Home Mortgages: Rates Up, Requirements Easing

The media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac). However, a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen.

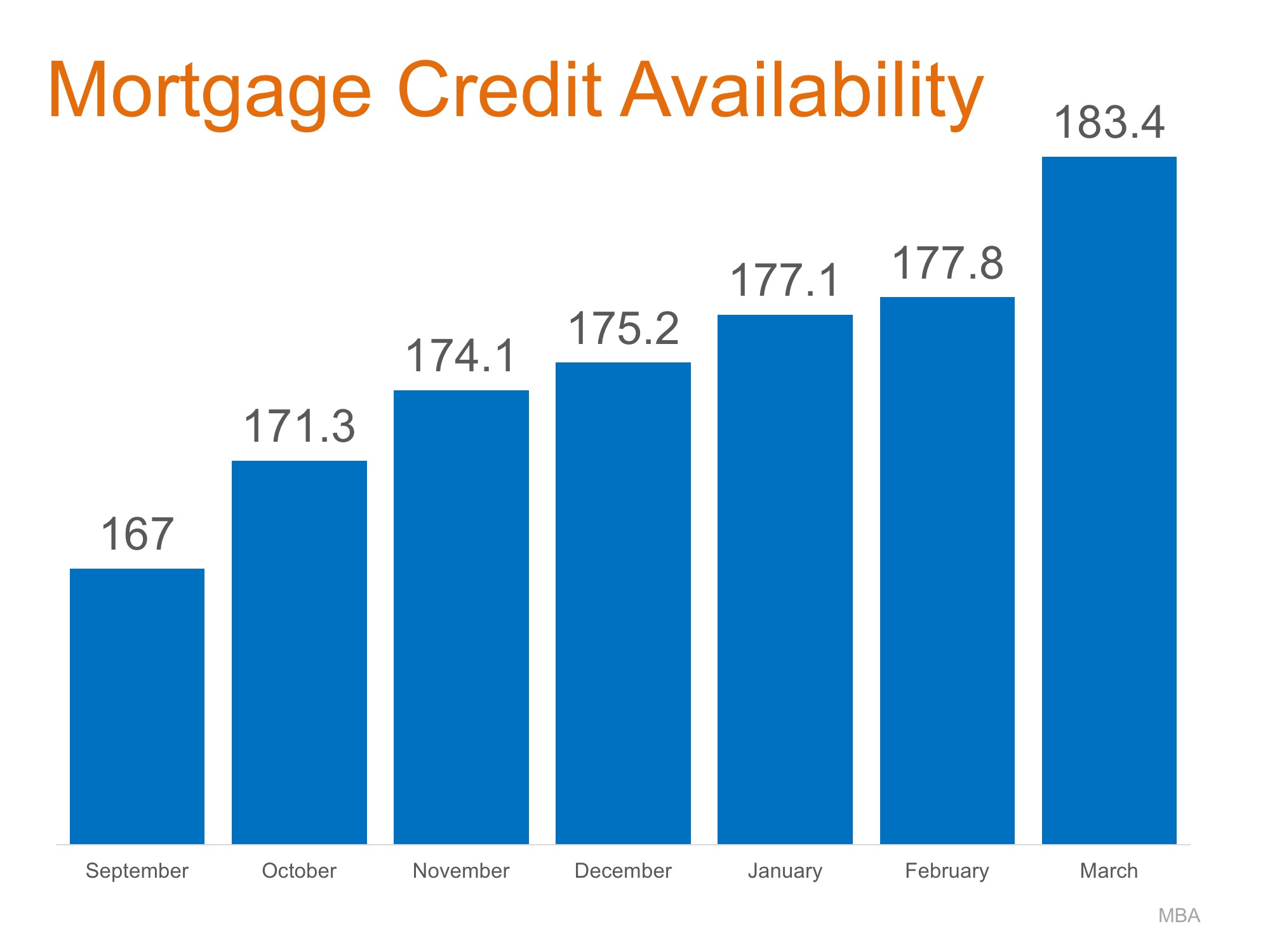

The Mortgage Bankers Association (MBA) quantifies the availability of mortgage credit each month with their Mortgage Credit Availability Index (MCAI). According to the MBA, the MCAI is:

“A summary measure which indicates the availability of mortgage credit at a point in time.”

The higher the index, the easier it is to get a mortgage. Here is a chart showing the MCAI over the last several months as rates have increased.

Have requirements for attaining a mortgage actually eased?

Yes. Here are two examples:

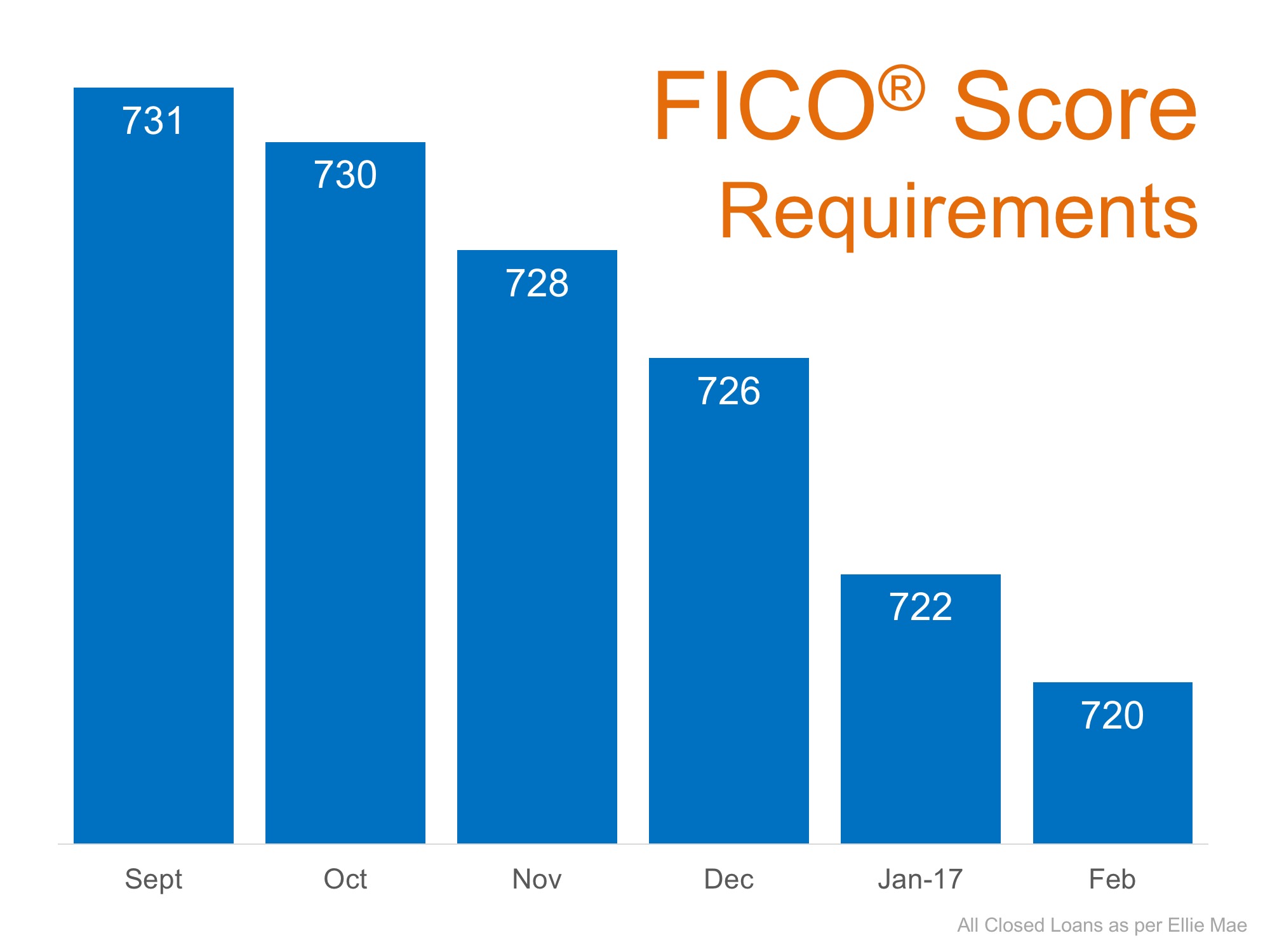

- FICO® Score – the credit score which helps determine a buyer’s eligibility. The score required to attain a mortgage has been falling over the last five months:

