Home Mortgages: Rates Up, Requirements Easing

The media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac). However, a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen.

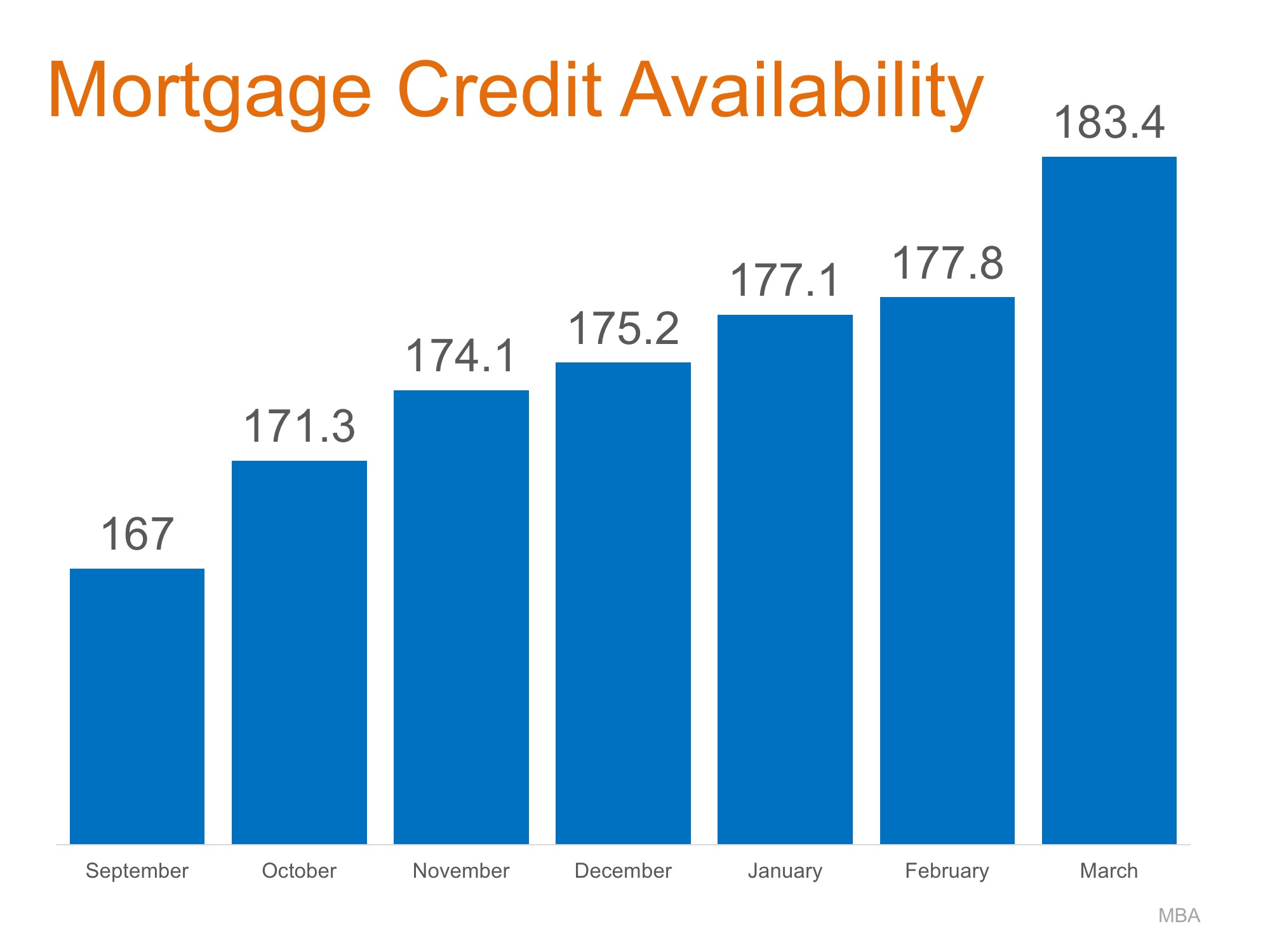

The Mortgage Bankers Association (MBA) quantifies the availability of mortgage credit each month with their Mortgage Credit Availability Index (MCAI). According to the MBA, the MCAI is:

“A summary measure which indicates the availability of mortgage credit at a point in time.”

The higher the index, the easier it is to get a mortgage. Here is a chart showing the MCAI over the last several months as rates have increased.

Have requirements for attaining a mortgage actually eased?

Yes. Here are two examples:

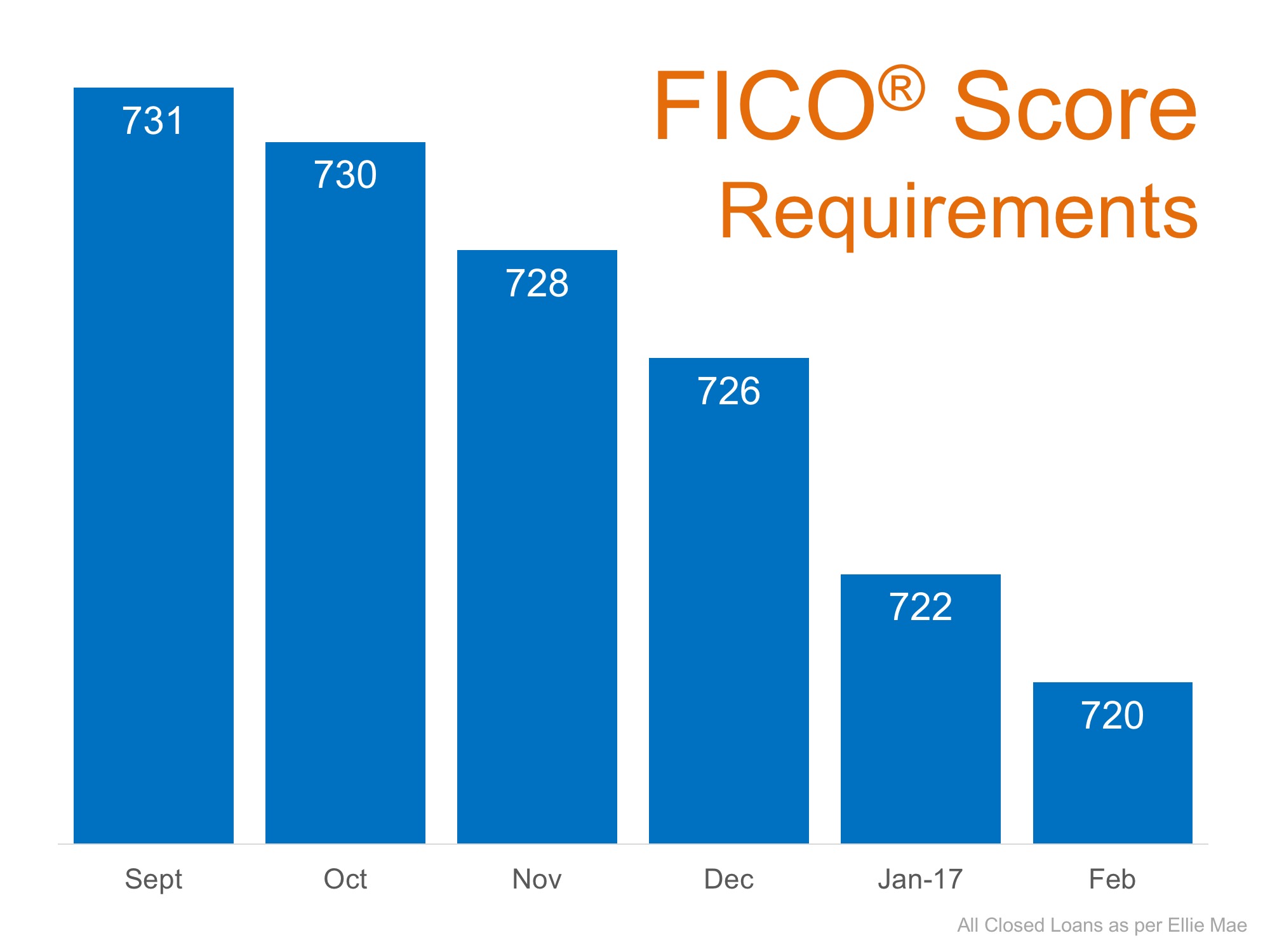

- FICO® Score – the credit score which helps determine a buyer’s eligibility. The score required to attain a mortgage has been falling over the last five months:

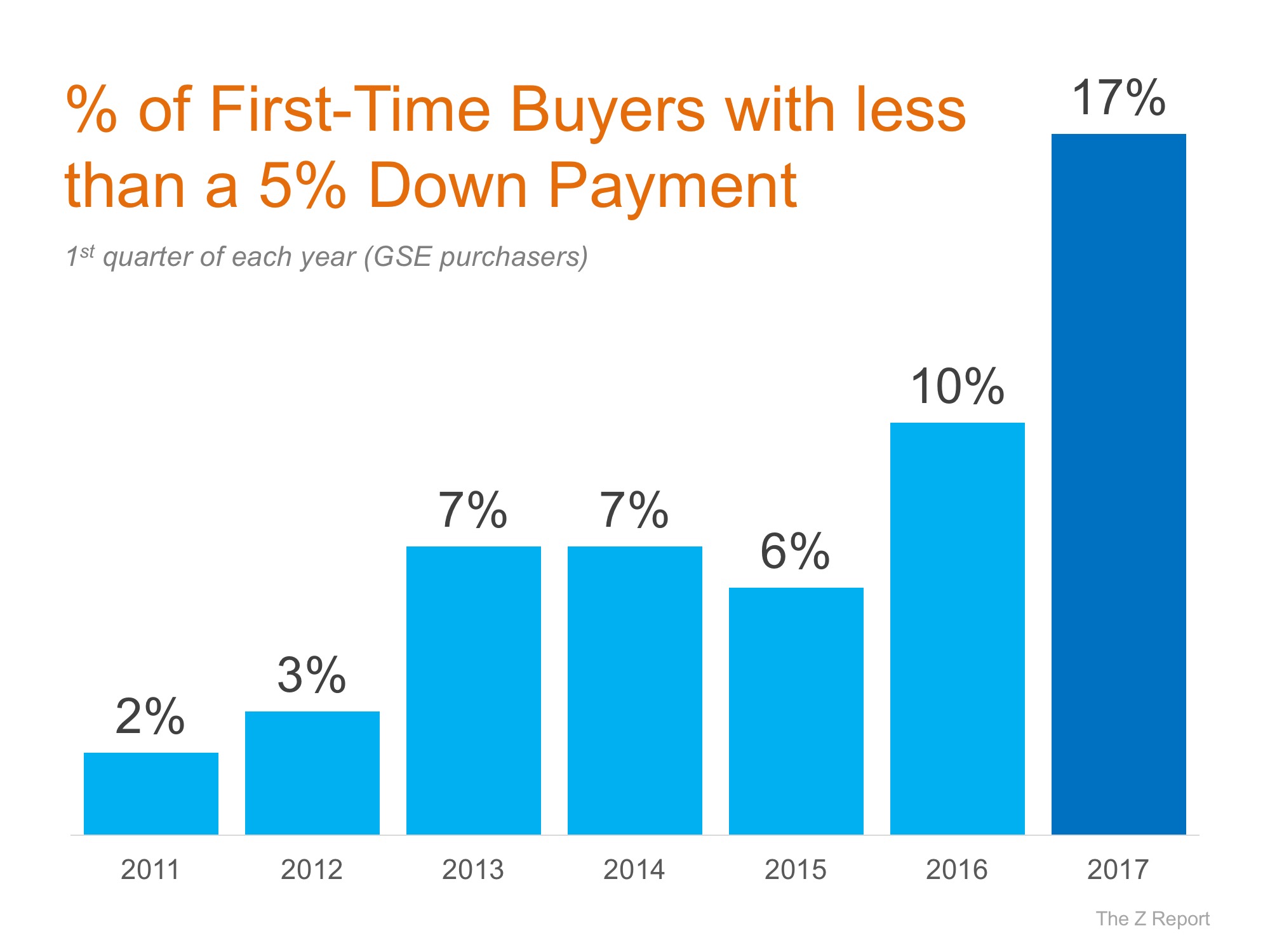

- Down Payment Requirement – the percentage of the purchase price necessary to place as a down payment on a home. To make this point, let’s look at the percentage of first-time buyers who have put less than 5% down over the last several years as compared to the 1st quarter of 2017:

Bottom Line

Whether you are a current homeowner looking to move to a home that will better serve your family’s current needs, or a first-time buyer looking for a starter home, it is easier to get a mortgage today than it has been at any other time in the last ten years.

The Down Payment Assistance You Didn’t Know About

Believe it or not, almost 80% of first-time homebuyers qualify for down payment assistance, but only 13% actually use it.

Mortgage Rates Drop to Lowest Level in over a Year and a Half

Mortgage rates have fallen more than half a percent . . . and are at their lowest level since February 2023.

2025 Housing Market Forecasts: What To Expect

Looking ahead to 2025, it’s important to know what experts are projecting for the housing market.

What’s the Impact of Presidential Elections on the Housing Market?

Historically, the housing market doesn’t tend to look very different in presidential election years compared to other years.

Is Your House Priced Too High?

Pricing your house correctly is one of the most crucial steps in the selling process and if you’re asking too much you may be turning potential buyers away.

The Best Time to Buy a Home This Year

Mortgage rates just hit their lowest point in 19 months, and that goes a long way to help with your purchasing power and affordability. Are you ready to buy?

Could a 55+ Community Be Right for You?

the number of listings tailored for homebuyers in this age group has increased by over 50% compared to last year.

Falling Mortgage Rates Are Bringing Buyers Back

If you’ve been hesitant to list your house because you’re worried no one’s buying, here’s your sign it may be time to talk with an agent.

Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List

While home affordability is finally starting to show signs of improving, it’s still tight. Your lender can help you.

Are We Heading into a Balanced Market?

Whether you’re buying or selling, understanding how the market is changing gives you a big advantage. Your agent has the latest data and local insights.