Homeowners: Your House Must Be Sold TWICE

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting the home values could appreciate by another 5%+ over the next twelve months. One major challenge in such a market is the bank appraisal.

If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank.

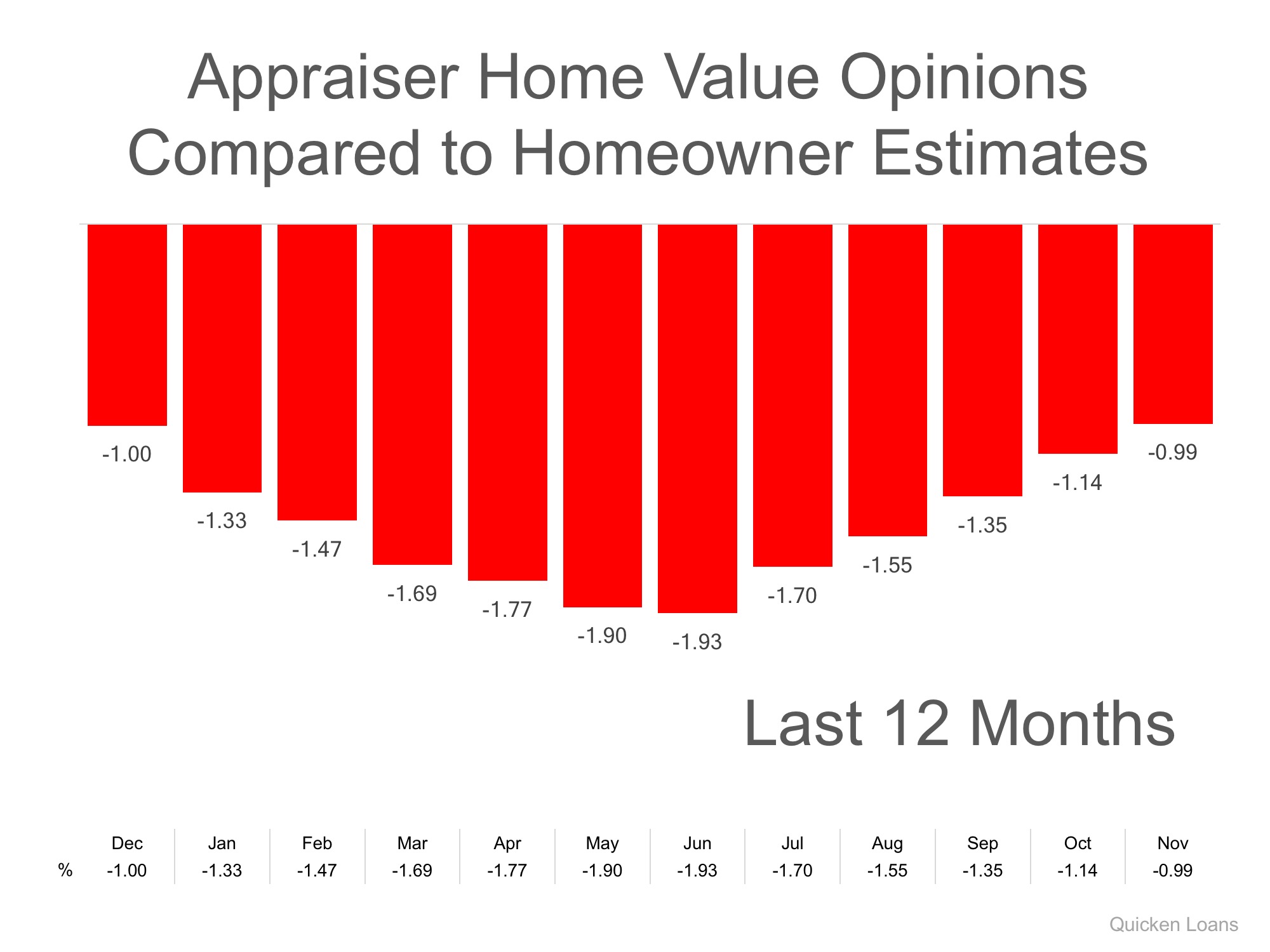

Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their hose is worth, and an appraiser’s evaluation of that same home.

Bill Banfield, Executive VP of Capital Markets at Quicken Loans urges anyone looking to buy or sell in today’s market to remember the impact of this challenge:

“Based on the HPPI, it appears homeowners in the markets where prices are rising faster than the national average – like Denver, Seattle and San Francisco – are continuing to underestimate just how quickly home values are rising, so the average appraisal is higher than homeowner estimate.

On the inverse of that, homeowners in areas where the values aren’t rising as fast may think they are rising faster than they are, leading to the appraisal lagging the estimate.”

The chart below illustrates the changes in home price estimates over the last 12 months.

Bottom Line

Every house on the market must be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, let’s get together to discuss this and any other obstacles that may arise.

To view original article, please visit Keeping Current Matters.

Lower Mortgage Rates Are Bringing Buyers Back to the Market

The upcoming months should see a return of buyers, as mortgage rates have been coming down since mid-November.

Where Will You Go If You Sell? You Have Options.

By working with a trusted real estate agent, you can be confident you’re making the most educated, informed decision.

Why It Makes Sense to Move Before Spring

If you’re ready to buy a home, right now is the best time to do so before your competition grows and more buyers enter the market.

The 3 Factors That Affect Home Affordability

When you think about affordability, the full picture includes more than just mortgage rates and prices. Wages need to be factored in too.

Want To Sell Your House? Price It Right.

In today’s more moderate market, how you price your house will make a big difference to not only your bottom line, but to how quickly your house could sell.

Pre-Approval in 2023: What You Need To Know

To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you.

Think Twice Before Waiting for 3% Mortgage Rates

It’s important to have a realistic vision for what you can expect this year; advice of expert real estate advisors is critical.

Today’s Housing Market Is Nothing Like 15 Years Ago

In the 2nd half of 2022, there was a dramatic shift in real estate causing many people to make comparisons to the 2008 housing crisis.

The Truth About Negative Home Equity Headlines

News headlines focus on short-term equity numbers and fail to convey the long-term view.

What Experts Are Saying About the 2023 Housing Market

2023 likely will become a year of long-lost normalcy returning to the market with mortgage rates stabilizing.