“Contrary to popular belief, you don’t always have to put 20% down to buy a house.”

One of the biggest misconceptions for first-time homebuyers is how much you’ll need to save for a down payment. Contrary to popular belief, you don’t always have to put 20% down to buy a house. Here’s how it breaks down.

A recent survey by Point2Homes mentions that 74% of millennials (ages 25-40) say they’re interested in purchasing a home over the next 12 months. The study notes, “88% say they have significantly less savings than the average national down payment amount, which is $62,600.”

Thankfully, $62,600 is not the amount every buyer needs for a down payment in the United States. There are many different options available, especially for first-time homebuyers (millennial or not). That amount can also be significantly less, depending on the purchase price of the house.

According to the National Association of Realtors (NAR), “The median existing-home price for all housing types in August was $310,600.” (These are the latest numbers available). NAR also indicates that:

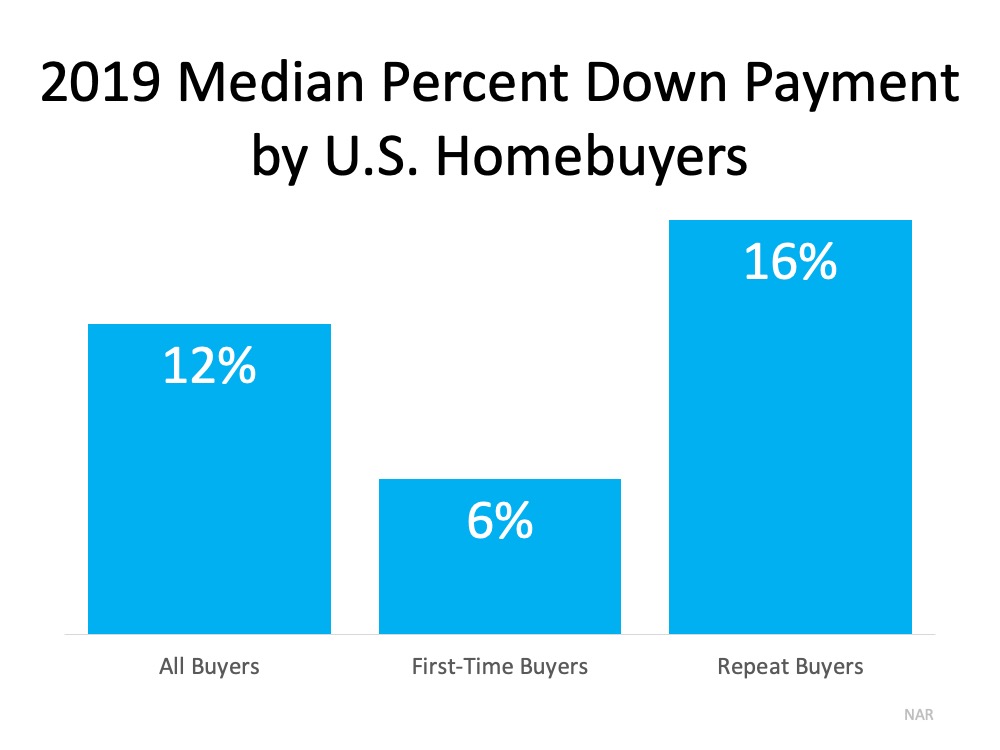

“In 2019, the median down payment was 12 percent for all buyers, six percent for first-time buyers, and 16 percent for repeat buyers.” (See graph below):

That means if a qualified first-time buyer purchases a home at today’s median price, $310,600, with a 6% down payment, in reality, the down payment only amounts to $18,636. That’s nowhere near $62,600.

That means if a qualified first-time buyer purchases a home at today’s median price, $310,600, with a 6% down payment, in reality, the down payment only amounts to $18,636. That’s nowhere near $62,600.

