“Before you decide to sell your house, it’s important to know what you can expect in the current housing market.”

Before you decide to sell your house, it’s important to know what you can expect in the current housing market. One positive trend right now is homebuyers are adapting to today’s mortgage rates and getting used to them as the new normal.

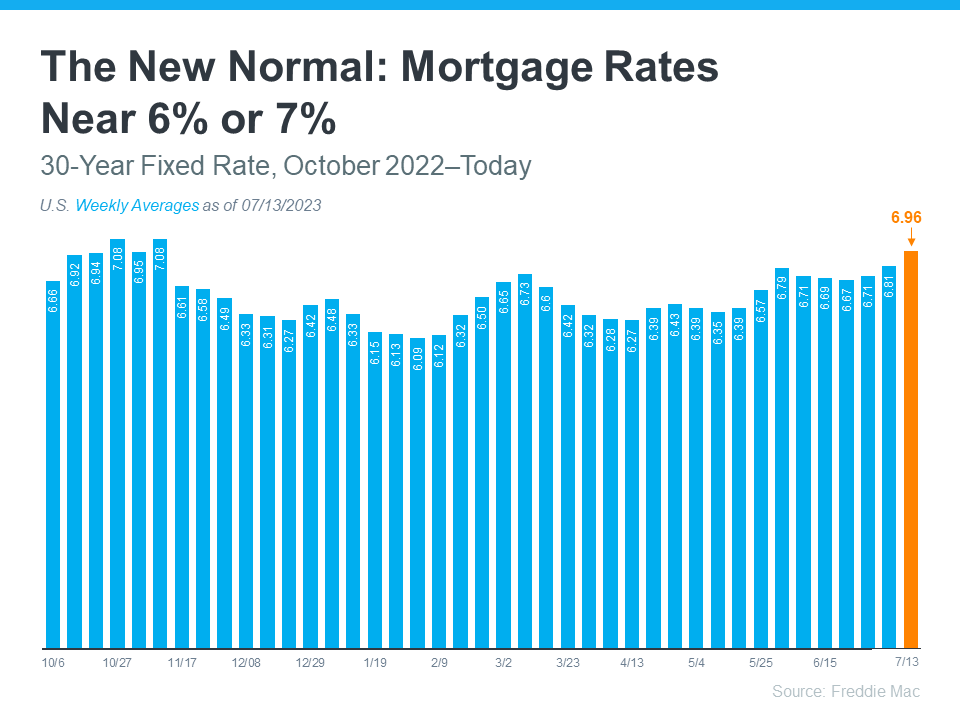

To better understand what’s been happening with mortgage rates lately, the graph below shows the trend for the 30-year fixed mortgage rate from Freddie Mac since last October. As you can see, rates have been between 6% and 7% pretty consistently for the past nine months:

According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), mortgage rates play a significant role in buyer demand and, by extension, home sales. Yun highlights the positive impact of stable rates:

“Mortgage rates heavily influence the direction of home sales. Relatively steady rates have led to several consecutive months of consistent home sales.”

As a seller, hearing that home sales are consistent right now is good news. It means buyers are out there and actively purchasing homes. Here’s a bit more context on how mortgage rates have impacted demand recently.

When mortgage rates surged dramatically last year, escalating from roughly 3% to 7%, many potential buyers felt a bit of sticker shock and decided to hold off on their plans to purchase a home. However, as time has passed, that initial shock has worn off. Buyers have grown more accustomed to current mortgage rates and have accepted that the record-low rates of the last few years are behind us. As Doug Duncan, SVP and Chief Economist at Fannie Mae, says:

“. . . consumers are adapting to the idea that higher mortgage rates will likely stick around for the foreseeable future.”

In fact, a recent survey by Freddie Mac reveals 18% of respondents say they’re likely to buy a home in the next six months. That means nearly one out of every five people surveyed plan to buy in the near future. And that goes to show buyers are planning to be active in the months ahead.

Of course, mortgage rates aren’t the sole factor affecting buyer demand. No matter where mortgage rates stand, people will always have reasons to move, whether it’s for job relocation, changing households, or any other personal motivation. As a seller, you can feel confident there is a market for your house today. And that demand is pretty strong as buyers settle into where rates are right now.

Bottom Line

The way buyers perceive today’s mortgage rates is shifting – they’re getting used to the new normal. Steady rates are contributing to strong buyer demand and consistent home sales. Let’s connect so we can get your house on the market and in front of those buyers.

To view original article, visit Keeping Current Matters.

Why Today’s Seller’s Market Is Good for Your Bottom Line

The market is still working in favor of sellers. If you house is ready and priced competitively, it should get a lot of attention.

What Mortgage Rate Do You Need To Move?

While mortgage rates are nearly impossible to forecast, the optimism from the experts should give you insight into what’s ahead.

Finding Your Perfect Home in a Fixer Upper

Your agent can also offer advice on which upgrades and renovations will set you up to get the greatest return on your investment.

The Benefits of Downsizing When You Retire

When you downsize your house, you often end up downsizing the bills that come with it, like energy costs, and maintenance requirements.

Why There Won’t Be a Recession That Tanks the Housing Market

The fundamentals of the economy, despite some hiccups, are doing pretty good.

What To Know About Credit Scores Before Buying a Home

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan.