Don’t Get Caught in the Rental Trap in 2019

Every year around this time, we take time to reflect and plan for next year. If you are renting your current home but have dreams of homeownership, your plan for the new year may include buying, and you wouldn’t be alone!

According to the 2018 Bank of America Homebuyer Insights Report, 74% of renters plan on buying in the next 5 years, with 38% planning to buy in the next 2 years!

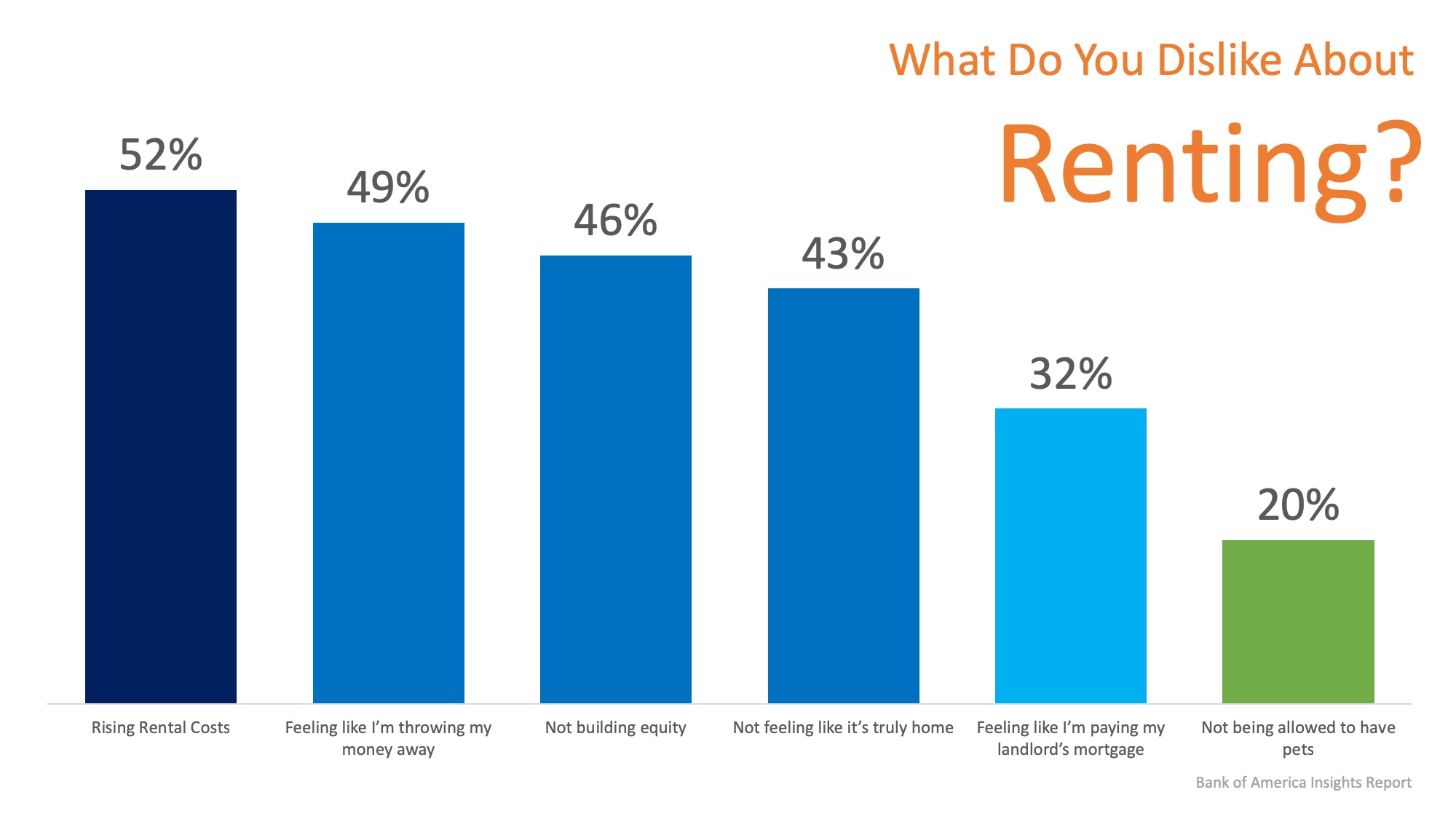

When those same renters were asked why they disliked renting, 52% said that rising rental costs were their top reason, and 42% of renters believe that their rent will rise every year. The full results of the survey can be seen below:

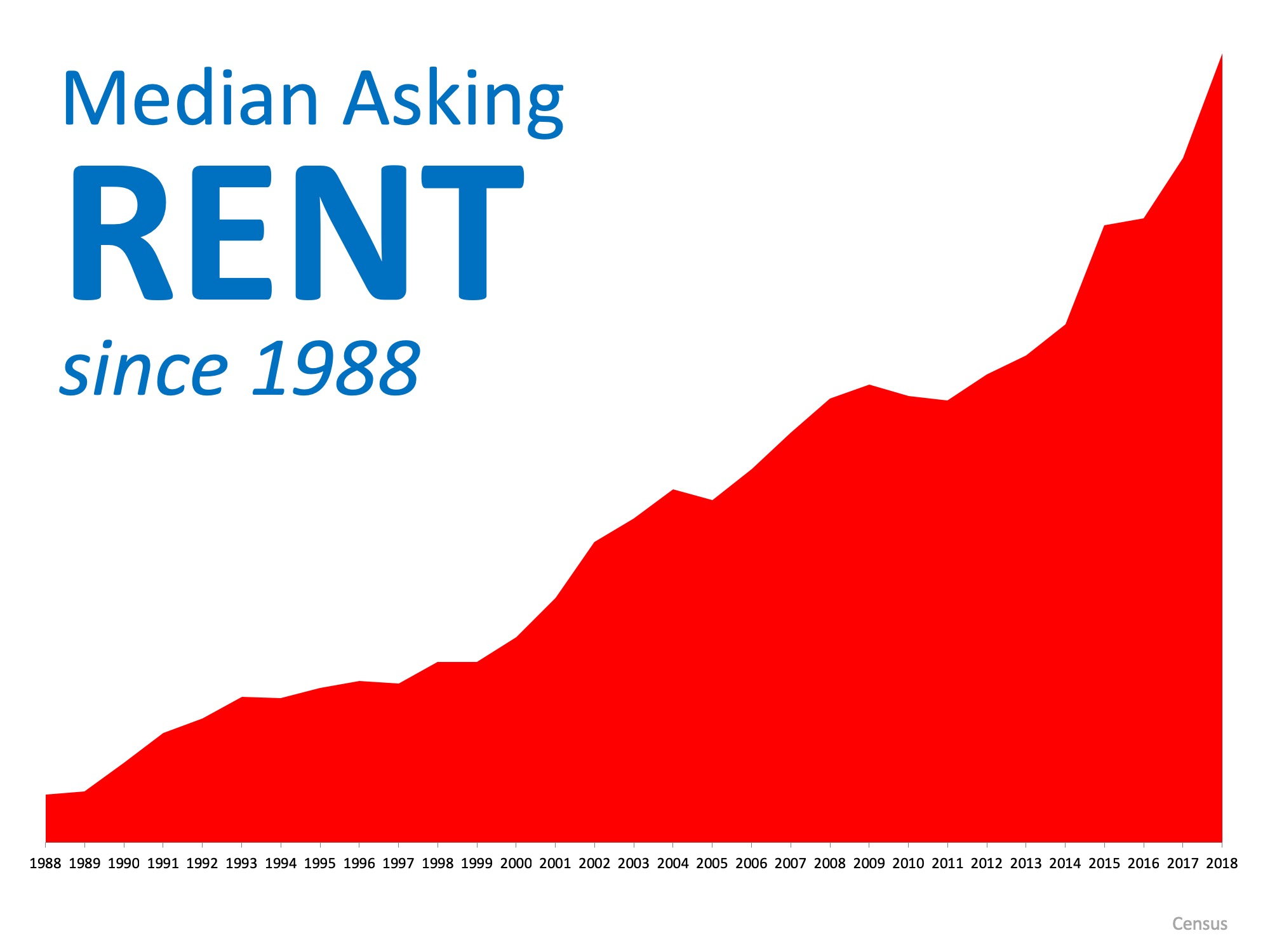

It’s no wonder that rising rental costs came in as the top answer! The median asking rent price has risen steadily over the last 30 years, as you can see below!

There is a long-standing rule that a household should not spend more than 28% of its income on housing expenses. With nearly half of renters (48%) surveyed already spending more than that, and with their rents likely to rise again… why are they renting?

When asked why they haven’t purchased a home yet, not having enough saved for a down payment (44%) came in as the top response. The report went on to reveal that nearly half of all respondents believe that “a 20% down payment is required to buy a home.”

If the majority of those who believe they haven’t saved a large enough down payment believe that they need 20% down to buy, that means a large number of renters may be able to buy now!

Bottom Line

If you are one of the many renters who is fed up with rising rents but may be confused about what is required to buy in today’s market, let’s get together to help you on your path to homeownership.

To view original article, visit Keeping Current Matters.

Why Moving to a Smaller Home After Retirement Makes Life Easier

As you approach retirement, its important to think about whether your current home still fits your needs.

Why Your Asking Price Matters Even More Right Now

Accurate pricing depends on current market conditions – and only an agent has all information necessary to price your home correctly.

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash.

Real Estate Still Holds the Title of Best Long-Term Investment

Homeownership has long been tied to building wealth—and for good reason.

What To Do When Your House Didn’t Sell

If you want an expert’s advice on why your home didn’t sell, rely on a trusted real estate agent.

Do Elections Impact the Housing Market?

While Presidential elections do have some impact on the housing market, the effects are usually small and temporary. For help navigating the market, election year or not, let’s connect.