Home Mortgages: Rates Up, Requirements Easing

The media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac). However, a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen.

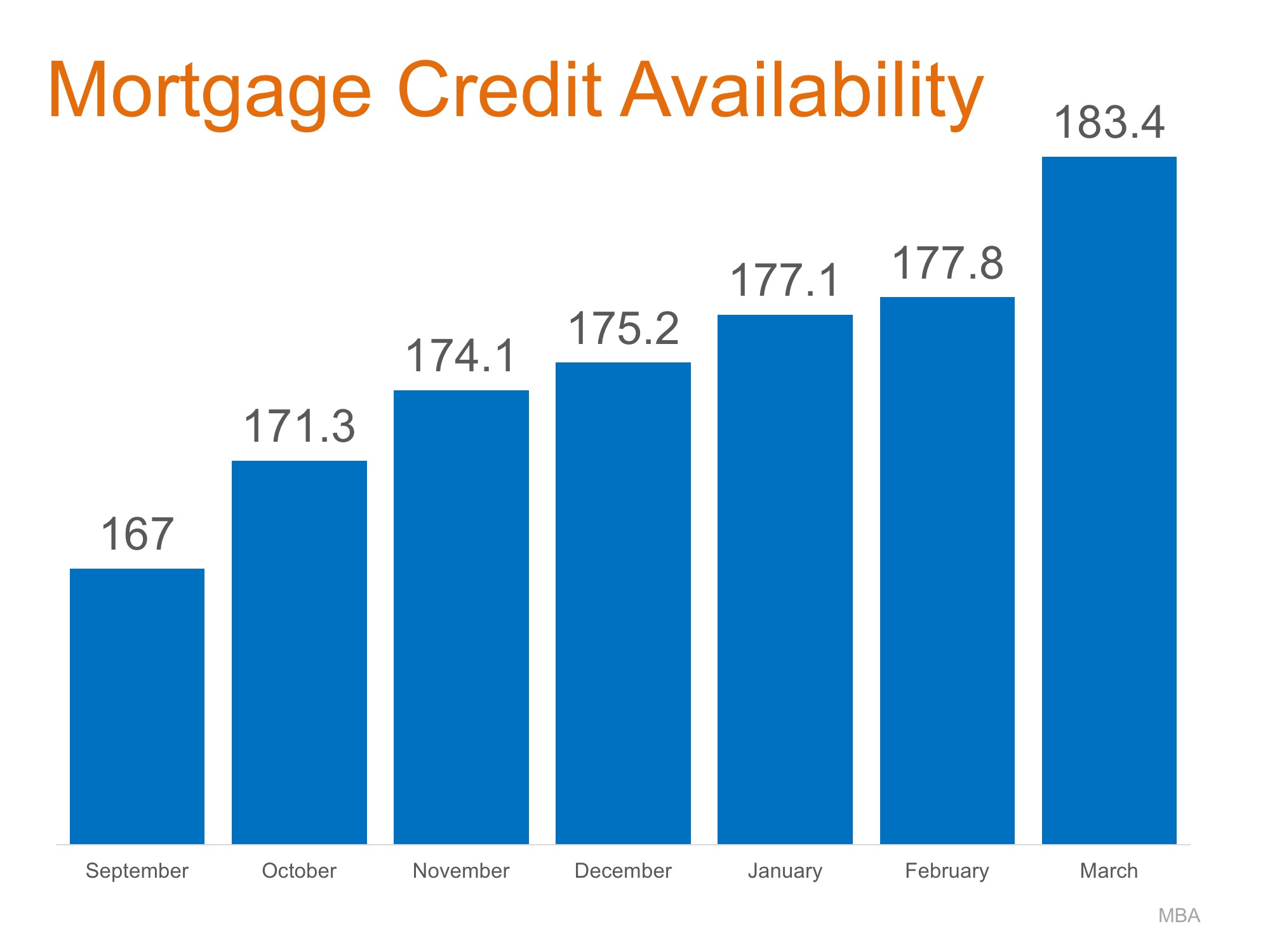

The Mortgage Bankers Association (MBA) quantifies the availability of mortgage credit each month with their Mortgage Credit Availability Index (MCAI). According to the MBA, the MCAI is:

“A summary measure which indicates the availability of mortgage credit at a point in time.”

The higher the index, the easier it is to get a mortgage. Here is a chart showing the MCAI over the last several months as rates have increased.

Have requirements for attaining a mortgage actually eased?

