Homeowners: Your House Must Be Sold TWICE

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting the home values could appreciate by another 5%+ over the next twelve months. One major challenge in such a market is the bank appraisal.

If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank.

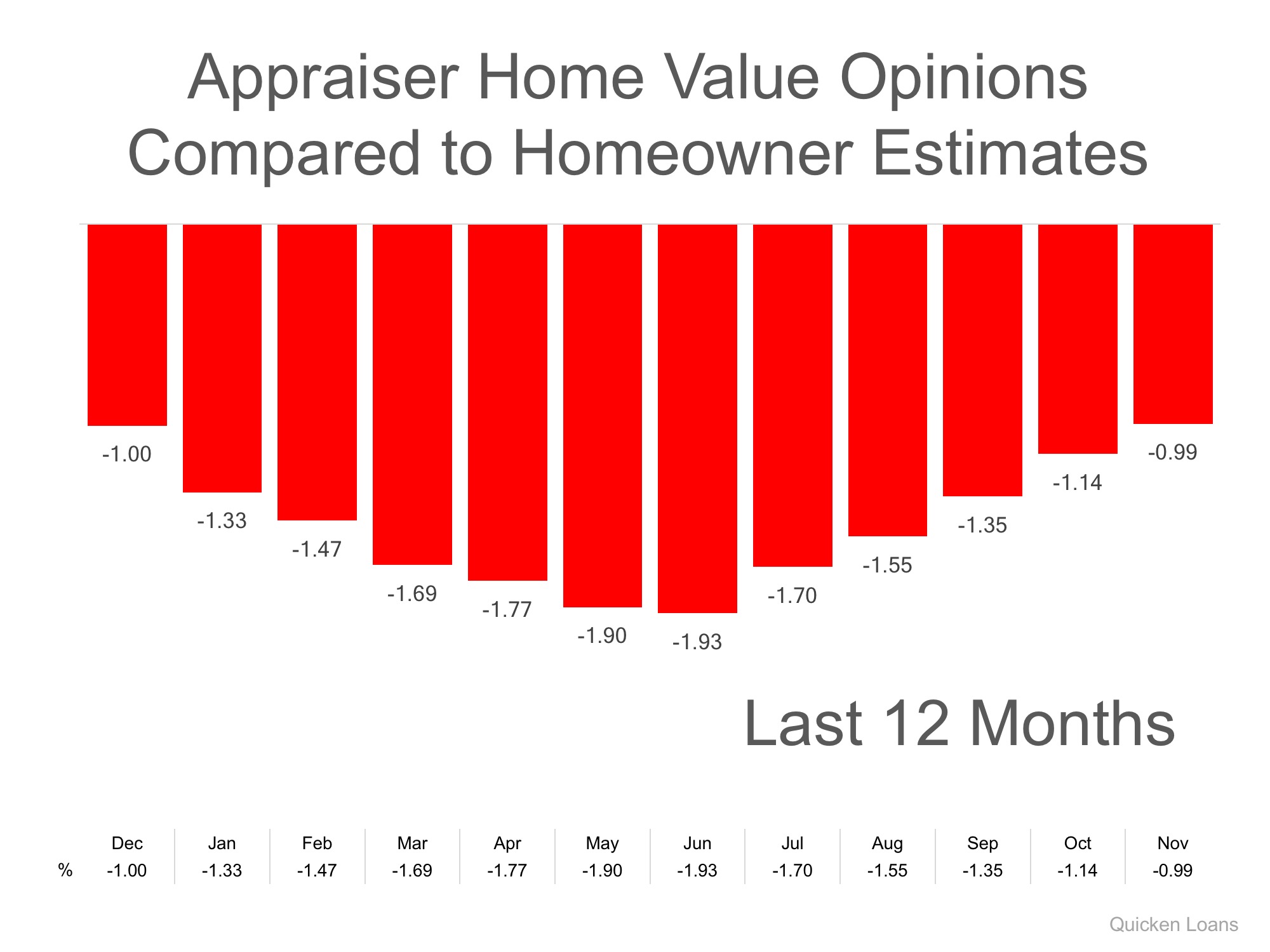

Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their hose is worth, and an appraiser’s evaluation of that same home.

Bill Banfield, Executive VP of Capital Markets at Quicken Loans urges anyone looking to buy or sell in today’s market to remember the impact of this challenge:

“Based on the HPPI, it appears homeowners in the markets where prices are rising faster than the national average – like Denver, Seattle and San Francisco – are continuing to underestimate just how quickly home values are rising, so the average appraisal is higher than homeowner estimate.

On the inverse of that, homeowners in areas where the values aren’t rising as fast may think they are rising faster than they are, leading to the appraisal lagging the estimate.”

The chart below illustrates the changes in home price estimates over the last 12 months.

Bottom Line

Every house on the market must be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, let’s get together to discuss this and any other obstacles that may arise.

To view original article, please visit Keeping Current Matters.

Uncertainty Abounds in the Search for Economic Recovery Timetable

The current situation makes it extremely difficult to project the future of the economy. Analysts are hoping for a quick recovery.

Keys to Selling Your House Virtually

In today’s market, it’s more important than ever to make sure you have a digital game plan and an effective online marketing strategy when selling your house.

The Pain of Unemployment: It Will Be Deep, But Not for Long

Over 20 million people in the U.S. became instantly unemployed. How long is this financial pain going to last?

Today’s Homebuyers Want Lower Prices. Sellers Disagree.

Buyers and sellers are viewing this uncertain time as as opportunity to win big. Let’s discuss you real estate needs and next steps.

What If I Need to Sell My Home Now? What Can I Do?

Real estate agents are working hard under untraditional circumstances using video chats and virtual tours to keep our clients safe.

Why Home Office Space Is More Desirable Than Ever

Remote work may become widely accepted as this current crisis teaches businesses what it takes to function virtually.

How Technology Is Enabling the Real Estate Process

Here’s a look at some of the elements of the process that are changing due to stay-at-home orders and social distancing.

How to Find the Perfect Real Estate Agent

Hiring an agent who has a finger on the pulse of the current market will make your buying or selling experience so much easier. #brookhamptonrealty

Will Surging Unemployment Crush Home Sales?

Because the health crisis brought the economy to a halt, many are feeling a personal financial crisis. Will this impact home sales?

Looking to the Future: What the Experts Are Saying

Here’s a look at what experts and current research indicate about the economic impact we’ll likely see as a result of the coronavirus.