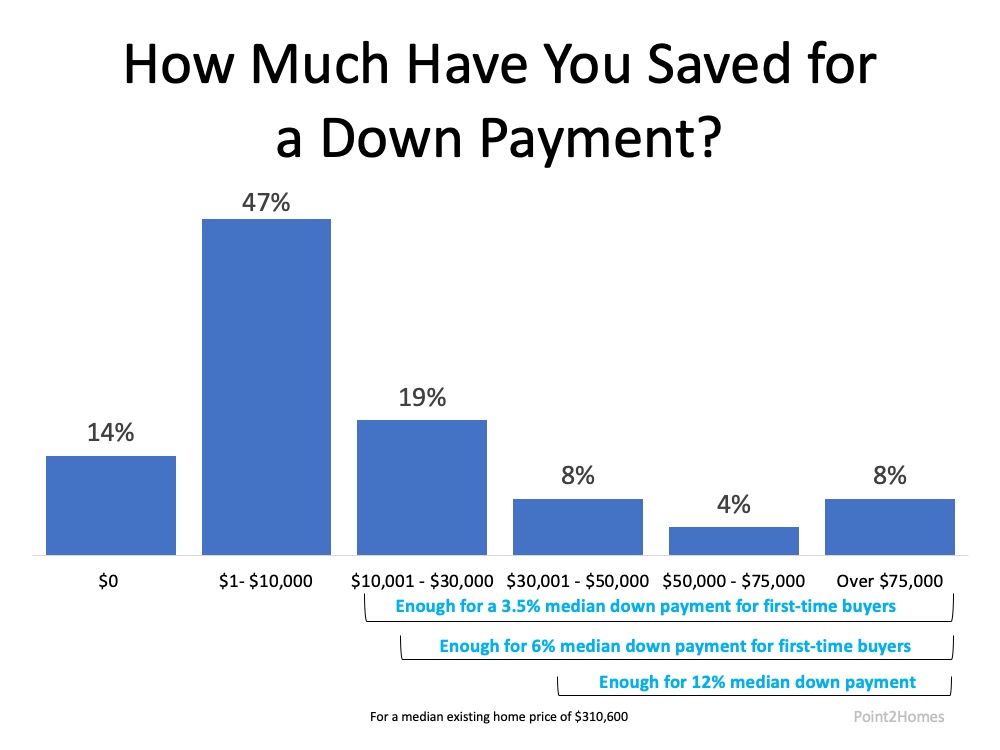

Knowing there are also programs like FHA where the down payment can be as low as 3.5% of the purchase price for a first-time buyer, that up-front cost could be significantly less – as little as $10,871 for the same home noted above. There are also other programs like USDA and loans for Veterans that waive down payment requirements.

The Point2Homes study also shares how much millennials have indicated they’ve saved for a down payment. As we can see in the graph below, 39% have already saved enough for a down payment on a median-priced home. Another 47% are close to reaching that goal, depending on the purchase price of the home. Unfortunately, the lack of knowledge about the homebuying process is keeping many motivated first-time buyers on the sidelines. That’s why it’s important to contact a local real estate professional to understand the requirements in your local area if you want to buy a home. A trusted agent and your lender can guide you through the process.

Unfortunately, the lack of knowledge about the homebuying process is keeping many motivated first-time buyers on the sidelines. That’s why it’s important to contact a local real estate professional to understand the requirements in your local area if you want to buy a home. A trusted agent and your lender can guide you through the process.

Bottom Line

Be careful not to let big myths about homebuying keep you and your family out of the housing market. Let’s connect to discuss your options today.

To view original article, visit Keeping Current Matters.

Should I Wait for Mortgage Rates To Come Down Before I Move?

When rates come down, more people are going to get back into the market leading to more competition.

Should I Move with Today’s Mortgage Rates?

While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

Keep in mind, every time you make a big decision in your life, especially a financial one, you need an expert on your side.

Don’t Let Your Student Loans Delay Your Homeownership Plans

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals.

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

While not all baby boomers are looking to sell their homes and move – the ones who do won’t all do it at the same time.

The Best Week To List Your House Is Almost Here

The third week of April brings the best combination of housing market factors for sellers.