Yes. Here are two examples:

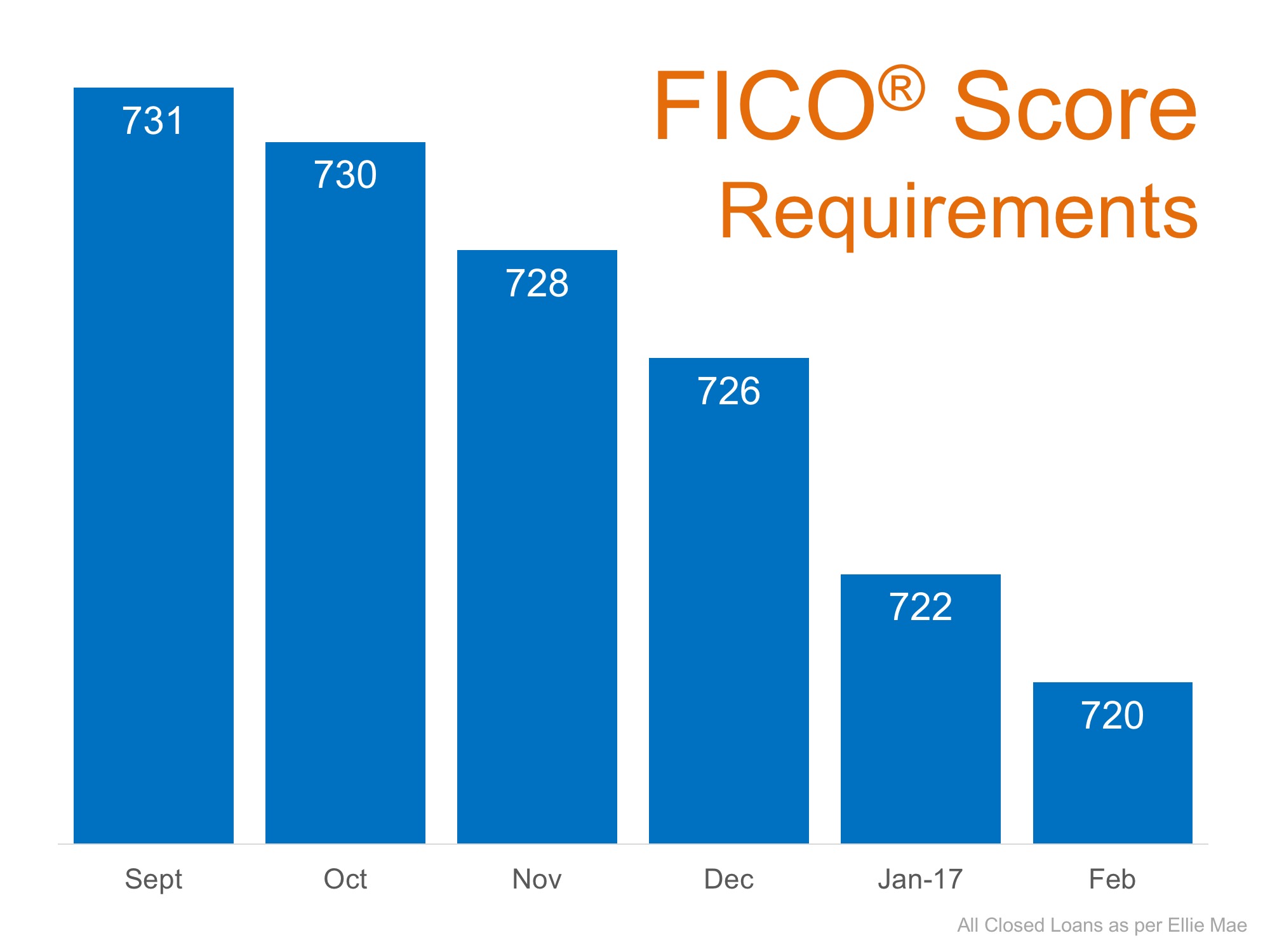

- FICO® Score – the credit score which helps determine a buyer’s eligibility. The score required to attain a mortgage has been falling over the last five months:

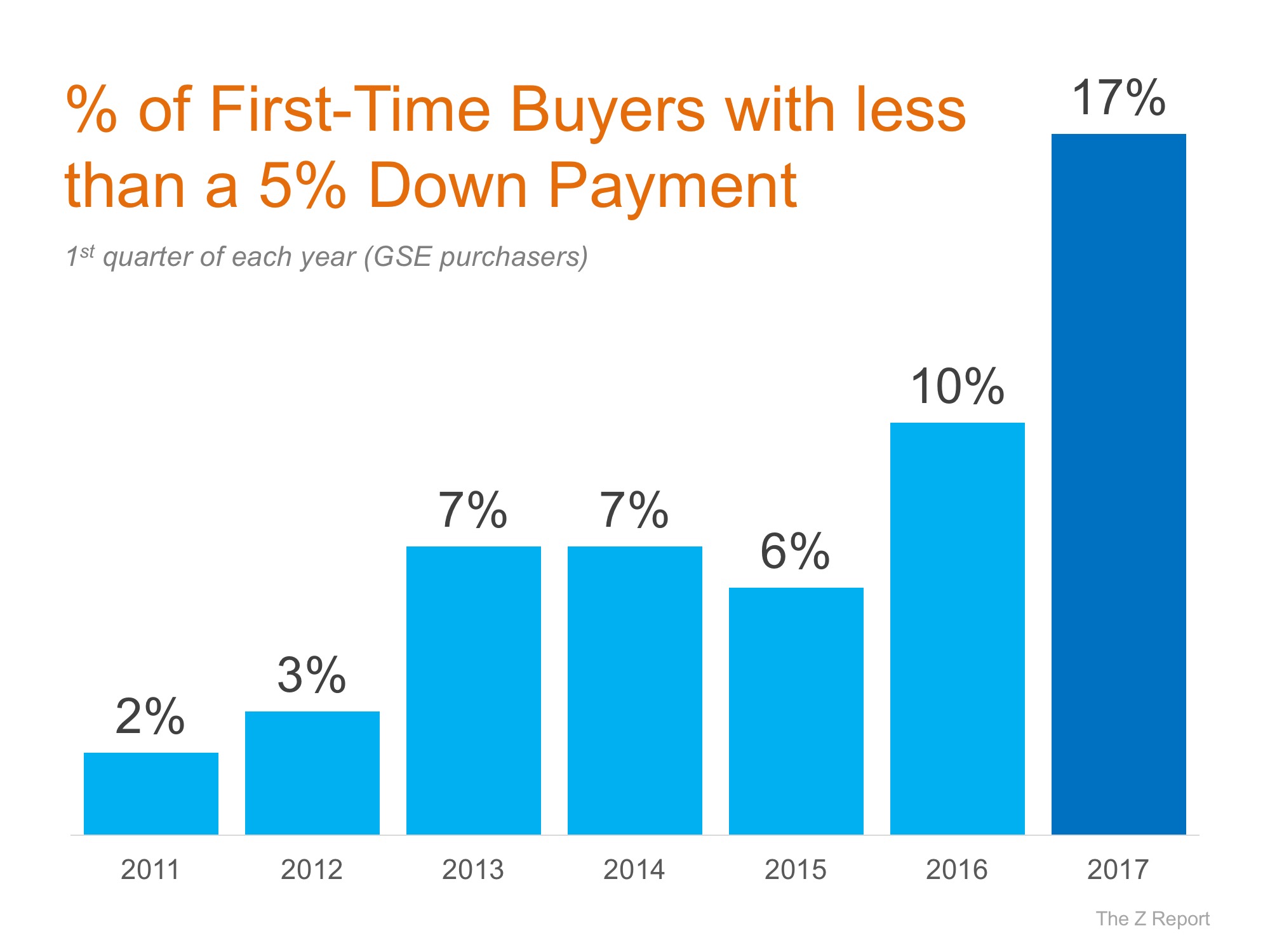

- Down Payment Requirement – the percentage of the purchase price necessary to place as a down payment on a home. To make this point, let’s look at the percentage of first-time buyers who have put less than 5% down over the last several years as compared to the 1st quarter of 2017:

Bottom Line

Whether you are a current homeowner looking to move to a home that will better serve your family’s current needs, or a first-time buyer looking for a starter home, it is easier to get a mortgage today than it has been at any other time in the last ten years.

Home Price Growth Is Moderating – Here’s Why That’s Good for You

It’s crucial to understand what’s happening in your local market and a local real estate agent can really help.

The Secret To Selling? Using an Agent To Get Your House Noticed

The way your agent markets your house can be the difference between whether or not it stands out and gets attention from buyers.

If Your House’s Price Is Not Compelling, It’s Not Selling

Work with a local real estate agent who’s going to be honest with you about how you should price your house.

One Homebuying Step You Don’t Want To Skip: Pre-Approval

A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.

Buyer Bright Spot: There Are More Homes on the Market

The number of homes for sale has grown a whole lot lately and that’s true for both existing and newly built homes.

How Home Equity Can Help Fuel Your Retirement

Your agent will help you understand how much equity to have and how you can use it and help you navigate the entire process.

Why More People Are Buying Multi-Generational Homes Today

According to the latest data from NAR, cost savings are the main reason more people are choosing to live with family today.

The Real Benefits of Buying a Home This Year

Let’s break down why homeownership is worth considering in 2025 and beyond, and how it can help set you up for the future.

3 Reasons To Buy a Home Before Spring

What if buying now — before the spring rush — might actually give you the upper hand? You’ll have less competition, more negotiating power and be able to lock in today’s prices before they rise.

When Is the Perfect Time To Move?

No matter when you buy, there’s always some benefit and some sort of trade-off – and that’s not a bad thing.

That’s just the reality of it.