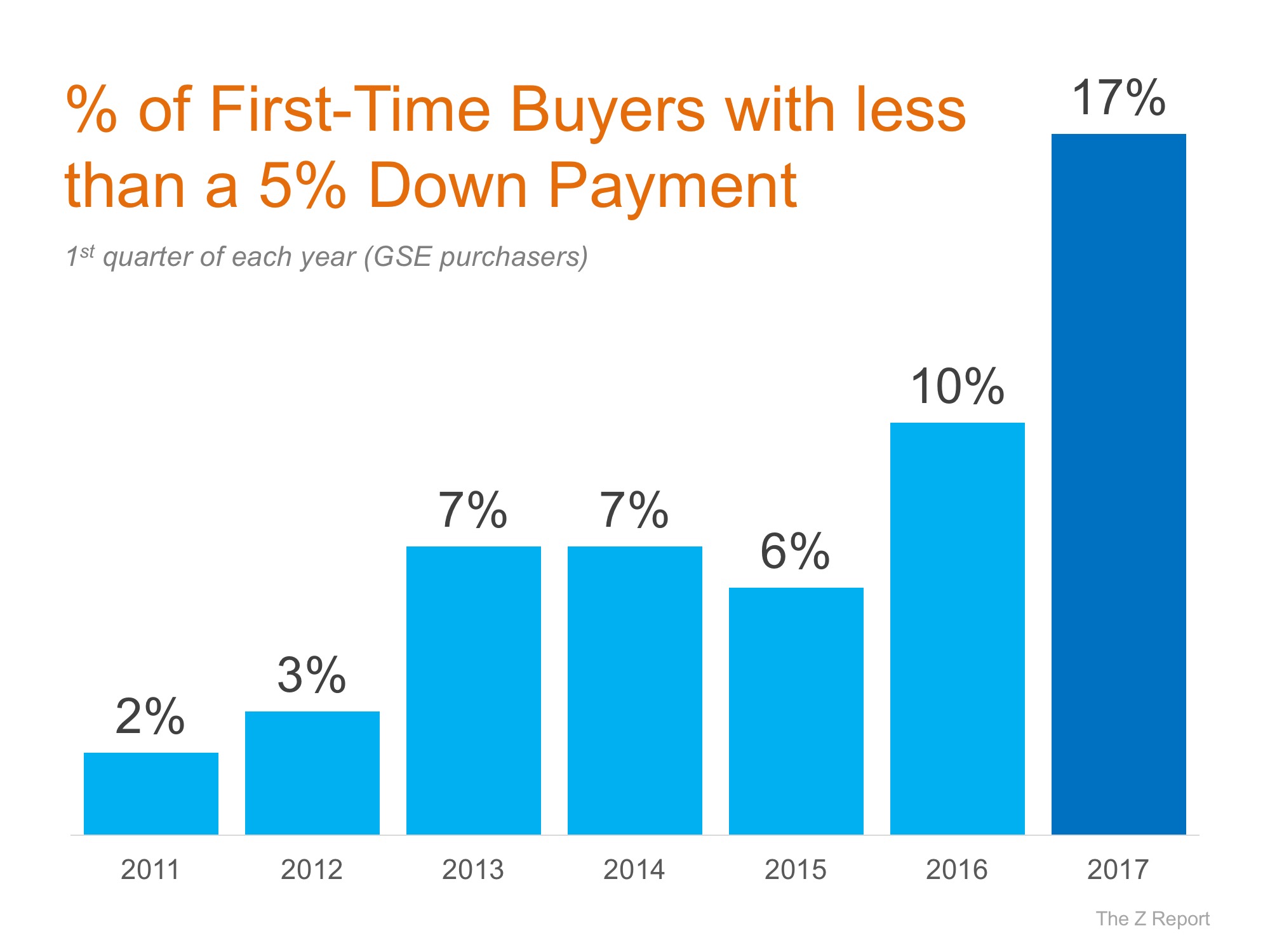

- Down Payment Requirement – the percentage of the purchase price necessary to place as a down payment on a home. To make this point, let’s look at the percentage of first-time buyers who have put less than 5% down over the last several years as compared to the 1st quarter of 2017:

Bottom Line

Whether you are a current homeowner looking to move to a home that will better serve your family’s current needs, or a first-time buyer looking for a starter home, it is easier to get a mortgage today than it has been at any other time in the last ten years.

Worried about Home Maintenance Costs? Consider This

If you’re worried about home maintenance, here’s some information you may find interesting.

Thinking of Selling? You Want an Agent with These Skills

A great agent will be very good at explaining what’s happening in the housing market in a way that’s easy to understand.

Tips for Younger Homebuyers: How To Make Your Dream a Reality

An agent will help you prioritize your list of home features and find houses that can deliver on the top ones.

Now’s a Great Time To Sell Your House

Late spring and early summer are generally considered the best times to sell a house as these are the seasons most people move and buyer demand grows.

What’s Next for Home Prices and Mortgage Rates?

If you’re ready, willing, and able to afford a home right now, partner with a trusted real estate advisor to decide what’s right for you.

Home Prices Are Climbing in These Top Cities

Persistent demand coupled with limited housing supply are key drivers pushing home values upward.

What Is Going on with Mortgage Rates?

Based on current market data, experts think inflation will be more under control and we still may see the Fed lower the Federal Funds Rate this year.

The Number of Homes for Sale Is Increasing

In today’s homebuying market, it’s more important than ever to find a real estate agent who really knows your local area.

How Buying or Selling a Home Benefits Your Community

It makes sense that housing creates a lot of jobs because so many different kinds of work are involved in the industry.

What More Listings Mean When You Sell Your House

if you’re considering whether or not to list your house, today’s limited supply is one of the biggest advantages you have right now.