“If you’re a homeowner planning to sell in 2023, now is the time to get ready.”

The spring season appears to be warming up in housing as more and more buyers enter the market. And after rising mortgage rates sidelined so many buyers last year, that’s a good sign for sellers. Realtor.com has the latest:

“Spring is officially here, and like green shoots emerging from the bleak winter, new data suggests that more buyers are back in the market, although more subdued compared to a year ago.”

We know buyer activity is trending up because of mortgage purchase application data. According to Investopedia:

“A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate.”

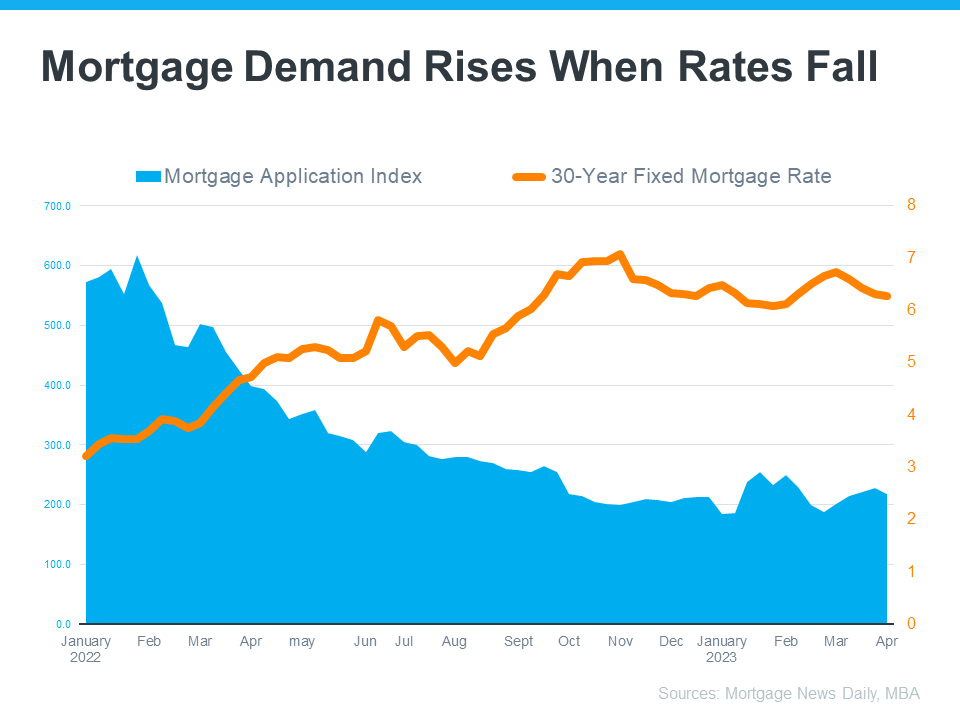

That means the number of mortgage applications shows how many buyers are applying for mortgages. Put another way, an increase in mortgage applications means an increase in buyer demand – and as Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explains, application activity started ramping up as mortgage rates fell steadily in March:

“Application activity increased as mortgage rates declined . . . recent increases, along with data from other sources showing an uptick in home sales, is a welcome development.”

In fact, we can see how mortgage rates have a direct impact on applications over time. As rates rose dramatically last year, applications fell in response (see graph below):

The recent uptick in mortgage applications, as well as the decline in mortgage rates, is good news for sellers because it means more buyers are actively looking for homes.

What This Means for You

Buyers are coming this spring, which is typically the busiest time of the year in real estate. And as Realtor.com tells us, if you’re a seller, you need to prepare:

“If homeowners are planning to sell in 2023, now is the time to get ready.”

The means working with a local real estate agent to maximize your home’s appeal and get it listed at the ideal price for your area.

Bottom Line

What You Need To Know About Saving for a Home in 2024

It’s important to work with a real estate professional to understand what’s best for your situation in your local area.

Retiring Soon? Why Moving Might Be the Perfect Next Step

Whether you’re looking to downsize or simply be closer to loved ones, your home equity can be a key to realizing your homeownership goals.

Sell Smarter: Why Working with a Real Estate Agent May Beat Going Solo

A real estate agent can help you price your home correctly and guide you through the paperwork.

Expert Quotes on the 2024 Housing Market Forecast

If you’re thinking about making a move next year, know that early signs show we’re turning a corner.

Why Now Is Still a Great Time To Sell Your House

Nationally, demand is still high compared to the last normal years in the housing market and plenty of buyers are making moves right now

If Your House Hasn’t Sold Yet, It May Be Overpriced

With today’s higher mortgage rates already putting a stretch on their budget, buyers are being a bit more sensitive about price.