“Let’s look at the latest information with context so we can see how this compares to previous years.”

If you’ve been keeping up with the news lately, you’ve probably come across headlines talking about the increase in foreclosures in today’s housing market. This may have left you with some uncertainty, especially if you’re considering buying a home. It’s important to understand the context of these reports to know the truth about what’s happening today.

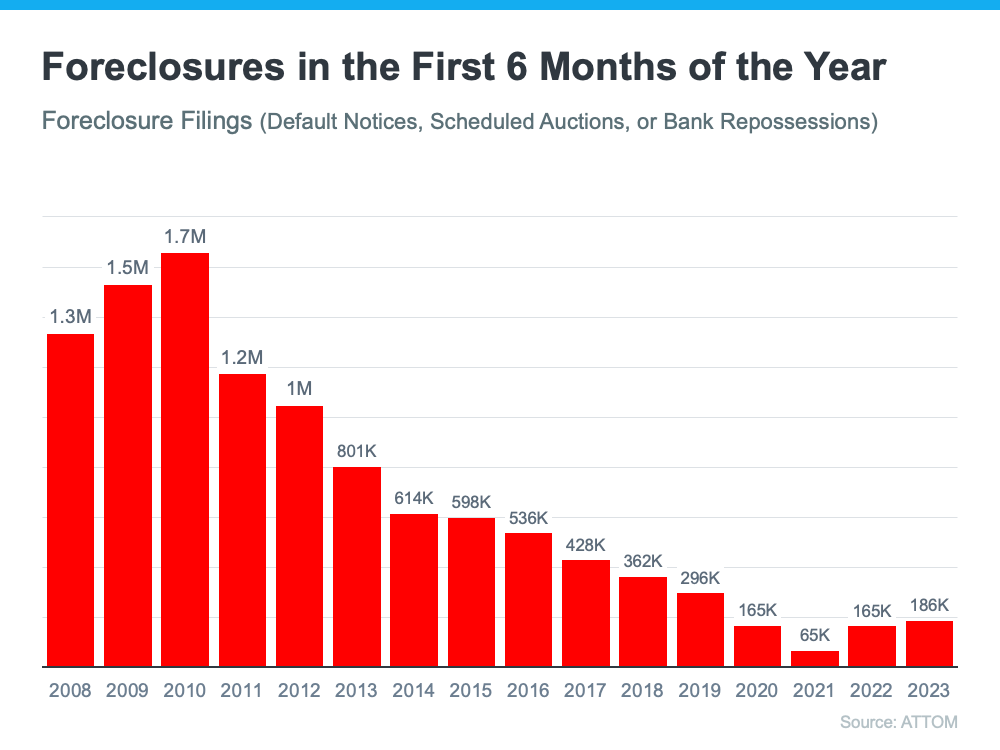

According to a recent report from ATTOM, a property data provider, foreclosure filings are up 2% compared to the previous quarter and 8% since one year ago. While media headlines are drawing attention to this increase, reporting on just the number could actually generate worry for fear that prices could crash. The reality is, while increasing, the data shows a foreclosure crisis is not where the market is headed.

Let’s look at the latest information with context so we can see how this compares to previous years.

It Isn’t the Dramatic Increase Headlines Would Have You Believe

In recent years, the number of foreclosures has been down to record lows. That’s because, in 2020 and 2021, the forbearance program and other relief options for homeowners helped millions of homeowners stay in their homes, allowing them to get back on their feet during a very challenging period. And with home values rising at the same time, many homeowners who may have found themselves facing foreclosure under other circumstances were able to leverage their equity and sell their houses rather than face foreclosure. Moving forward, equity will continue to be a factor that can help keep people from going into foreclosure.

As the government’s moratorium came to an end, there was an expected rise in foreclosures. But just because foreclosures are up doesn’t mean the housing market is in trouble. As Clare Trapasso, Executive News Editor at Realtor.com, says:

“Many of these foreclosures would have occurred during the pandemic, but were put off due to federal, state, and local foreclosure moratoriums designed to keep people in their homes . . . Real estate experts have stressed that this isn’t a repeat of the Great Recession. It’s not that scores of homeowners suddenly can’t afford their mortgage payments. Rather, many lenders are now catching up. The foreclosures would have happened during the pandemic if moratoriums hadn’t halted the proceedings.”

In a recent article, Bankrate also explains:

“In the years after the housing crash, millions of foreclosures flooded the housing market, depressing prices. That’s not the case now. Most homeowners have a comfortable equity cushion in their homes. Lenders weren’t filing default notices during the height of the pandemic, pushing foreclosures to record lows in 2020. And while there has been a slight uptick in foreclosures since then, it’s nothing like it was.”

Basically, there’s not a sudden flood of foreclosures coming. Instead, some of the increase is due to the delayed activity explained above while more is from economic conditions.

To further paint the picture of just how different the situation is now compared to the housing crash, take a look at the graph below. It uses data on foreclosure filings for the first half of each year since 2008 to show foreclosure activity has been consistently lower since the crash.

While foreclosures are climbing, it’s clear foreclosure activity now is nothing like it was back then. Today, foreclosures are far below the record-high number that was reported when the housing market crashed.

In addition to all the factors mentioned above, that’s also largely because buyers today are more qualified and less likely to default on their loans.

Bottom Line

Right now, putting the data into context is more important than ever. While the housing market is experiencing an expected rise in foreclosures, it’s nowhere near the crisis levels seen when the housing bubble burst, and that won’t lead to a crash in home prices.

To view original article, visit Keeping Current Matters.

Early October is the Sweet Spot for Buyers

While home prices are still appreciating overall, you may see some homes with price adjustments from eager sellers this October.

If You’re a Buyer, Is Offering Asking Price Enough?

If you’ve found your dream home, you need to be realistic about today’s housing market and how that impacts the offer you’ll make.

Two Reasons Why Waiting a Year To Buy Could Cost You

If you are hoping that waiting a year might mean better market conditions to purchase a home, you may want to think again.

Is a 20% Down Payment Really Necessary To Purchase a Home?

If you’re a prospective homebuyer, it’s important to know you don’t have to put the full 20% down

Is It Time To Move on to a New Home?

As the past year has shown, our needs can change rapidly. That means the longer you’ve been in your home, the more likely it is your needs have evolved.

Is the Number of Homes for Sale Finally Growing?

Signs of relief are finally appearing for frustrated buyers. If you’re thinking of selling, now may be a good time to do so!