freddie Mac, and Fannie Mae all project that mortgage interest rates will increase by this time next year. According to CoreLogic’s most recent Home Price Index Report, home prices will appreciate by 4.7% over the next 12 months.

What Does This mean as a Buyer?

If home prices appreciate by 4.7% over the next twelve months as predicted by CoreLogic, here is a simple demonstration of the impact that an increase in interest rate would have on the mortgage payment of a home selling for approximately $250,000 today:

Bottom Line

If buying a home is in your plan for 2018, doing it sooner rather than later could save you thousands of dollars over the terms of your loan.

To view original article, please visit Keeping Current Matters.

Real Estate Is a Driving Force in the Economy

The American Dream of homeownership has continued to thrive in the midst of this year’s economic downturn.

Rent vs. Buy: How to Decide What’s Best for You

With today’s low mortgage rates, there’s great opportunity for current renters to make a move into homeownership.

4 Reasons Why the Election Won’t Dampen the Housing Market

Recent trends suggest that the housing market will continue its strong momentum in the months to come.

Buyer Interest Is Growing among Younger Generations

he demand for homes this year is extraordinary as record-breaking numbers of hopeful buyers continue to shop for homes.

Two Important Impacts of Home Equity

According to the most recent data from CoreLogic, the average homeowner gained $9,800 in equity over the past year which can make moving up a real possibility.

Home Values Projected to Keep Rising

Looking at the big picture, the rules of supply and demand will give us the clearest idea of what is to come. Buyer demand is high, inventory is low driving home prices higher.

Why Today’s Options Will Save Homeowners from Foreclosure

Homeowners now have a large amount of equity in their homes and may decide to sell rather than wait for the bank to foreclose.

Real Estate Continues to Show Unprecedented Strength This Year

Home sales continue to amaze industry experts, and there are plenty of buyers in the pipeline ready to enter the market.

How to Prepare for a Bidding War

From pre-approval to making your best offer, here are three tips to make sure you can act quickly and confidently when you find the perfect home.

Do You Need to Know More about Forbearance and Mortgage Relief Options?

Know your options! Call your mortgage provider.