What is the Cost of Waiting Until Next Year to Buy?

We recently shared that over the course of the last 12 months, home prices have appreciated by 7.0%. Over the same amount of time, interest rates have remained historically low which has allowed many buyers to enter the market.

As a seller, you will likely be most concerned about ‘short-term price’ – where home values are headed over the next six months. As a buyer, however, you must not be concerned about price, but instead about the ‘long-term cost’ of the home.

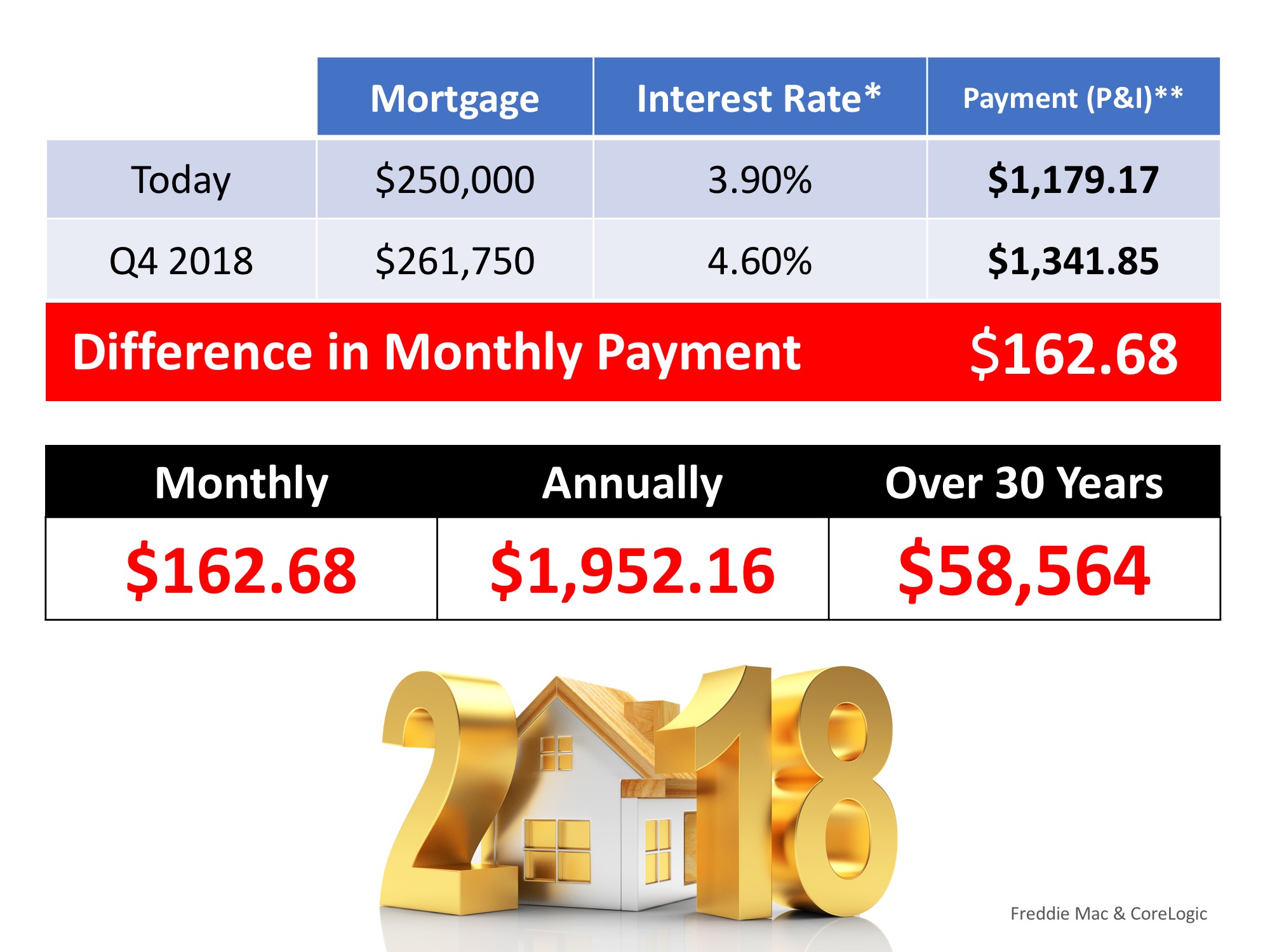

The Mortgage Bankers Association (MBA), Freddie Mac, and Fannie Mae all project that mortgage interest rates will increase by this time next year. According to CoreLogic’s most recent Home Price Index Report, home prices will appreciate by 4.7% over the next 12 months.

What Does This mean as a Buyer?

If home prices appreciate by 4.7% over the next twelve months as predicted by CoreLogic, here is a simple demonstration of the impact that an increase in interest rate would have on the mortgage payment of a home selling for approximately $250,000 today:

Bottom Line

If buying a home is in your plan for 2018, doing it sooner rather than later could save you thousands of dollars over the terms of your loan.

To view original article, please visit Keeping Current Matters.

Guidance and Support Are Key When Buying Your First Home

If you’re not sure where to begin or you simply want help in figuring out how to save for a home, we are here to help you! Call us today 🙂

Three of the Latest Reports Show Housing Market Is Strong

The residential real estate market is remaining resilient as the country still struggles to beat the COVID-19 pandemic.

A Real Estate Pro Is More Helpful NOW than Ever

A recent study shared by NAR notes that both buyers and sellers think an agent is more helpful than ever during the current health crisis.

Home Sales Hit a Record-Setting Rebound

Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply.

Two Reasons We Won’t See a Rush of Foreclosures This Fall

Many think we may see a rush of foreclosures this fall, but the facts just don’t add up in this case.

A Remarkable Recovery for the Housing Market

Many experts have said the housing market will lead the way to a recovery, and today we’re seeing signs of that coming to light.

Thinking of Selling Your House? Now May be the Right Time

Housing inventory is down 18.8% from one year ago, and the houses that do come to the market are selling very quickly.

Does Your Home Have What Buyers Are Looking For?

The housing market has plenty of buyers who would benefit from a few more sellers. Are you ready to sell?

Mortgage Rates Hit Record Lows for Three Consecutive Weeks

A lower monthly payment means savings that can add up significantly over the life of a home loan.

Buyers: Are You Ready for a Bidding War?

The imbalance between supply and demand is pushing home prices upward while driving more bidding wars and multiple-offer scenarios.