Home Mortgages: Rates Up, Requirements Easing

The media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac). However, a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen.

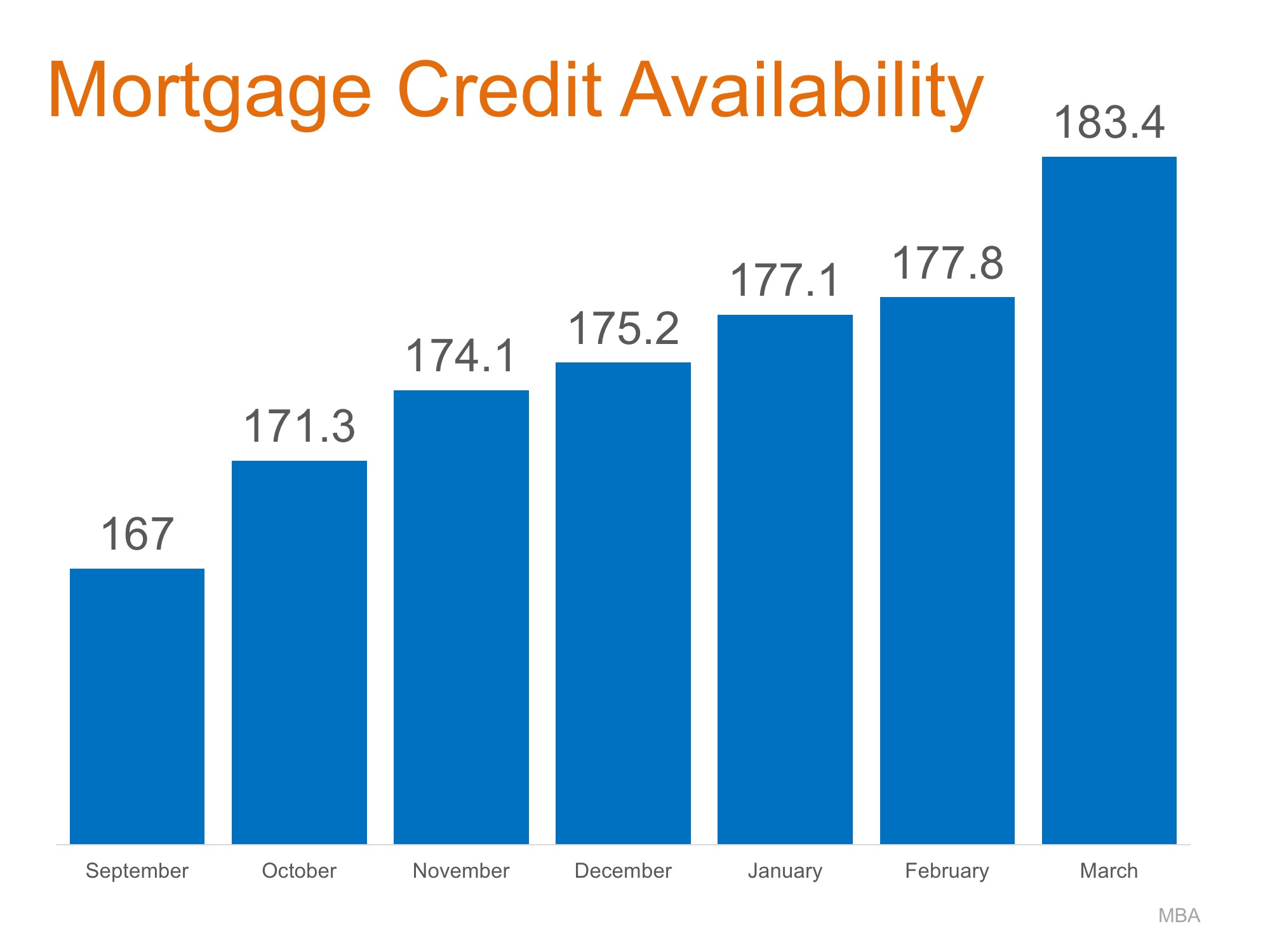

The Mortgage Bankers Association (MBA) quantifies the availability of mortgage credit each month with their Mortgage Credit Availability Index (MCAI). According to the MBA, the MCAI is:

“A summary measure which indicates the availability of mortgage credit at a point in time.”

The higher the index, the easier it is to get a mortgage. Here is a chart showing the MCAI over the last several months as rates have increased.

Have requirements for attaining a mortgage actually eased?

