Homeowners: Your House Must Be Sold TWICE

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting the home values could appreciate by another 5%+ over the next twelve months. One major challenge in such a market is the bank appraisal.

If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank.

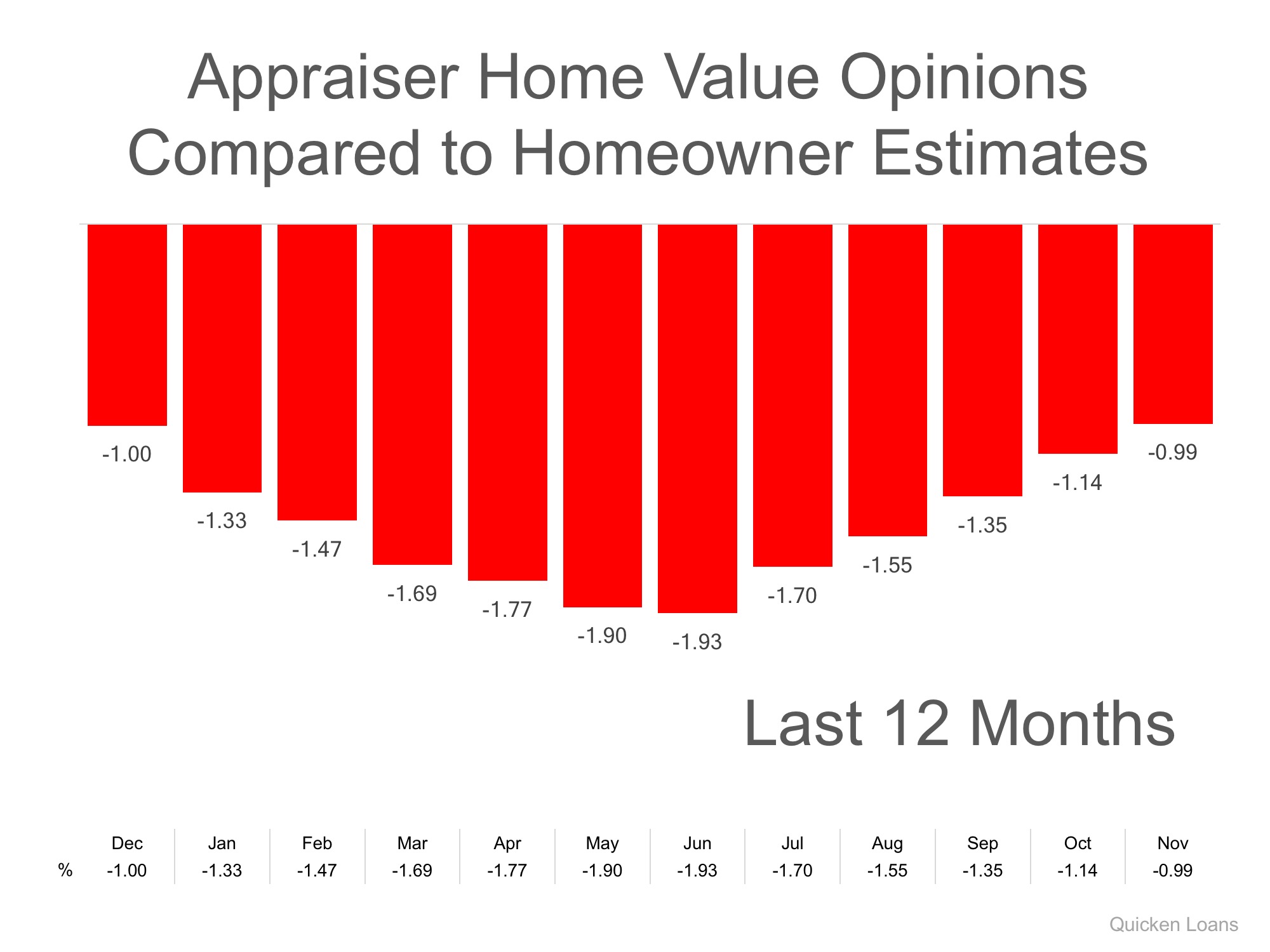

Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their hose is worth, and an appraiser’s evaluation of that same home.

Bill Banfield, Executive VP of Capital Markets at Quicken Loans urges anyone looking to buy or sell in today’s market to remember the impact of this challenge:

“Based on the HPPI, it appears homeowners in the markets where prices are rising faster than the national average – like Denver, Seattle and San Francisco – are continuing to underestimate just how quickly home values are rising, so the average appraisal is higher than homeowner estimate.

On the inverse of that, homeowners in areas where the values aren’t rising as fast may think they are rising faster than they are, leading to the appraisal lagging the estimate.”

The chart below illustrates the changes in home price estimates over the last 12 months.

Bottom Line

Every house on the market must be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, let’s get together to discuss this and any other obstacles that may arise.

To view original article, please visit Keeping Current Matters.

6 Foundational Benefits of Homeownership Today

As we think about the future and what we want to achieve beyond 2021, it’s a great time to look at the benefits of owning a home.

Do I Really Need a 20% Down Payment to Buy a Home?

Be sure to work with trusted professionals from the start to learn what you may qualify for in the homebuying process.

Why Owning a Home Is a Powerful Financial Decision

In today’s housing market, there are clear financial benefits to owning a home including the chance to build your net worth.

Want to Build Wealth? Buy a Home This Year.

A financial advantage to owning a home is the wealth built through equity when you own a home.

Turn to an Expert for the Best Advice, Not Perfect Advice

An agent can give you the best advice possible based on the information and situation at hand.

What Happens When Homeowners Leave Their Forbearance Plans?

If we do experience a higher foreclosure rate, most experts believe the current housing market will easily absorb the excess inventory.

What’s the Difference between an Appraisal and a Home Inspection?

Here’s the breakdown of each one and why they’re both important when buying a home.

Why Moving May Be Just the Boost You Need

There’s logic behind the idea that making a move could improve someone’s quality of life

Owning a Home Is Still More Affordable Than Renting One

In 2020, mortgage rates reached all-time lows 16 times, and so far, they’re continuing to hover in low territory this year.

Should I Wait for Lower Mortgage Interest Rates?

Borrowers are smart to take advantage of these low rates now and will certainly benefit as a result.