Homeowners: Your House Must Be Sold TWICE

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting the home values could appreciate by another 5%+ over the next twelve months. One major challenge in such a market is the bank appraisal.

If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank.

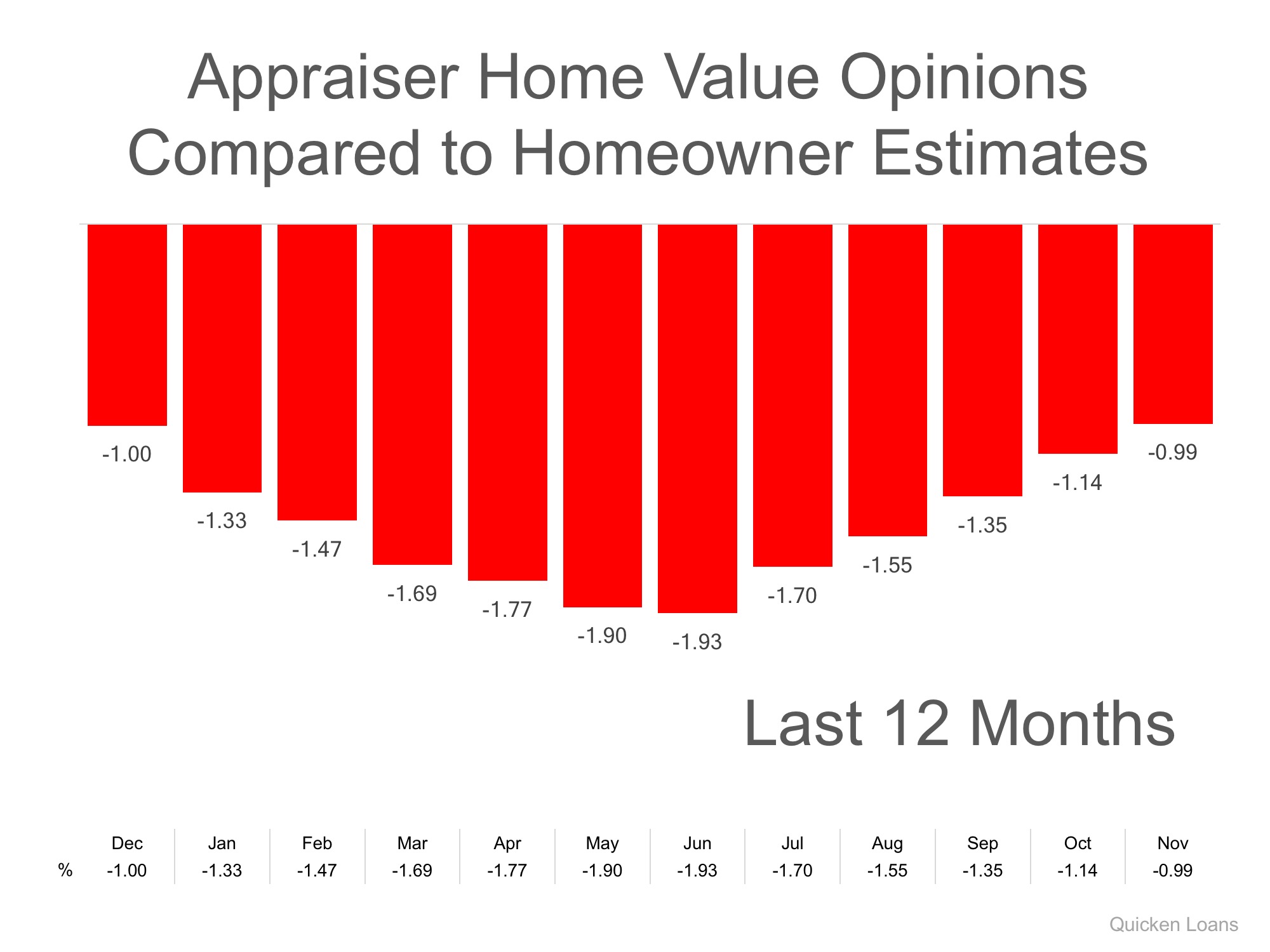

Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their hose is worth, and an appraiser’s evaluation of that same home.

Bill Banfield, Executive VP of Capital Markets at Quicken Loans urges anyone looking to buy or sell in today’s market to remember the impact of this challenge:

“Based on the HPPI, it appears homeowners in the markets where prices are rising faster than the national average – like Denver, Seattle and San Francisco – are continuing to underestimate just how quickly home values are rising, so the average appraisal is higher than homeowner estimate.

On the inverse of that, homeowners in areas where the values aren’t rising as fast may think they are rising faster than they are, leading to the appraisal lagging the estimate.”

The chart below illustrates the changes in home price estimates over the last 12 months.

Bottom Line

Every house on the market must be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, let’s get together to discuss this and any other obstacles that may arise.

To view original article, please visit Keeping Current Matters.

The Difference a Year Makes for Homeownership

Today’s low mortgage rates are a huge perk for buyers, so it’s a great time to get more for your money and consider a new home.

The Do’s and Dont’s after Applying for a Mortgage

Once you’ve found the right home and applied for a mortgage, there are some key things to keep in mind before you close.

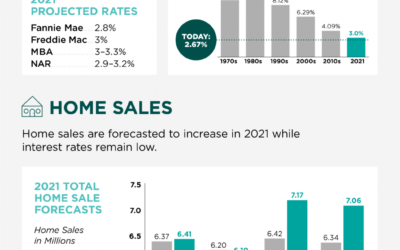

2021 Housing Forecast – Infographic

With mortgage rates forecasted to remain low, high buyer demand is expected to fuel more home sales and continue to increase home prices.

Homeowner Equity Increases an Astonishing $1 Trillion

Over the past year, strong home price growth has created a record level of home equity for homeowners.

The Holidays Aren’t Stopping Homebuyers This Year

There are first-time, move-up, and move-down buyers actively looking for the home of their dreams this winter.

5 Steps to Follow When Applying for Forbearance

Help is out there for homeowners in need, but it’s important to apply now while this benefit is still available.

Winning as a Buyer in a Sellers’ Market

Buying a home in today’s sellers’ market doesn’t have to feel like an uphill battle. Make your life easier by working with one of our trusted agents!

Why It Makes Sense to Sell Your House This Holiday Season

The supply of homes for sale is not keeping up with this high demand, making now the optimal time to sell your house.

Are Home Prices Headed Toward Bubble Territory?

High demand coupled with restricted supply has caused home prices to appreciate above historic levels.

An Honest Look at Unemployment Numbers

Though millions of Americans are still out of work, the situation was forecasted to be even direr than it is today.