Homeowners: Your House Must Be Sold TWICE

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting the home values could appreciate by another 5%+ over the next twelve months. One major challenge in such a market is the bank appraisal.

If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank.

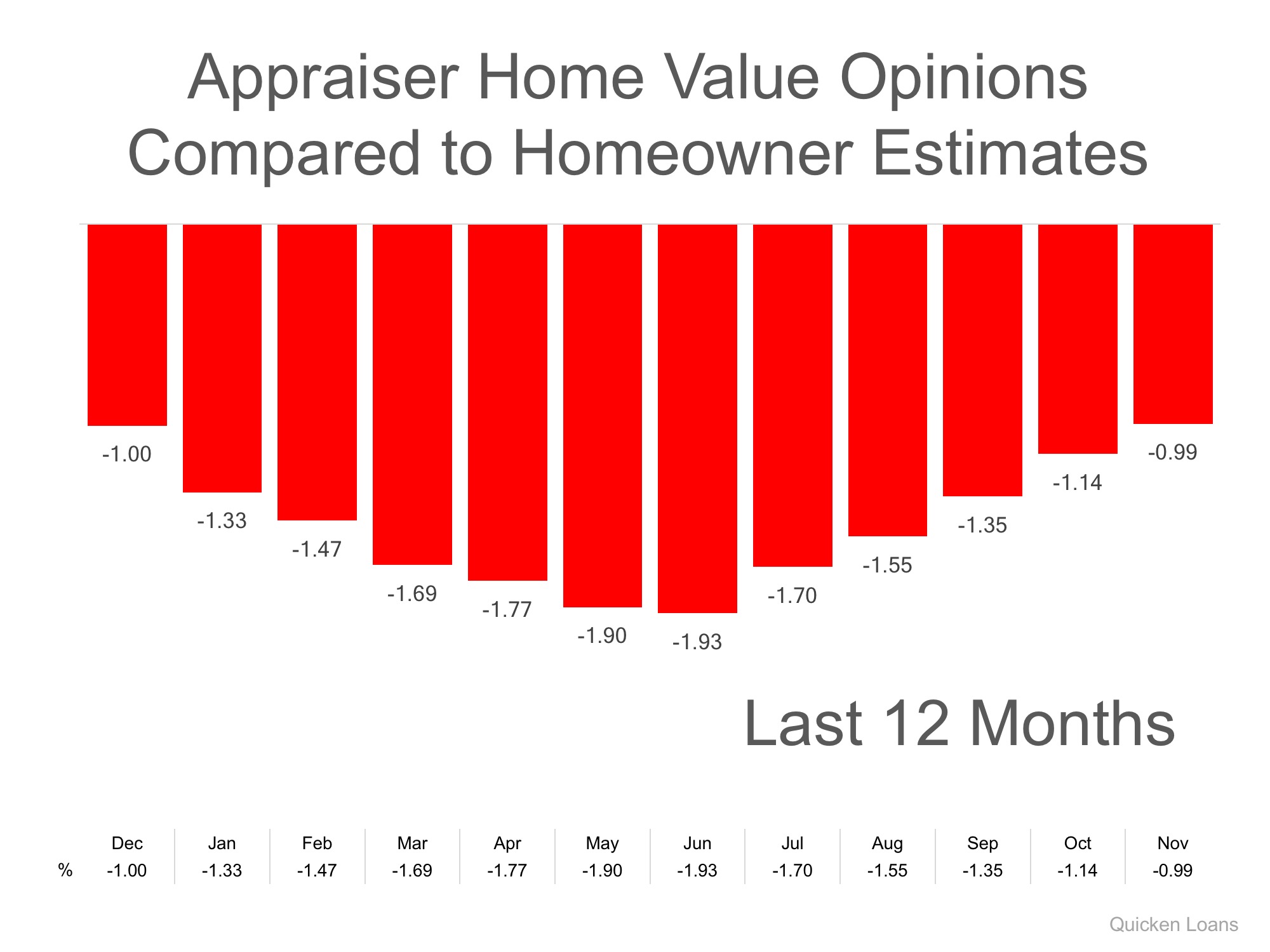

Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their hose is worth, and an appraiser’s evaluation of that same home.

Bill Banfield, Executive VP of Capital Markets at Quicken Loans urges anyone looking to buy or sell in today’s market to remember the impact of this challenge:

“Based on the HPPI, it appears homeowners in the markets where prices are rising faster than the national average – like Denver, Seattle and San Francisco – are continuing to underestimate just how quickly home values are rising, so the average appraisal is higher than homeowner estimate.

On the inverse of that, homeowners in areas where the values aren’t rising as fast may think they are rising faster than they are, leading to the appraisal lagging the estimate.”

The chart below illustrates the changes in home price estimates over the last 12 months.

Bottom Line

Every house on the market must be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, let’s get together to discuss this and any other obstacles that may arise.

To view original article, please visit Keeping Current Matters.

Are More Homes Coming onto the Market?

If you’ve been putting off selling your house, now may be the sweet spot to make your move. The longer you wait, the more competition you’ll have.

Why Is Housing Inventory So Low?

The shortage of inventory isn’t just a today problem. It’s been a challenge for years. Let’s take a look what contributed this limited supply

What Experts Project for Home Prices Over the Next 5 Years

Once you buy a home, price appreciation raises your home’s value, and that grows your household wealth.

Planning to Retire? Your Equity Can Help You Make a Move

Whether you’re looking to downsize, relocate to a dream destination, or move closer to friends or loved ones, equity in your home may help.

Expert Home Price Forecasts Revised Up for 2023

As activity slows again at the end of the year, home price growth will slow too. This doesn’t mean prices are falling.

Buyer Traffic Is Still Stronger than the Norm

Buyers will always need to buy, and those who can afford to move at today’s rates are going to do so.

Why You May Still Want To Sell Your House After All

If you need to sell now because something in your own life has changed, don’t let mortgage rates hold you back from what you want.

Gen Z: The Next Generation Is Making Moves in the Housing Market

Generation Z (Gen Z) is eager to put down their own roots and achieve financial independence. As a result, they’re turning to homeownership.

Why You Don’t Need To Fear the Return of Adjustable-Rate Mortgages

If you’re worried today’s adjustable-rate mortgages are like the ones from the housing crash, rest assured, things are different this time.

Why Median Home Sales Price Is Confusing Right Now

Median home sales prices change because there’s a mix of homes being sold is being impacted by affordability and mortgage rates.