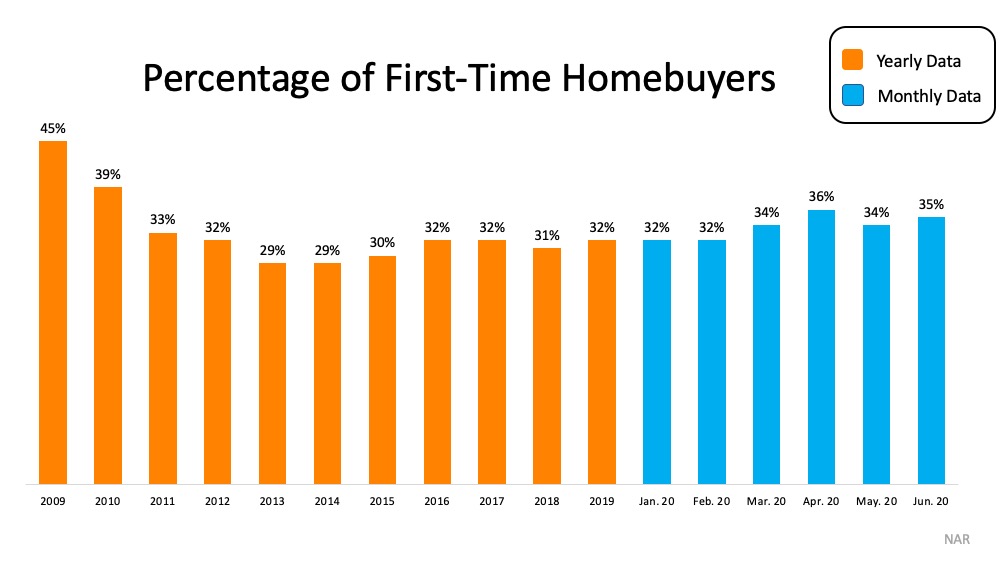

In June, the number of first-time homebuyers accounted for 35% of the existing homes sold, a trend that’s been building steadily throughout the year. According to the National Association of Realtors (NAR):

“The share of first-time buyers increased in March through June—right into the heart of the pandemic period and the surge in unemployment—and is now trending higher than the 29% to 32% average in past years since 2012.” (See graph below):

Why the rise in first-time homebuying?

NAR continues to say:

“The major factor is, arguably, low mortgage rates. As of the week ended July 16, the 30-year fixed mortgage rate dropped to 2.98%. With rates so low that are locked in under a 30-year mortgage, the typical mortgage payment, estimated at $1,036, has fallen below the median rent, at $1,045. For potential home buyers who were thinking of purchasing a home anyway before the pandemic outbreak and who are likely to remain employed, the low mortgage rate may be the clincher.”

Clearly, historically low mortgage rates are encouraging many to buy. With the average mortgage payment now estimated at a lower monthly cost than renting, it’s a great time for first-time homebuyers to enter the market. According to the Q2 2020 Housing Trends Report from the National Association of Homebuilders (NAHB):

“Eighty-four percent of Gen Z’s planning to buy a home are first timers, compared to 68% of Millennials, 52% of Gen X’s, and 21% of Boomers. Looking at results by region shows that over 60% of prospective buyers in the Northeast and South are buying a home for the first time. The share is above 55% in the Midwest and West.”

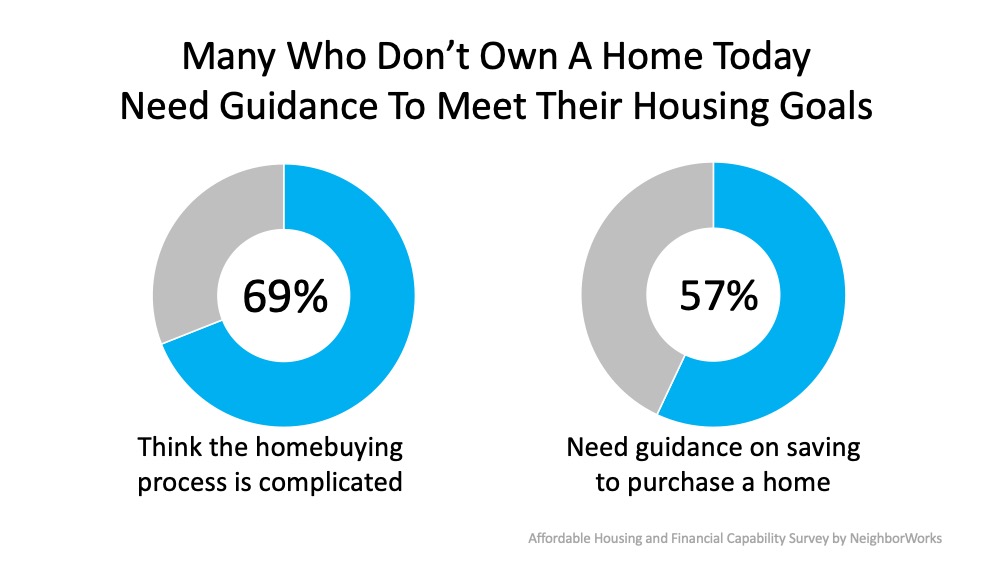

There are, however, challenges for first-time buyers. A recent survey conducted by NeighborWorks America also notes that understanding the homebuying process may be the most significant barrier for many hopeful homeowners:

“Homeownership is a particular challenge for many, despite high levels of interest. Americans believe there are many benefits to homeownership and half of non-owners will seek information about the process in the next few years…a large share of non-owners say the process is too challenging and only a minority know where to find advice if they wanted it. And although many would seek the guidance of community and non-profit programs, only one in three non-owners are aware of such services.”

If you’re among the first-time homebuyers who feel the process is complicated, you’re not alone. If you’re not sure where to begin or you simply want help in figuring out how to save for a home, finding a trusted real estate advisor to work with is a critical step toward your success. A real estate professional can help you understand the process, review your current situation, and guide you with a plan to help you to feel confident when buying a home.

If you’re among the first-time homebuyers who feel the process is complicated, you’re not alone. If you’re not sure where to begin or you simply want help in figuring out how to save for a home, finding a trusted real estate advisor to work with is a critical step toward your success. A real estate professional can help you understand the process, review your current situation, and guide you with a plan to help you to feel confident when buying a home.

Bottom Line

If you’re interested in purchasing a home and need help getting started, let’s connect today so you can take advantage of the support available to guide you through each step of the way.

To view original article, visit Keeping Current Matters.

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

VA home loans are designed to make homeownership a reality for those who have served our country.

Renting vs. Buying: The Net Worth Gap You Need To See

If you’re on the fence, it may be helpful to speak with a local real estate agent. They can help you weigh your options.

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

Understanding what’s happening will help you make the right decisions, whether that’s buying or selling.

Is a Fixer Upper Right for You?

The perfect home is the one you perfect after buying it. With careful planning, budgeting, and a little bit of vision, you can turn a house that needs some love into your perfect home.

How Real Estate Agents Take the Fear Out of Moving

Real estate agents are trusted guides to help you navigate the complexities of the housing market with confidence and ease.

Why Home Sales Bounce Back After Presidential Elections

As has been the case before, once the election uncertainty passes, buyers and sellers will return to the market.