For years, real estate has been considered the best investment you can make. A major reason for this is due to the net worth a household gains through homeownership. In fact, according to the 2019 Survey of Consumer Finance Data from the Federal Reserve, for the average homeowner:

“…a primary home accounts for 90% of the total wealth of a family in the U.S.”

How do homeowners gain wealth?

Most large purchases, like cars and appliances, depreciate in value as they age, so it’s understandable to question how owning a home can increase wealth over time. In a simple equation, the National Association of Realtors (NAR) explains how the combination of paying your mortgage and home price appreciation grow overall wealth:

Principal Payments + Price Appreciation Gains = Housing Wealth Gain

As home values increase and you make payments toward your home loan, you’ll gain wealth through equity. The same article from NAR also addresses how wealth gains tend to play out over time:

“Housing wealth accumulation takes time and is built up by paying off the mortgage debt and by price appreciation. And while home prices can fall, home prices tend to recover and go up over the longer term. As of September 2020, the median sales price of existing home sales was $311,800, a 35% gain since July 2006 when prices peaked at $230,000.”

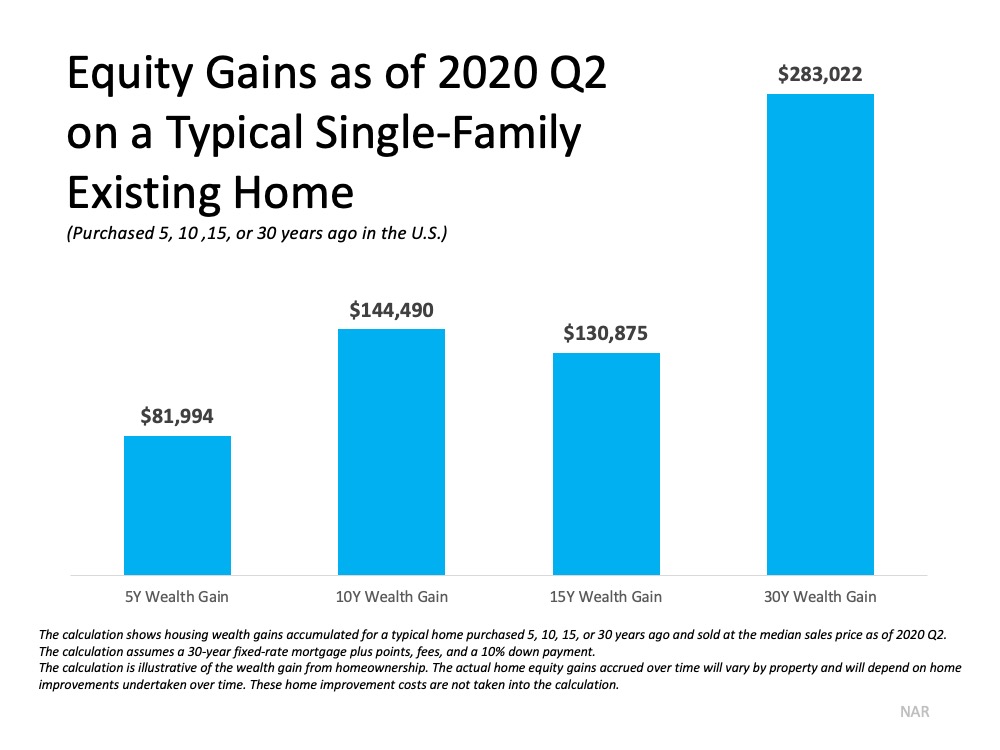

Taking a look at how equity has grown for the typical homeowner, it’s clear to see how real estate is a sound long-term investment. NAR notes:

“Nationally, a person who purchased a typical home 30 years ago would have typically gained about $283,000 as of the second quarter of 2020.” (See graph below):

Bottom Line

Whether you’re a current homeowner planning to put your equity toward a new home or have hopes of buying your first home soon, homeownership will always be a great opportunity to build your net worth and overall wealth. Owning a home is truly an investment in your financial future.

To view original article, visit Keeping Current Matters.

Are You Ready for the Summer Housing Market?

Summer is gearing up to be the 2020 buying season, so including your house in the mix may be your best opportunity to sell yet.

Real Estate Will Lead the Economic Recovery

Experts say the economy will begin to recover later this year. With real estate as a driver, that recovery may start sooner than we think.

Is a Recession Here? Yes. Does that Mean a Housing Crash? No.

While we may be in a recession, the housing industry is much different than it was in 2008.

Three Things to Understand About Unemployment Statistics

Tomorrow’s unemployment report will be difficult to digest, but as the nation reopens, many will return to work.

New York State COVID-19 Phase 2 Reopening

Beginning Wed., June 10, 2020, as NY enters Phase 2 of reopening, we will resume in-person showings following mandatory guidelines.

Home Prices: It’s All About Supply and Demand

Wondering what impact the pandemic will have on home prices? Supply and demand will give us the best idea of what’s to come.