“One of the often-overlooked benefits of rising prices, however, is the impact they have on a homeowner’s equity position.”

Rising home prices have been in the news a lot lately, and much of the focus is on whether they’re accelerating too quickly and how sustainable the growth in prices really is. One of the often-overlooked benefits of rising prices, however, is the impact they have on a homeowner’s equity position.

Home equity is defined as the difference between a home’s fair market value and the outstanding balance of all liens on the property. While homeowners pay down their mortgages, the amount of equity they have in their homes climbs each time the value increases.

Today, the number of homeowners that currently have significant equity in their homes is growing. According to the Census Bureau, 38% of all homes in the country are mortgage-free. In a home equity study, ATTOM Data Solutions revealed that of the 54.5 million homes with a mortgage, 26.7% of them have at least 50% equity. That number has been increasing over the last eight years.

CoreLogic also notes:

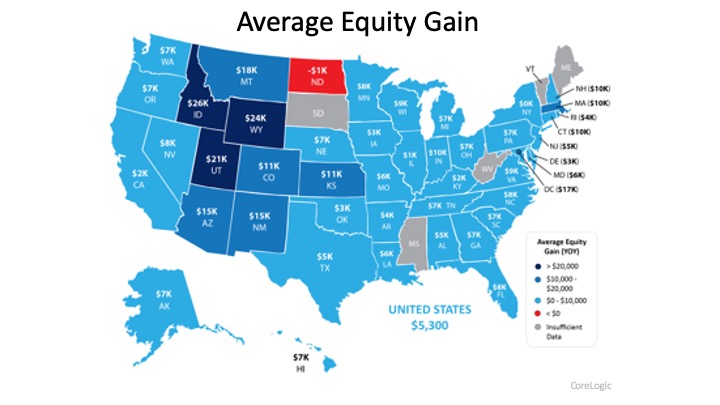

“…the average homeowner gained approximately $5,300 in equity during the past year.”

The map below shows a breakdown of the increasing equity gain across the country, painting a clear picture that home equity is growing in nearly every state.

Bottom Line

This may be the year to take advantage of your home equity by applying it forward, either as you downsize or as you move up to a new home.

To view original article, visit Keeping Current Matters.

Why Now’s Not the Time To Take Your House Off the Market

By keeping your home on the market, you increase the chances of attracting people who are truly ready to make a purchase.

Now’s the Time to Upgrade to Your Dream Home

A recent survey reveals the top motivator for today’s homebuyers is the desire for more space or an upgraded home.

This Is the Sweet Spot Homebuyers Have Been Waiting For

If you’re waiting for the perfect time to buy, it’s important to understand that timing the market is nearly impossible.

Buying Beats Renting in 22 Major U.S. Cities

Whether you live in one of these budget-friendly cities or any town in-between, it’s time to to talk a local real estate agent to get started.

Don’t Fall for These Real Estate Agent Myths

Don’t let myths keep you from the expert guidance you deserve. A trusted local real estate agent isn’t just helpful, they’re invaluable.

The Down Payment Assistance You Didn’t Know About

Believe it or not, almost 80% of first-time homebuyers qualify for down payment assistance, but only 13% actually use it.