What is the Cost of Waiting Until Next Year to Buy?

We recently shared that over the course of the last 12 months, home prices have appreciated by 7.0%. Over the same amount of time, interest rates have remained historically low which has allowed many buyers to enter the market.

As a seller, you will likely be most concerned about ‘short-term price’ – where home values are headed over the next six months. As a buyer, however, you must not be concerned about price, but instead about the ‘long-term cost’ of the home.

The Mortgage Bankers Association (MBA), Freddie Mac, and Fannie Mae all project that mortgage interest rates will increase by this time next year. According to CoreLogic’s most recent Home Price Index Report, home prices will appreciate by 4.7% over the next 12 months.

What Does This mean as a Buyer?

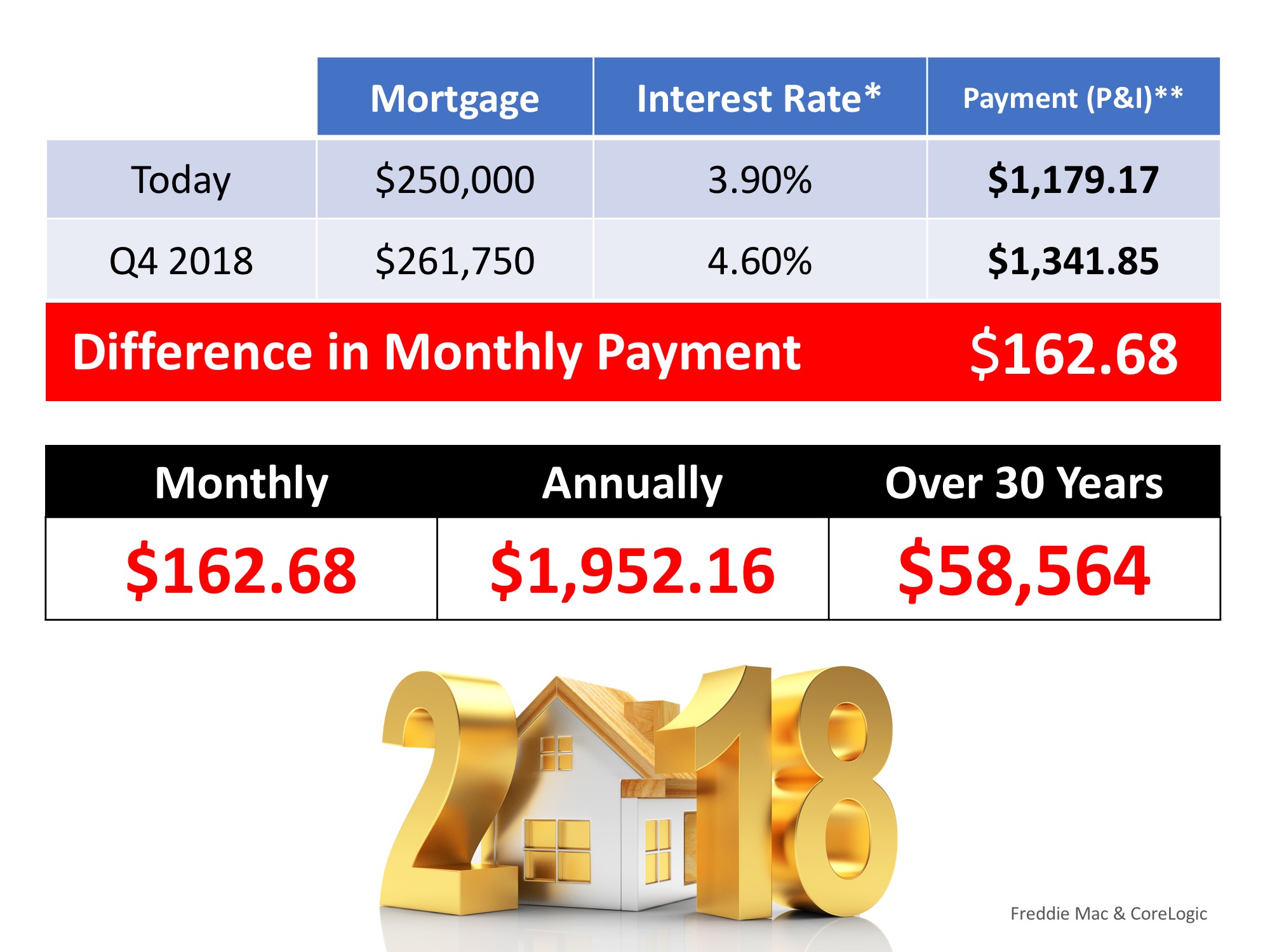

If home prices appreciate by 4.7% over the next twelve months as predicted by CoreLogic, here is a simple demonstration of the impact that an increase in interest rate would have on the mortgage payment of a home selling for approximately $250,000 today:

Bottom Line

If buying a home is in your plan for 2018, doing it sooner rather than later could save you thousands of dollars over the terms of your loan.

To view original article, please visit Keeping Current Matters.

Builders & Realtors Agree: Real Estate Is Back

The housing market is well past the recovery phase and is now booming with higher home sales compared to the pre-pandemic days.

In laid-back East Moriches, concerns about future development

Steve Monzeglio describes East Moriches as a “real gem of a small South Shore town” in this recent Newsday article. Take a look!

Forbearance Numbers Are Lower than Expected

Today, the options available to homeowners will prevent a large spike in foreclosures and that’s good for the overall housing market.

Just How Strong Is the Housing Recovery?

The residential real estate market has definitely been the shining light in this country’s current economic situation.

Sellers Are Returning to the Housing Market

With sellers starting to get back into the market, if you want to sell your house for the best possible price, now is a great time to do so.

The Beginning of an Economic Recovery

Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, some indicating over 20% growth along with improved consumer spending.

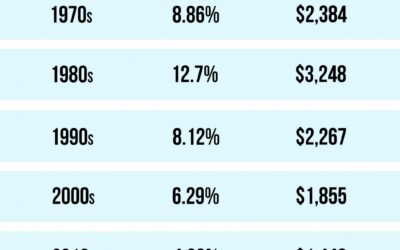

Mortgage Rates & Payments by Decade

Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your loan is significant.

#brookhamptonrealty

Homes Are More Affordable Right Now Than They Have Been in Years

If you’re thinking of making a move, now is the time to take advantage of the affordability that comes with low mortgage rates.

Why Foreclosures Won’t Crush the Housing Market Next Year

Homeowners today have many options to avoid foreclosure, and equity is surely helping to keep many afloat.

Current Buyer & Seller Perks in the Housing Market

Today’s housing market is making an impressive turnaround. It’s also setting up some outstanding opportunities for buyers and sellers.