For years, real estate has been considered the best investment you can make. A major reason for this is due to the net worth a household gains through homeownership. In fact, according to the 2019 Survey of Consumer Finance Data from the Federal Reserve, for the average homeowner:

“…a primary home accounts for 90% of the total wealth of a family in the U.S.”

How do homeowners gain wealth?

Most large purchases, like cars and appliances, depreciate in value as they age, so it’s understandable to question how owning a home can increase wealth over time. In a simple equation, the National Association of Realtors (NAR) explains how the combination of paying your mortgage and home price appreciation grow overall wealth:

Principal Payments + Price Appreciation Gains = Housing Wealth Gain

As home values increase and you make payments toward your home loan, you’ll gain wealth through equity. The same article from NAR also addresses how wealth gains tend to play out over time:

“Housing wealth accumulation takes time and is built up by paying off the mortgage debt and by price appreciation. And while home prices can fall, home prices tend to recover and go up over the longer term. As of September 2020, the median sales price of existing home sales was $311,800, a 35% gain since July 2006 when prices peaked at $230,000.”

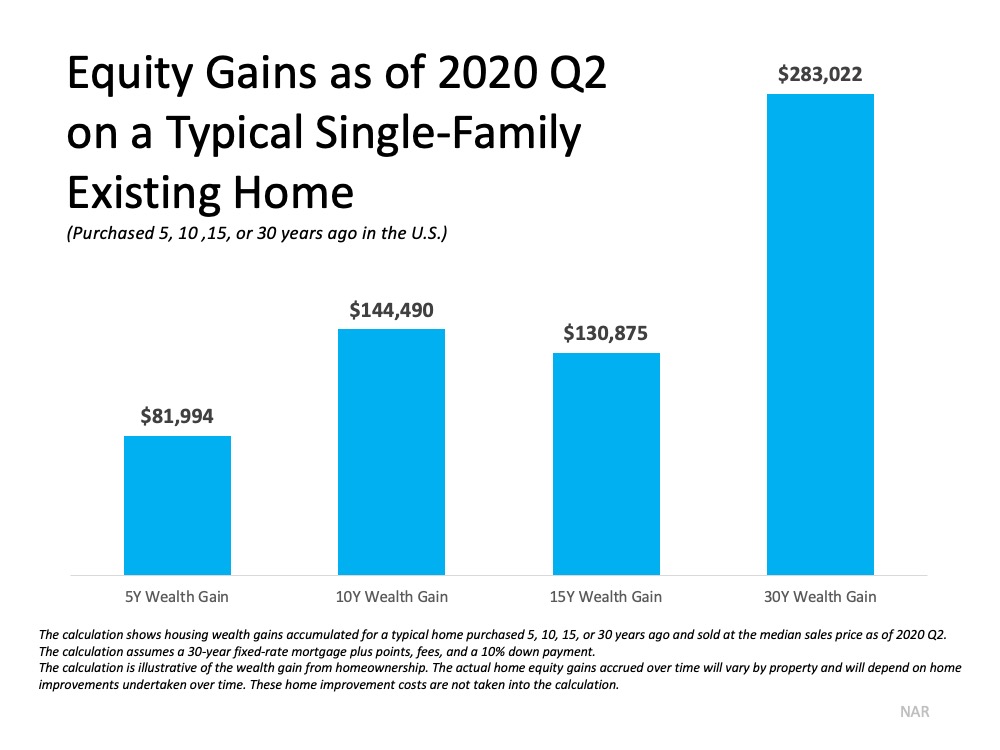

Taking a look at how equity has grown for the typical homeowner, it’s clear to see how real estate is a sound long-term investment. NAR notes:

“Nationally, a person who purchased a typical home 30 years ago would have typically gained about $283,000 as of the second quarter of 2020.” (See graph below):

Bottom Line

Whether you’re a current homeowner planning to put your equity toward a new home or have hopes of buying your first home soon, homeownership will always be a great opportunity to build your net worth and overall wealth. Owning a home is truly an investment in your financial future.

To view original article, visit Keeping Current Matters.

It’s Not Just About the Price of the Home

Today’s low rates are off-setting rising home prices because it’s less expensive to borrow money. Now may be the perfect time to purchase your dream home.

Three Ways to Win in a Bidding War

The housing market is very strong right now, and buyers are scooping up available homes faster than they’re coming to market.

#brookhamptonrealty

Why Is It so Important to Be Pre-Approved in the Homebuying Process?

Pre-approval shows homeowners you’re a serious buyer and helps you stand out from the crowd if you get into a multiple-offer scenario.

Builders & Realtors Agree: Real Estate Is Back

The housing market is well past the recovery phase and is now booming with higher home sales compared to the pre-pandemic days.

In laid-back East Moriches, concerns about future development

Steve Monzeglio describes East Moriches as a “real gem of a small South Shore town” in this recent Newsday article. Take a look!

Forbearance Numbers Are Lower than Expected

Today, the options available to homeowners will prevent a large spike in foreclosures and that’s good for the overall housing market.