“No one knows for sure how long the pandemic will last. The hope is that it will resolve sometime over the next several months. Most agree that when it does, the economy will regain its strength quickly.”

More and more economists are predicting a recession is imminent as the result of the pullback in the economy caused by COVID-19. According to the National Bureau of Economic Research:

“A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

Bill McBride, the founder of Calculated Risk, believes we are already in a recession:

“With the sudden economic stop, and with many states shutting down by closing down schools, bars and restaurants…my view is the US economy is now in a recession (started in March 2020), and GDP will decline sharply in Q2. The length of the recession will depend on the course of the pandemic.”

How deep will it go?

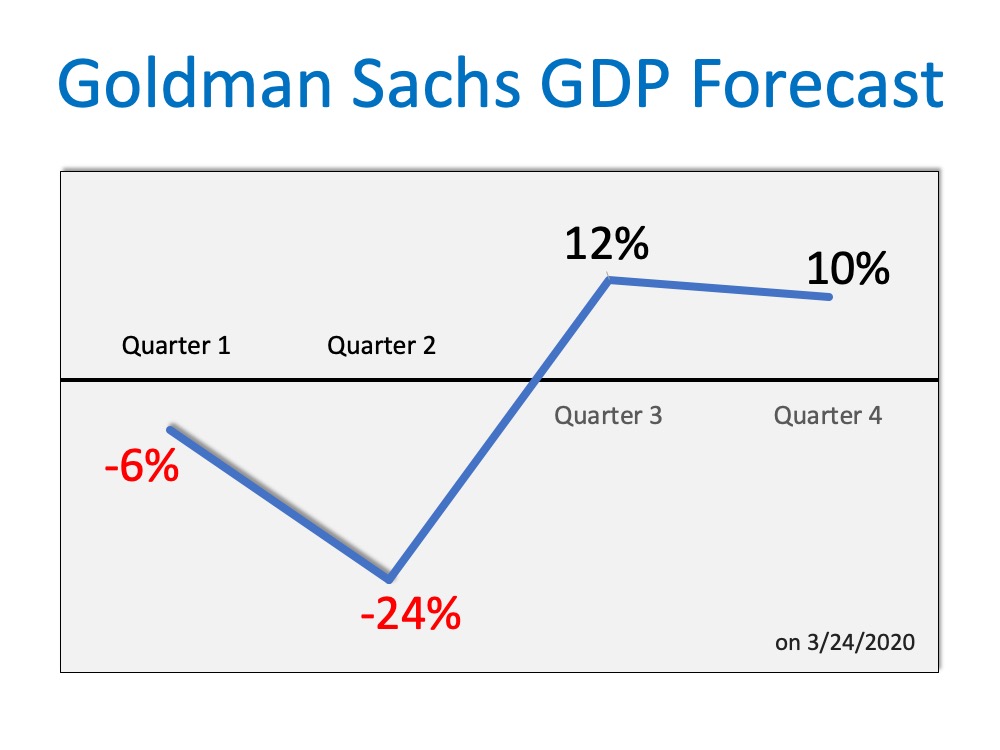

No one knows for sure. It depends on how long it takes to beat this virus. Goldman Sachs anticipates we will see a difficult first half of the year, but the economy will recover in the second half (see below): This aligns with the projection from Wells Fargo Investment Institute:

This aligns with the projection from Wells Fargo Investment Institute:

“Once the virus infection rate peaks, we expect a recovery to gain momentum into the final quarter of the year and especially into 2021.”

Again, no one knows for sure how long the pandemic will last. The hope is that it will resolve sometime over the next several months. Most agree that when it does, the economy will regain its strength quickly.

Bottom Line

This virus is not only impacting the physical health of Americans, but also the financial health of the nation. The sooner we beat it, the sooner our lives will return to normal.

To view original article, visit Keeping Current Matters.

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling.

4 Things To Expect from the Spring Housing Market

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and coming back into the market.

Buyers Have More Negotiation Power – Here’s How to Use It

Negotiating is a complex process. Lean on your agent for expert advice about what’s realistic to ask for and what’s not.

What You Need To Know About Homeowner’s Insurance

Homeowner’s insurance is a must to protect your home and your investment.

The Best Week To List Your House Is Almost Here – Are You Ready?

A seller listing a well-priced, move-in ready home is likely to find success.

Is It Time To Put Your House Back on the Market?

Since January, demand has picked up – and that should continue as spring draws even closer.