” In today’s strong seller’s market, bidding wars are common and expected with starter or entry-level homes.”

The reality of what we’re seeing this month is that homes are selling fast. In today’s strong seller’s market, bidding wars are common and expected with starter or entry-level homes.

In most areas of the country, first-time buyers have been met with fierce competition throughout their homebuying experience. Some have been out-bid multiple times before finally going into contract on a home to call their own.

Right now, inventory is the big challenge. Here’s what we know today:

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), there is currently a 3.9-month supply of homes for sale, which can drive this kind of hefty buyer competition. Remember, anything less than 6 months of inventory is a seller’s market.

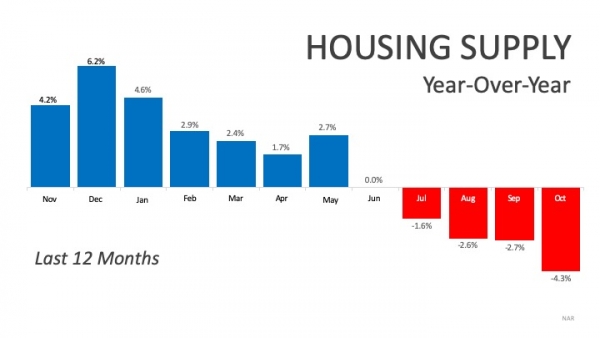

Even though the month’s supply of inventory is not increasing, ironically, the number of homes for sale is. This means homes are coming up for sale, but they’re being sold quickly. The graph below shows the year-over-year change in inventory over the last 12 months. As depicted above, the percentage of available inventory has fallen for four consecutive months when compared to the previous year.

As depicted above, the percentage of available inventory has fallen for four consecutive months when compared to the previous year.

So, what does this mean? If you’re a buyer, be sure to get pre-approved for a mortgage and be ready to make a competitive offer, so you can move quickly. Chances are, homes high on your wish list are likely going to go fast.

Bottom Line

If you’re thinking of buying a home, make sure you’re taking the right steps at the beginning of the process, so you’re a top contender if you ultimately find yourself in a bidding war. Let’s get together to discuss what you need to do to make your move toward homeownership.

To view original article, visit Keeping Current Matters.

Existing Home Sales Slowed by a Lack of Listings

The inventory of existing homes for sale has dropped year-over-year for the last 29 consecutive months and is now at a 3.9-month supply.

The Cost of NOT Owning Your Home

Owning a home has great financial benefits, yet many continue to rent! Today, let’s look at the financial reasons why owning a home of your own has been a part of the American Dream for as long as America has existed.

Low Interest Rates Have a High Impact on Your Purchasing Power

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 3.92%, which is still near record lows in comparison to recent history!

5 Reasons Homeownership Makes ‘Cents’

The American Dream of homeownership is alive and well. Recent reports show that the US homeownership rate has rebounded from recent lows and is headed in the right direction. The personal reasons to own differ for each buyer, but there are many basic similarities.

A Housing Bubble? Industry Experts Say NO!

With residential home prices continuing to appreciate at levels above historic norms, some are questioning if we are heading toward another housing bubble. Recently, five housing experts weighed in on the question.

How to Save on a Mortgage Payment Whether Buying or Selling

In Trulia’s recent report, Rent vs. Buy: Roommate Edition, they examined the impact that renting with a roommate has in determining whether it is more expensive to rent or buy. The study explains: “Since we started keeping track in 2012, it’s been a better deal to buy...