Yes. Here are two examples:

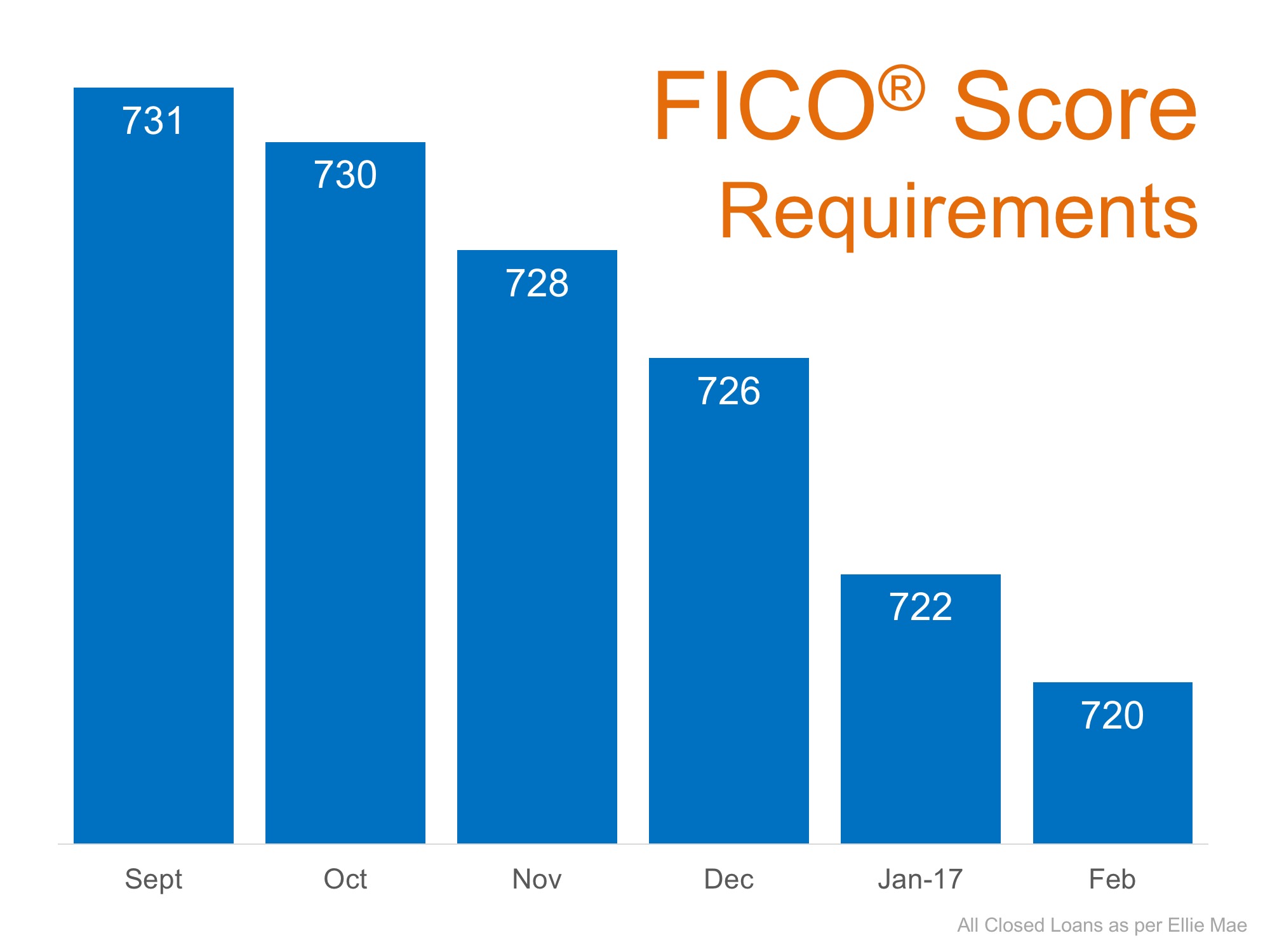

- FICO® Score – the credit score which helps determine a buyer’s eligibility. The score required to attain a mortgage has been falling over the last five months:

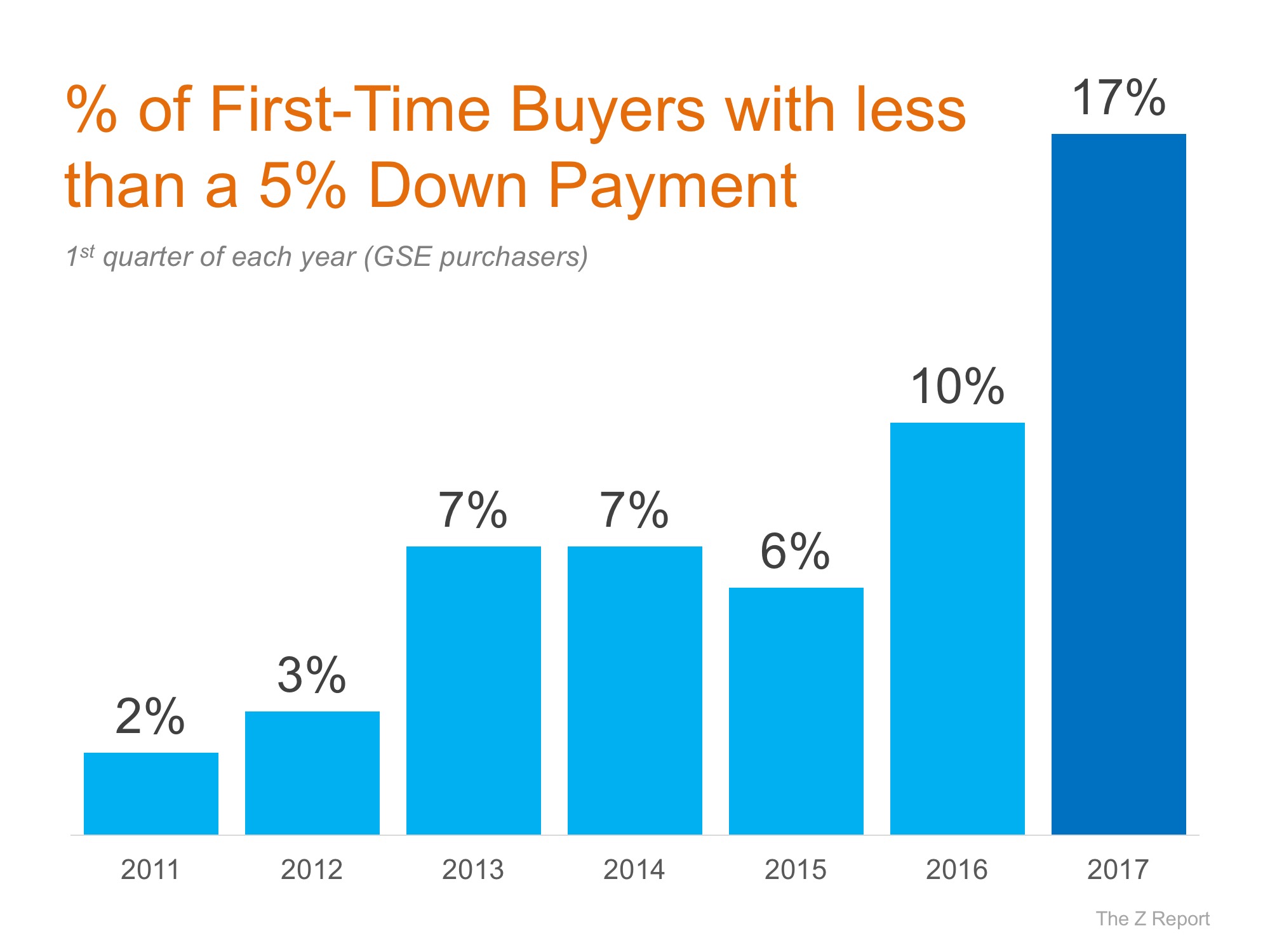

- Down Payment Requirement – the percentage of the purchase price necessary to place as a down payment on a home. To make this point, let’s look at the percentage of first-time buyers who have put less than 5% down over the last several years as compared to the 1st quarter of 2017:

Bottom Line

Whether you are a current homeowner looking to move to a home that will better serve your family’s current needs, or a first-time buyer looking for a starter home, it is easier to get a mortgage today than it has been at any other time in the last ten years.

The True Cost of Selling Your House on Your Own

When it comes to selling your most valuable asset, consider the invaluable support that a real estate agent can provide.

What Homebuyers Need To Know About Credit Scores

Your credit score is one of the most important factors lenders consider when you apply for a mortgage.

Why the Median Home Price Is Meaningless in Today’s Market

Using the median home price as a gauge of what’s happening with home values isn’t worthwhile right now.

Saving for a Down Payment? Here’s What You Need To Know.

One of the biggest misconceptions among housing consumers is what the typical down payment is.

Why Buying or Selling a Home Helps the Economy and Your Community

If you’re thinking about buying or selling a house, it’s important to know that it doesn’t just affect your life, but also your community.

Your Needs Matter More Than Today’s Mortgage Rates

If you’re thinking about selling your house right now, chances are it’s because something in your life has changed.

Are Home Prices Going Up or Down? That Depends…

We’re about to enter a few months when home prices could possibly be lower than they were the same month last year.

This Real Estate Market Is the Strongest of Our Lifetime

This is one of the most foundationally strong housing markets of our lifetime – if not the strongest housing market of our lifetime.

Real Estate Is Still Considered the Best Long-Term Investment

Real estate was voted the best long-term investment for the 11th consecutive year, beating gold, stocks, and bonds.

Oops! Home Prices Didn’t Crash After All

Home prices didn’t come crashing down and may already rebounding from the minimal depreciation experienced over the last few months.