“One of the often-overlooked benefits of rising prices, however, is the impact they have on a homeowner’s equity position.”

Rising home prices have been in the news a lot lately, and much of the focus is on whether they’re accelerating too quickly and how sustainable the growth in prices really is. One of the often-overlooked benefits of rising prices, however, is the impact they have on a homeowner’s equity position.

Home equity is defined as the difference between a home’s fair market value and the outstanding balance of all liens on the property. While homeowners pay down their mortgages, the amount of equity they have in their homes climbs each time the value increases.

Today, the number of homeowners that currently have significant equity in their homes is growing. According to the Census Bureau, 38% of all homes in the country are mortgage-free. In a home equity study, ATTOM Data Solutions revealed that of the 54.5 million homes with a mortgage, 26.7% of them have at least 50% equity. That number has been increasing over the last eight years.

CoreLogic also notes:

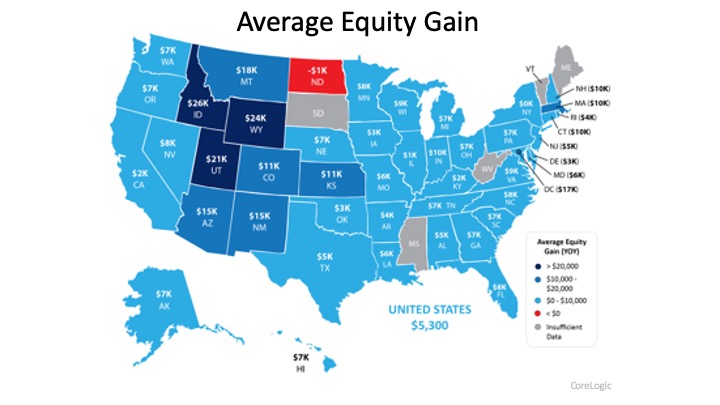

“…the average homeowner gained approximately $5,300 in equity during the past year.”

The map below shows a breakdown of the increasing equity gain across the country, painting a clear picture that home equity is growing in nearly every state.

Bottom Line

This may be the year to take advantage of your home equity by applying it forward, either as you downsize or as you move up to a new home.

To view original article, visit Keeping Current Matters.

Should I Buy a Home Now or Wait?

Yes, today’s housing market has challenges, but the key is making a move when it makes sense for you, rather than waiting for a perfect scenario that may never arrive.

Pre-Approval Isn’t Commitment – It’s Clarity

Pre-approval isn’t about jumping the gun or rushing your timeline. It’s about making sure you’re ready when it’s go-time.

What You Can Do When Mortgage Rates Are a Moving Target

You can get the best rate possible in today’s market by controlling your credit score, loan type, and loan term..

Are You Saving Up to Buy a Home? Your Tax Refund Can Help

If you’re getting a tax refund this year, you can use it to help you pay for some of the upfront costs that come with buying a home.

Don’t Miss This Prime Spring Window To Sell Your House

By targeting late spring, sellers can get their home listed when the most shoppers are looking.

4 Ways to Make an Offer That Stands Out This Spring

If you’re serious about landing a home you’ll love, you need a smart strategy that includes a working with a great agent.